New ArrivalsBack in stock

pet insurance for dogs

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D293711232 second hand :D293711232 |

Manufacturer | pet insurance | release date | 2025-05-16 | List price | $34 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | insurance for | ||||||||

| category | |||||||||

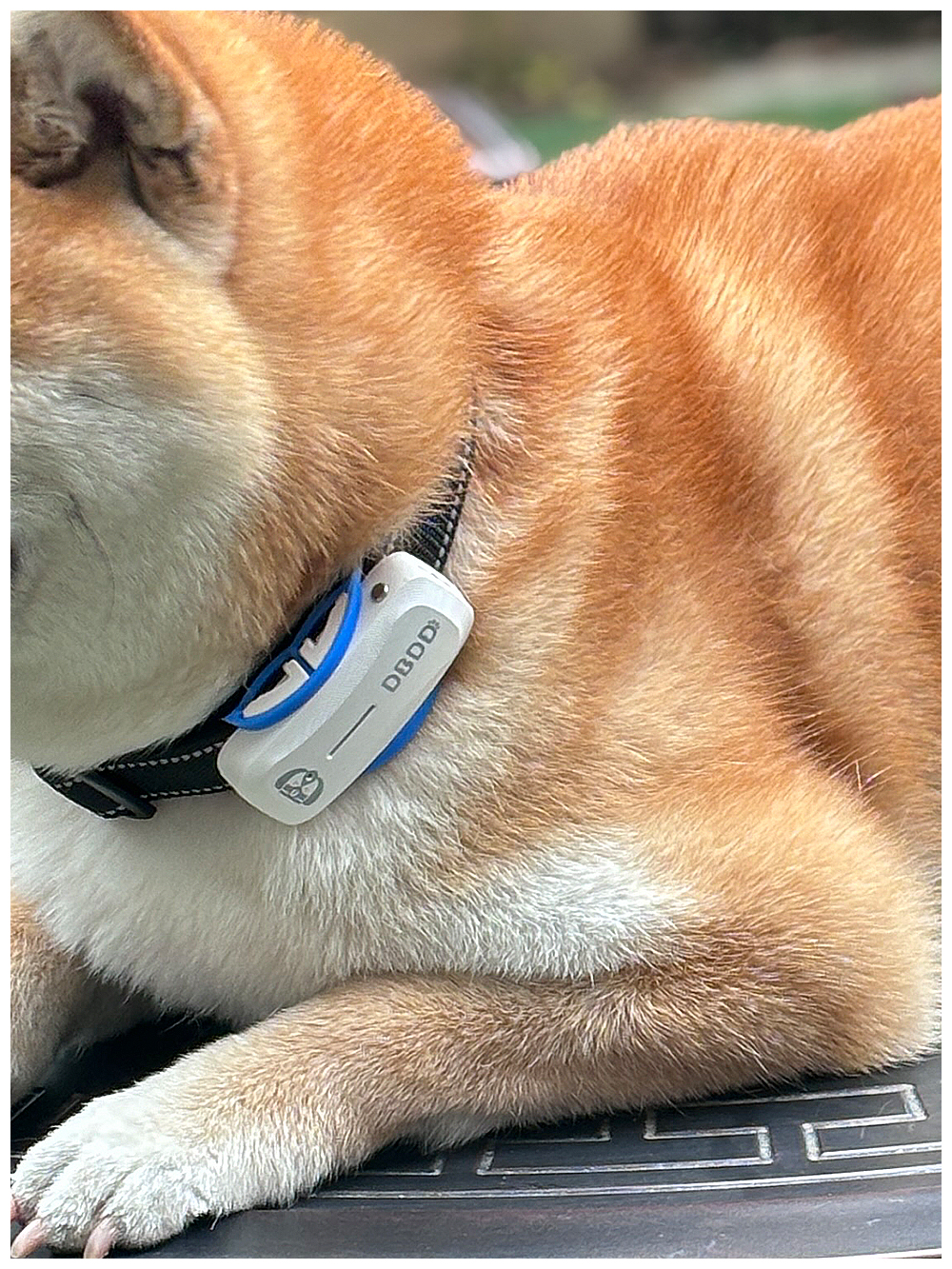

