New ArrivalsBack in stock

petsmart dog training

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D135312421 second hand :D135312421 |

Manufacturer | petsmart dog | release date | 2025-05-15 | List price | $37 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | dog training | ||||||||

| category | |||||||||

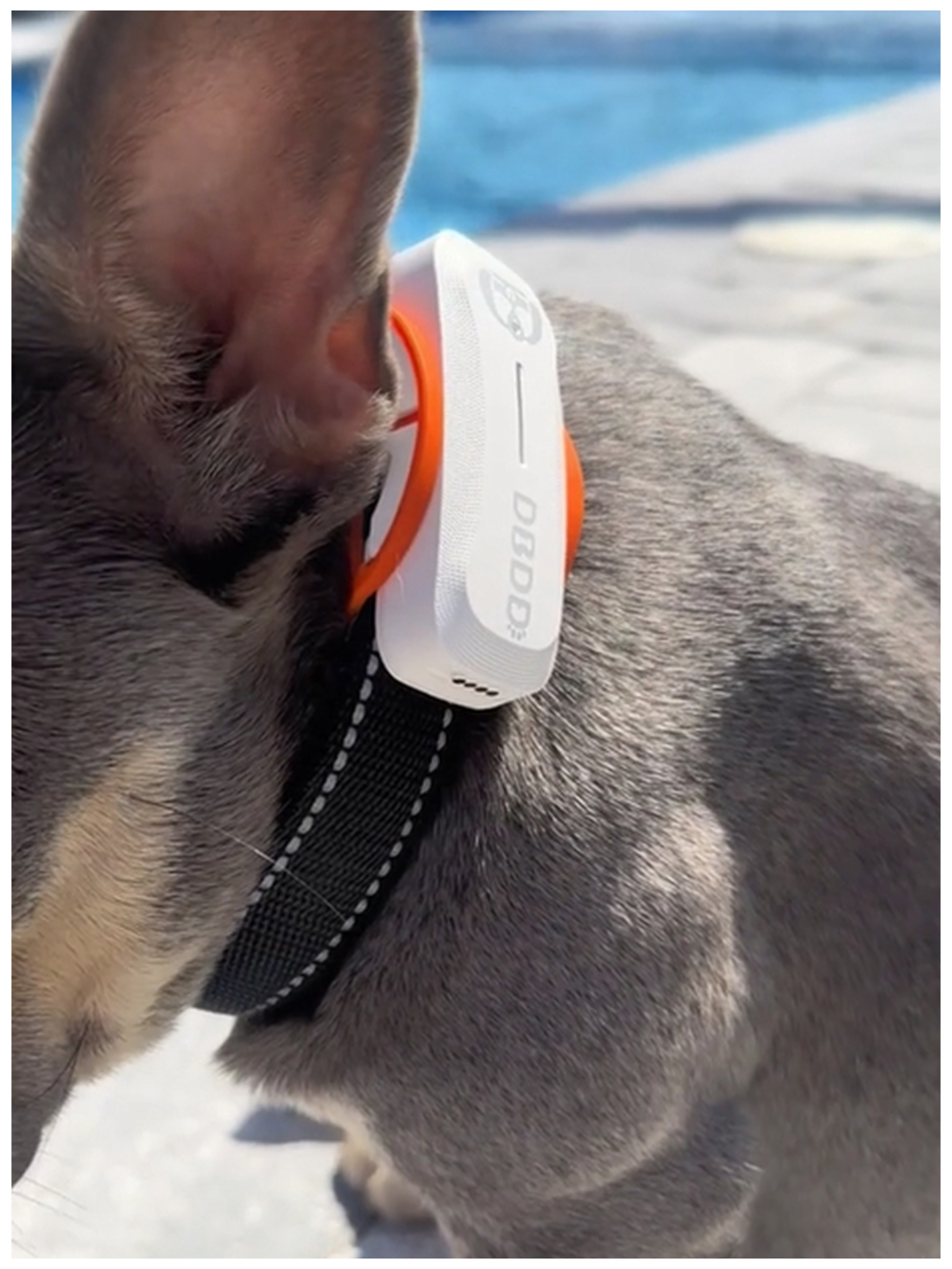

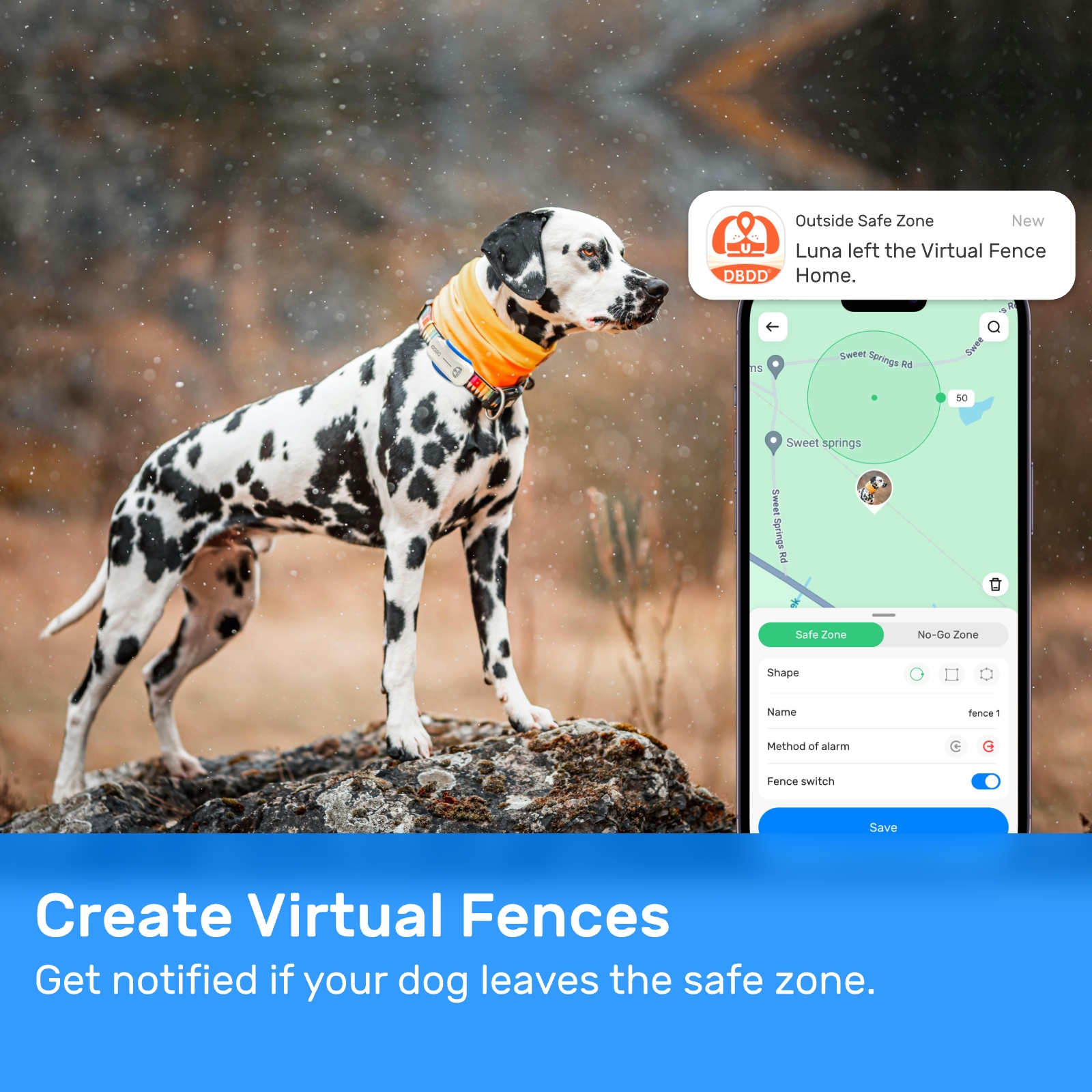

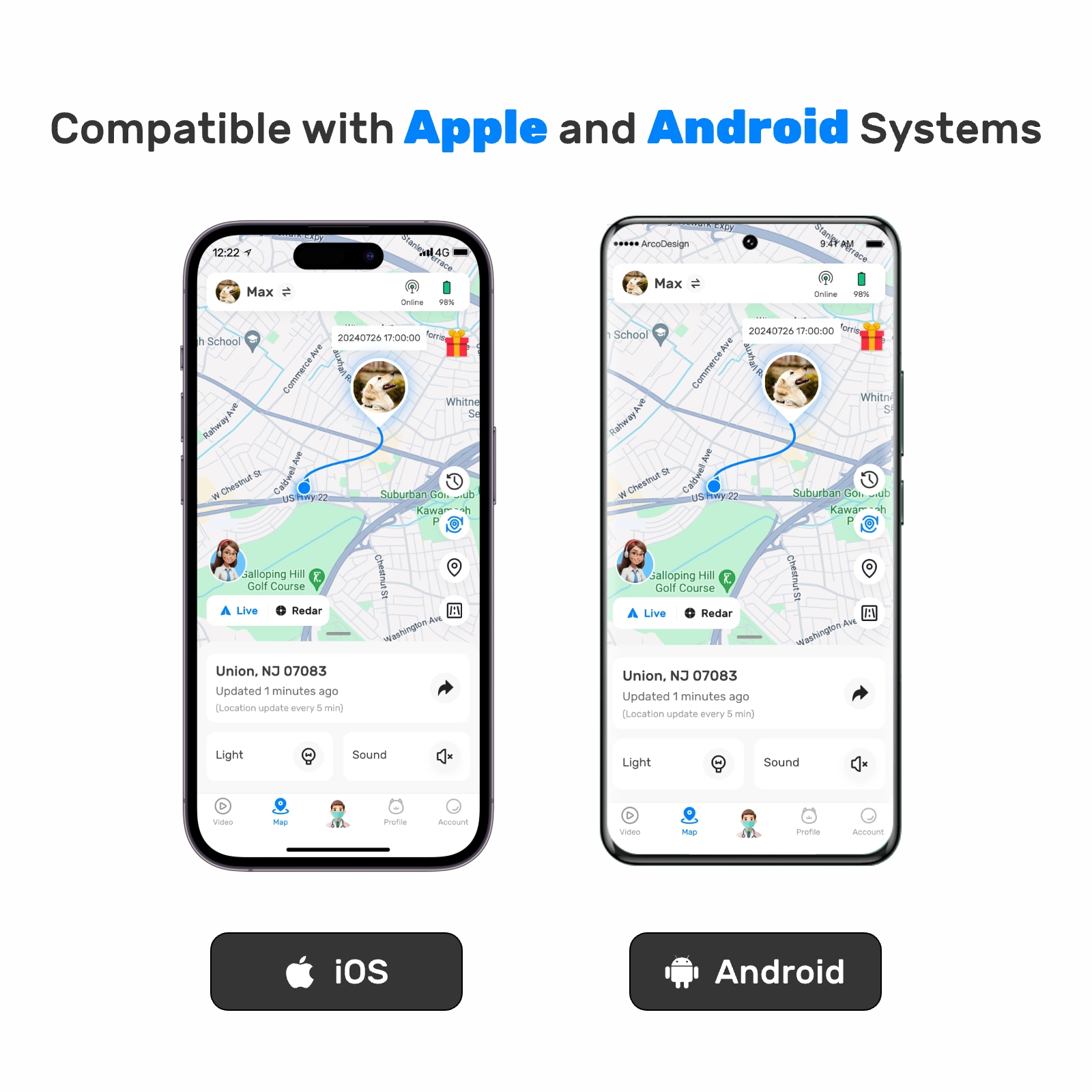

Precision Agriculture#Livestock Tracking

air-tracker-tag-android-samsung-gps-for-dogs

### Understanding Pet Insurance

Pet insurance is a specialized form of coverage designed to help pet owners manage the costs associated with veterinary care. Similar to human health insurance, it covers a portion of the expenses related to accidents, illnesses, surgeries, and sometimes even routine check-ups. However, unlike human insurance, pet insurance operates on a reimbursement model. This means that you pay the veterinarian upfront, then submit a claim to your insurance provider for reimbursement.

There are various types of pet insurance packages available, each catering to different needs and budgets. Some plans focus solely on accident and illness coverage, while others include preventive care such as vaccinations, dental cleanings, and wellness exams. When choosing a plan, it’s important to consider factors such as deductibles, co-pays, annual limits, and exclusions. For instance, some policies may not cover pre-existing conditions or certain hereditary diseases.

### Why Invest in Pet Insurance?

The primary reason pet owners opt for insurance is the unpredictability of veterinary expenses. Medical emergencies, chronic conditions, and unexpected injuries can quickly add up, leading to significant financial strain. According to recent studies, the average cost of treating a sick or injured pet can range from several hundred to thousands of dollars. Without insurance, these costs could deter many owners from seeking necessary treatment for their pets.