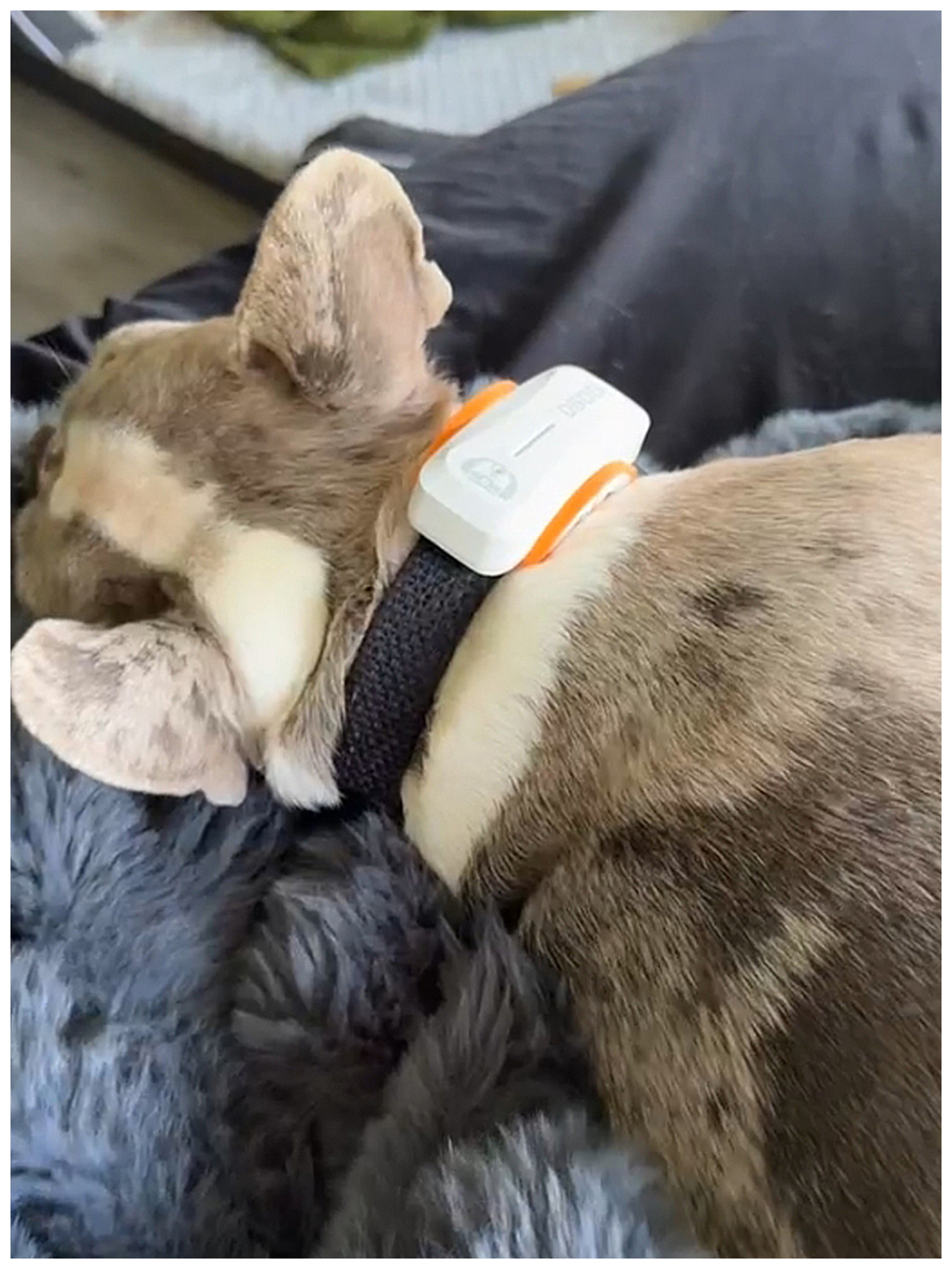

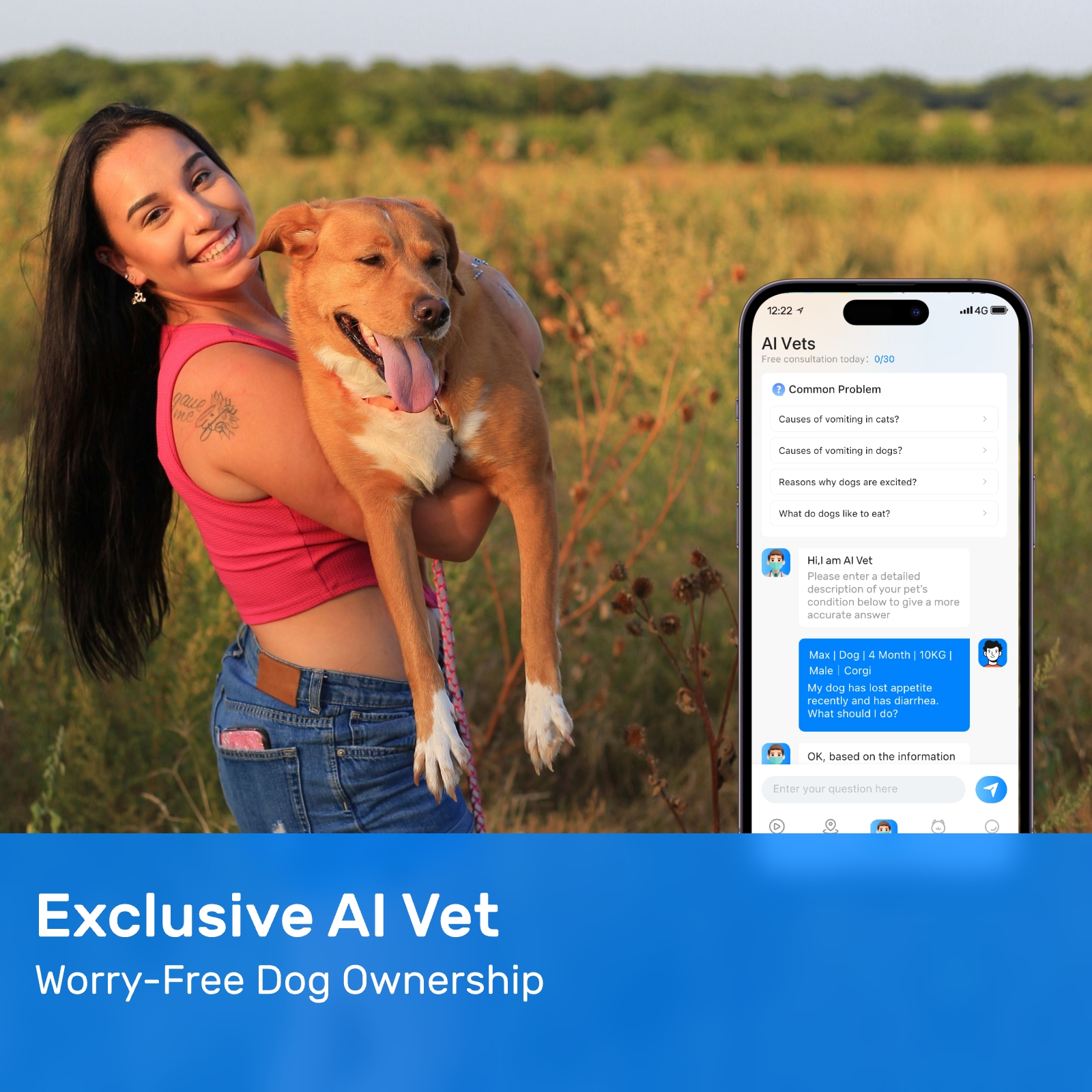

IoT Solutions#Animal Tracking Terminals

Pet insurance for dogs has become an increasingly popular option for pet owners who are looking to safeguard their furry friends against unexpected medical expenses. With the rising costs of veterinary care, it's no surprise that more and more people are turning to pet insurance as a way to ensure their pets receive the best possible care without breaking the bank. This article will delve into the details of pet insurance for dogs, discussing its benefits, how it works, and why it might be worth considering for your beloved canine companion.

First and foremost, let's discuss what exactly pet insurance for dogs entails. Pet insurance is a type of insurance policy designed specifically for pets, offering coverage for various medical conditions and treatments. Just like health insurance for humans, pet insurance for dogs can help cover the costs associated with accidents, illnesses, surgeries, and even routine care in some cases. By paying a monthly premium, dog owners can gain peace of mind knowing that they are financially prepared for any unforeseen veterinary expenses that may arise.

One of the key benefits of pet insurance for dogs is the financial protection it provides. Veterinary bills can quickly add up, especially if your dog requires emergency surgery or ongoing treatment for a chronic condition. Without insurance, these costs could lead to significant financial strain on pet owners. However, with pet insurance for dogs, you can avoid being hit with a large, unexpected bill by having part of the cost covered by your insurance provider. This allows you to focus on your dog's recovery rather than worrying about how you'll pay for their care.

Another advantage of pet insurance for dogs is the wide range of coverage options available. Policies can vary significantly in terms of what they cover, allowing you to choose a plan that best suits your dog's needs and your budget. Some policies offer basic coverage for accidents and illnesses, while others include additional benefits such as wellness care, alternative therapies, and prescription medications. It's important to carefully review the specifics of each policy to ensure that it aligns with your expectations and your dog's potential healthcare needs.

When selecting pet insurance for dogs, there are several factors to consider. One of the most crucial aspects is the deductible, which is the amount you must pay out-of-pocket before your insurance coverage kicks in. Deductibles can vary widely between policies, so it's essential to weigh the pros and cons of a higher or lower deductible based on your financial situation. Additionally, understanding the reimbursement process is vital. Most pet insurance companies require you to pay the veterinarian upfront and then submit a claim for reimbursement. Knowing how long this process typically takes and whether there are any restrictions on where you can seek veterinary care can help you make an informed decision.

It's also important to be aware of any exclusions or limitations within the policy. Some pet insurance plans may not cover pre-existing conditions or certain hereditary diseases common in specific breeds. Be sure to thoroughly read through the fine print to understand what is and isn't covered under the policy you're considering. This will prevent any unpleasant surprises down the road if your dog requires treatment for an excluded condition.

Another consideration when choosing pet insurance for dogs is the age of your pet. Many insurance providers offer discounts for insuring younger dogs, as they are generally healthier and less likely to incur high medical costs. However, as your dog ages, premiums may increase due to the higher likelihood of developing age-related health issues. It's wise to start a pet insurance policy while your dog is still young to take advantage of lower rates and comprehensive coverage.

In addition to traditional accident and illness coverage, some pet insurance plans offer optional add-ons that can enhance your dog's overall well-being. These might include coverage for dental care, behavioral counseling, or even pet theft and travel assistance. While these extras can increase the cost of your premium, they may provide valuable benefits depending on your dog's lifestyle and individual needs.

Cost is, of course, a major factor when evaluating pet insurance for dogs. Premiums can vary greatly depending on factors such as your dog's breed, age, location, and the level of coverage you select. It's important to compare quotes from multiple providers to find a plan that offers the best value for your money. Keep in mind that while a cheaper policy may seem appealing, it may come with fewer benefits or higher deductibles, ultimately costing you more in the long run if your dog requires extensive medical care.

Some pet owners may wonder whether pet insurance for dogs is truly necessary. While it's true that not every dog will experience serious health issues during their lifetime, the unpredictability of life makes it difficult to anticipate potential veterinary expenses. Even seemingly healthy dogs can suffer sudden injuries or develop unexpected illnesses, leading to costly treatments. Having pet insurance for dogs in place can provide peace of mind, knowing that you have a safety net should anything happen to your furry friend.