Another advantage of pet insurance is the ability to choose the best care for your pet without worrying about the price tag. Whether it’s advanced diagnostics, surgery, or specialty medications, having insurance ensures that you have access to high-quality veterinary services when needed. Moreover, some insurers offer additional perks, such as discounts on grooming, boarding, and other pet-related services, further enhancing the value of your policy.

### How Does Pet Insurance Work?

When you enroll your pet in an insurance plan, you’ll need to select a deductible, which is the amount you pay out-of-pocket before the insurance kicks in. Once the deductible is met, the insurer will reimburse you for a percentage of eligible expenses, typically between 70% and 90%. It’s crucial to understand what is covered under your specific plan, as policies vary widely in terms of benefits and limitations.

For example, some plans exclude congenital or hereditary conditions, while others might impose age restrictions or require wellness exams as part of the enrollment process. Reading the fine print and asking questions during the application phase can prevent surprises down the road.

### Pairing Pet Insurance with PetSmart Dog Training

While pet insurance primarily addresses medical concerns, there are other aspects of pet care that contribute to a happy and healthy life. One such area is behavioral training, particularly for dogs. Proper training not only strengthens the bond between you and your pet but also helps prevent issues that could lead to accidents or injuries—both of which fall under the purview of pet insurance.

PetSmart dog training offers comprehensive programs designed to address a wide range of behaviors, from basic obedience to advanced tricks and socialization. These classes are taught by certified trainers who use positive reinforcement techniques to encourage good behavior. By enrolling your dog in a training program, you reduce the likelihood of incidents that might otherwise result in costly vet visits.

For instance, a well-trained dog is less likely to bolt into traffic, chew on dangerous objects, or exhibit aggressive behavior toward people or other animals. All of these scenarios could potentially lead to injuries requiring medical attention. Thus, investing in PetSmart dog training can be seen as a proactive step toward minimizing risks and maximizing your pet’s safety.

### The Role of Preventive Care

Preventive care plays a critical role in maintaining your pet’s health and reducing long-term costs. Many pet insurance plans now offer options for covering routine care, including spaying/neutering, parasite prevention, and dental hygiene. By addressing minor issues early on, you can avoid more serious problems later.

Similarly, PetSmart dog training emphasizes the importance of preventive measures in shaping a dog’s behavior. Early socialization and consistent training lay the foundation for a well-adjusted adult dog. This reduces the chances of behavioral problems that could escalate into physical harm or necessitate professional intervention.

### Financial Considerations

When evaluating pet insurance packages, it’s important to weigh the monthly premium against potential savings. While premiums vary based on factors like breed, age, and location, most plans fall within an affordable range for the average pet owner. Keep in mind that younger pets generally qualify for lower rates, as they are considered lower risk compared to older animals.

To make the most of your investment, consider bundling pet insurance with complementary services like PetSmart dog training. Many pet stores and veterinary clinics offer loyalty programs or discounts for customers who utilize multiple services. Combining these offerings can save you money while ensuring your pet receives holistic care.

### Real-Life Examples

Let’s look at a couple of real-life examples to illustrate the benefits of pet insurance:

**Example 1:** A young Labrador retriever named Max suffered a torn ACL after playing fetch in the backyard. The surgery cost $3,500, but thanks to his pet insurance, Max’s owner only paid the $200 deductible, plus 10% of the remaining balance—a total out-of-pocket expense of $550.

**Example 2:** Bella, a senior cat, was diagnosed with diabetes, requiring regular insulin injections and monitoring. Her owner’s pet insurance covered 80% of the ongoing treatment costs, making it easier to manage her condition over time.

In both cases, pet insurance significantly reduced the financial burden, allowing the owners to focus on providing the best care for their beloved companions.

### Conclusion

Pet insurance is a valuable tool for safeguarding your pet’s health and protecting your wallet from unexpected veterinary bills. By carefully selecting a plan that aligns with your pet’s needs and budget, you can enjoy peace of mind knowing that you’re prepared for whatever comes your way. Furthermore, incorporating programs like PetSmart dog training into your pet-care routine can complement your insurance efforts by promoting good behavior and preventing accidents.

Ultimately, being a responsible pet owner involves more than just feeding and sheltering your animal; it requires planning for all aspects of their well-being. With the right combination of pet insurance and supportive services like PetSmart dog training, you can set your furry friend up for a long, healthy, and happy life.

Update Time:2025-05-15 06:09:32

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form