Moreover, pet insurance for dogs can encourage proactive care. With some policies offering coverage for preventive services such as vaccinations, annual check-ups, and parasite prevention, owners may be more inclined to prioritize routine care for their dogs. Regular veterinary visits can help detect potential health problems early, potentially saving money in the long term by preventing more severe conditions from developing.

Despite the many advantages, it's worth noting that pet insurance for dogs isn't without its drawbacks. For instance, some policies may have waiting periods before coverage begins, meaning that immediate needs won't be covered right away. Additionally, the claims process can sometimes be lengthy or complicated, requiring detailed documentation and patience. It's crucial to research and understand the specifics of each policy to minimize potential frustrations.

For those who are new to the concept of pet insurance for dogs, it may feel overwhelming to navigate the various options available. A good starting point is to determine your dog's specific needs and your own financial capabilities. Consider factors such as your dog's breed, age, and current health status, as well as your budget for monthly premiums and out-of-pocket expenses. Once you have a clearer picture of what you're looking for, you can begin comparing policies from different providers to find the one that best fits your requirements.

Many pet insurance companies offer online tools and resources to assist in the decision-making process. These may include comparison charts, customer reviews, and personalized quotes based on your input. Taking advantage of these resources can simplify the selection process and give you a better understanding of what each policy entails.

Ultimately, the decision to purchase pet insurance for dogs comes down to personal preference and circumstances. While it may not be the right choice for everyone, for many pet owners, it provides invaluable peace of mind and financial security. Knowing that you have a safety net in place should your dog require unexpected medical attention can alleviate much of the stress associated with pet ownership.

In conclusion, pet insurance for dogs offers a practical solution for managing the financial burden of veterinary care. With numerous coverage options, flexible plans, and added benefits, it's a worthwhile consideration for anyone committed to providing the best possible care for their canine companion. By taking the time to research and compare policies, you can find a plan that meets your needs and ensures that your dog receives the treatment they deserve, regardless of the cost. Investing in pet insurance for dogs is an investment in their health and happiness, allowing you to enjoy the companionship of your furry friend without the worry of exorbitant medical bills.

Update Time:2025-05-16 06:15:34

First and foremost, let's discuss what exactly pet insurance for dogs entails. Pet insurance is a type of insurance policy designed specifically for pets, offering coverage for various medical conditions and treatments. Just like health insurance for humans, pet insurance for dogs can help cover the costs associated with accidents, illnesses, surgeries, and even routine care in some cases. By paying a monthly premium, dog owners can gain peace of mind knowing that they are financially prepared for any unforeseen veterinary expenses that may arise.

One of the key benefits of pet insurance for dogs is the financial protection it provides. Veterinary bills can quickly add up, especially if your dog requires emergency surgery or ongoing treatment for a chronic condition. Without insurance, these costs could lead to significant financial strain on pet owners. However, with pet insurance for dogs, you can avoid being hit with a large, unexpected bill by having part of the cost covered by your insurance provider. This allows you to focus on your dog's recovery rather than worrying about how you'll pay for their care.

Another advantage of pet insurance for dogs is the wide range of coverage options available. Policies can vary significantly in terms of what they cover, allowing you to choose a plan that best suits your dog's needs and your budget. Some policies offer basic coverage for accidents and illnesses, while others include additional benefits such as wellness care, alternative therapies, and prescription medications. It's important to carefully review the specifics of each policy to ensure that it aligns with your expectations and your dog's potential healthcare needs.

When selecting pet insurance for dogs, there are several factors to consider. One of the most crucial aspects is the deductible, which is the amount you must pay out-of-pocket before your insurance coverage kicks in. Deductibles can vary widely between policies, so it's essential to weigh the pros and cons of a higher or lower deductible based on your financial situation. Additionally, understanding the reimbursement process is vital. Most pet insurance companies require you to pay the veterinarian upfront and then submit a claim for reimbursement. Knowing how long this process typically takes and whether there are any restrictions on where you can seek veterinary care can help you make an informed decision.

It's also important to be aware of any exclusions or limitations within the policy. Some pet insurance plans may not cover pre-existing conditions or certain hereditary diseases common in specific breeds. Be sure to thoroughly read through the fine print to understand what is and isn't covered under the policy you're considering. This will prevent any unpleasant surprises down the road if your dog requires treatment for an excluded condition.

Another consideration when choosing pet insurance for dogs is the age of your pet. Many insurance providers offer discounts for insuring younger dogs, as they are generally healthier and less likely to incur high medical costs. However, as your dog ages, premiums may increase due to the higher likelihood of developing age-related health issues. It's wise to start a pet insurance policy while your dog is still young to take advantage of lower rates and comprehensive coverage.

In addition to traditional accident and illness coverage, some pet insurance plans offer optional add-ons that can enhance your dog's overall well-being. These might include coverage for dental care, behavioral counseling, or even pet theft and travel assistance. While these extras can increase the cost of your premium, they may provide valuable benefits depending on your dog's lifestyle and individual needs.

Cost is, of course, a major factor when evaluating pet insurance for dogs. Premiums can vary greatly depending on factors such as your dog's breed, age, location, and the level of coverage you select. It's important to compare quotes from multiple providers to find a plan that offers the best value for your money. Keep in mind that while a cheaper policy may seem appealing, it may come with fewer benefits or higher deductibles, ultimately costing you more in the long run if your dog requires extensive medical care.

Some pet owners may wonder whether pet insurance for dogs is truly necessary. While it's true that not every dog will experience serious health issues during their lifetime, the unpredictability of life makes it difficult to anticipate potential veterinary expenses. Even seemingly healthy dogs can suffer sudden injuries or develop unexpected illnesses, leading to costly treatments. Having pet insurance for dogs in place can provide peace of mind, knowing that you have a safety net should anything happen to your furry friend.

Moreover, pet insurance for dogs can encourage proactive care. With some policies offering coverage for preventive services such as vaccinations, annual check-ups, and parasite prevention, owners may be more inclined to prioritize routine care for their dogs. Regular veterinary visits can help detect potential health problems early, potentially saving money in the long term by preventing more severe conditions from developing.

Despite the many advantages, it's worth noting that pet insurance for dogs isn't without its drawbacks. For instance, some policies may have waiting periods before coverage begins, meaning that immediate needs won't be covered right away. Additionally, the claims process can sometimes be lengthy or complicated, requiring detailed documentation and patience. It's crucial to research and understand the specifics of each policy to minimize potential frustrations.

For those who are new to the concept of pet insurance for dogs, it may feel overwhelming to navigate the various options available. A good starting point is to determine your dog's specific needs and your own financial capabilities. Consider factors such as your dog's breed, age, and current health status, as well as your budget for monthly premiums and out-of-pocket expenses. Once you have a clearer picture of what you're looking for, you can begin comparing policies from different providers to find the one that best fits your requirements.

Many pet insurance companies offer online tools and resources to assist in the decision-making process. These may include comparison charts, customer reviews, and personalized quotes based on your input. Taking advantage of these resources can simplify the selection process and give you a better understanding of what each policy entails.

Ultimately, the decision to purchase pet insurance for dogs comes down to personal preference and circumstances. While it may not be the right choice for everyone, for many pet owners, it provides invaluable peace of mind and financial security. Knowing that you have a safety net in place should your dog require unexpected medical attention can alleviate much of the stress associated with pet ownership.

In conclusion, pet insurance for dogs offers a practical solution for managing the financial burden of veterinary care. With numerous coverage options, flexible plans, and added benefits, it's a worthwhile consideration for anyone committed to providing the best possible care for their canine companion. By taking the time to research and compare policies, you can find a plan that meets your needs and ensures that your dog receives the treatment they deserve, regardless of the cost. Investing in pet insurance for dogs is an investment in their health and happiness, allowing you to enjoy the companionship of your furry friend without the worry of exorbitant medical bills.

Update Time:2025-05-16 06:15:34

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form