New ArrivalsBack in stock

droopy dog

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D126794281 second hand :D126794281 |

Manufacturer | droopy dog | release date | 2025-05-15 | List price | $37 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | droopy dog | ||||||||

| category | |||||||||

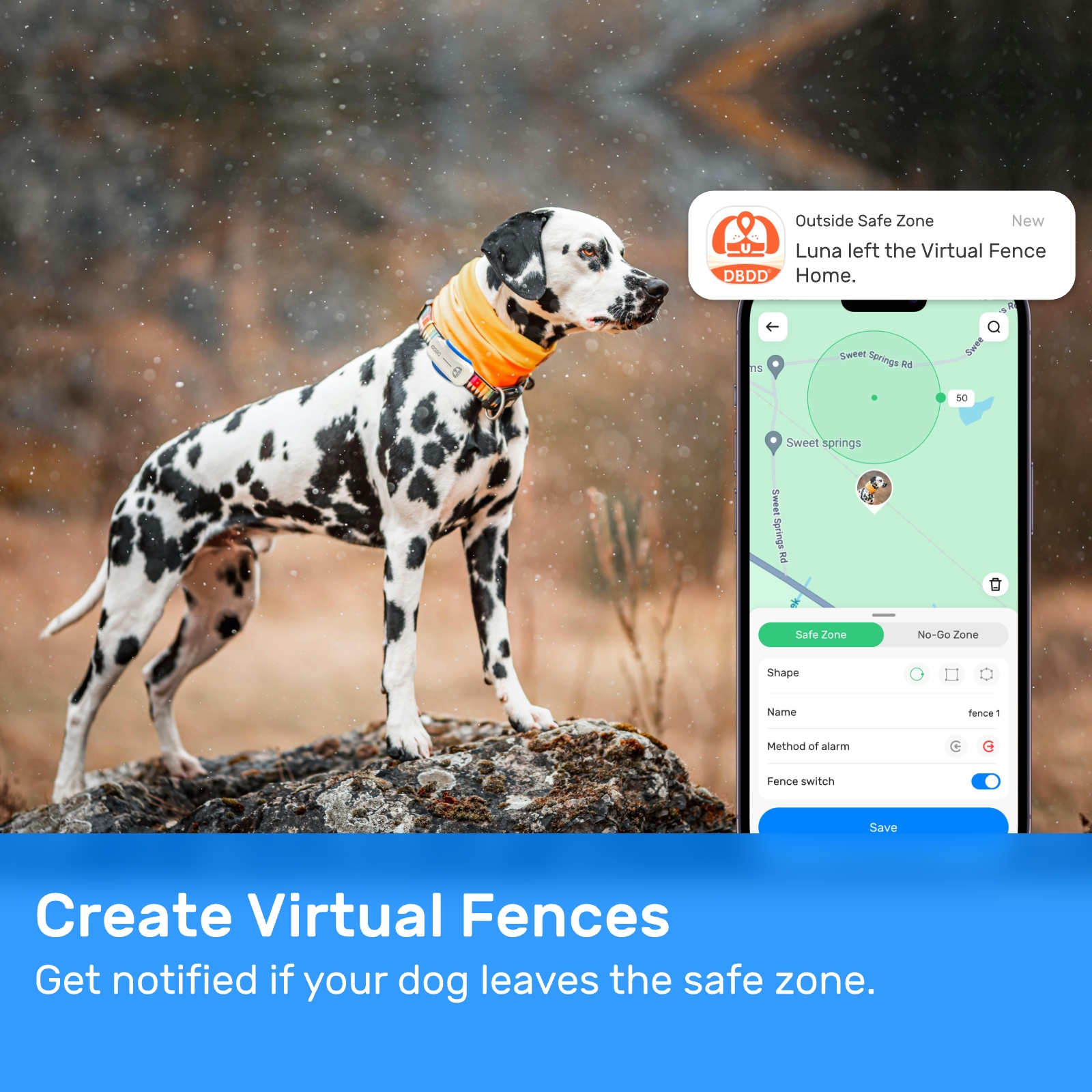

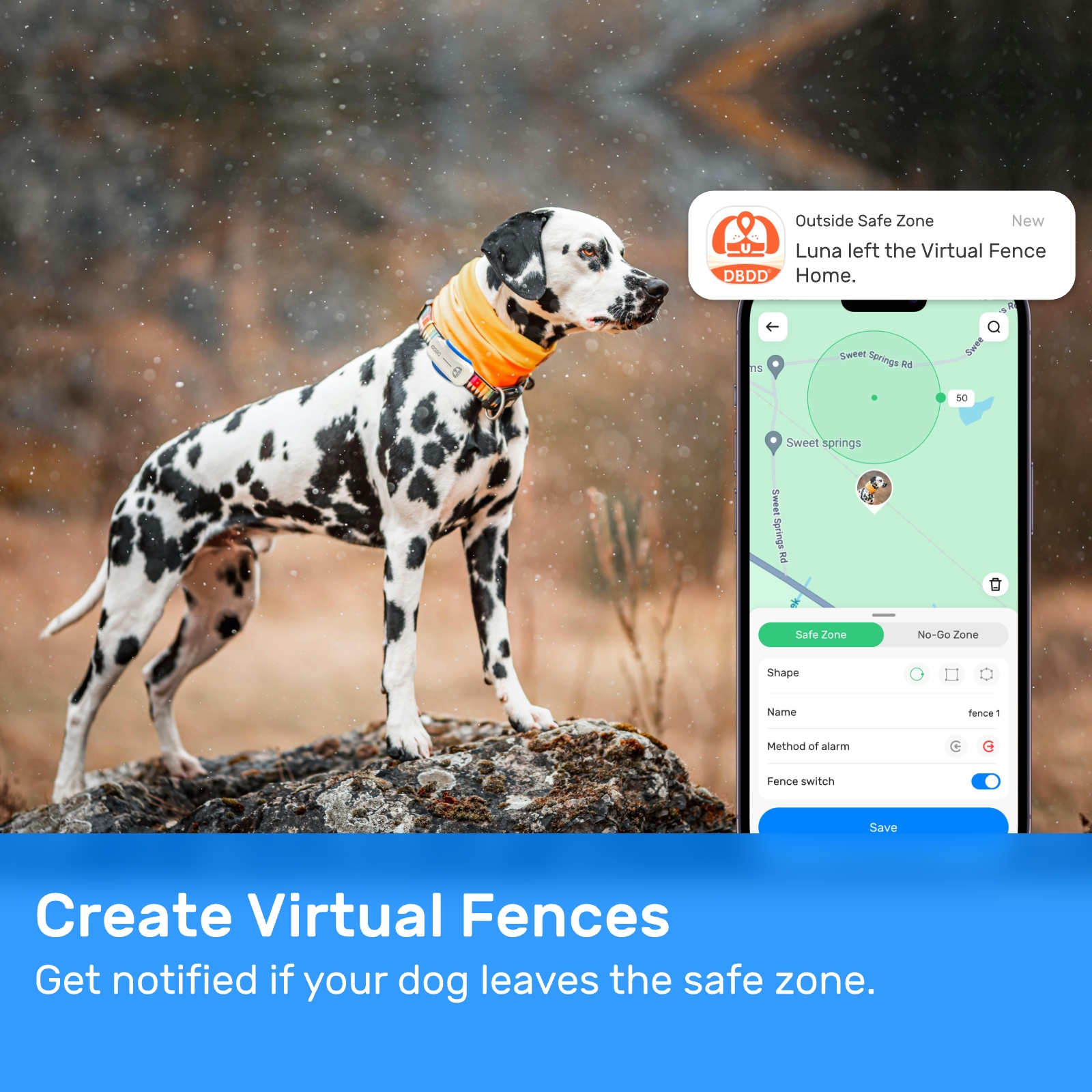

Travel Accessories#Pet Journey Safety

Pet insurance has become an increasingly popular choice for pet owners who want to ensure their furry friends receive the best possible care without breaking the bank. Whether you're a proud owner of a droopy dog or any other breed, understanding the nuances of pet insurance packages is crucial in making informed decisions about your pet's healthcare needs.

When it comes to insuring your beloved pet, there are several factors to consider. The first step is identifying what kind of coverage suits your specific situation. For instance, if you have a droopy dog, which may be predisposed to certain health conditions due to its unique physical characteristics, specialized insurance plans can provide peace of mind. Droopy dogs, characterized by their long ears and saggy facial features, often require additional attention when it comes to eye care, ear infections, and skin issues. These breeds include Bassett Hounds, Bloodhounds, and Cocker Spaniels, among others.

Choosing the right pet insurance package involves evaluating various options that cater to different needs. Most policies cover accidents, illnesses, surgeries, and chronic conditions. Some even extend to wellness programs that include routine check-ups, vaccinations, dental cleanings, and preventive care. Depending on your droopy dog’s age, breed, and medical history, selecting a plan with comprehensive benefits can save you significant expenses down the road.

One important aspect to look out for when choosing a pet insurance plan is the deductible amount. A deductible represents the initial sum you must pay before the insurance company starts covering costs. Typically, deductibles range from $50 to $1,000 per year or incident. Lower deductibles usually come with higher premiums, while higher deductibles lower monthly payments but increase out-of-pocket expenses at claim time. For owners of droopy dogs, opting for a moderate deductible might strike the right balance between affordability and protection against unexpected veterinary bills.

Another critical factor to assess is the reimbursement percentage offered by the policy. This refers to how much of the eligible vet bill the insurer will refund after applying the deductible. Common reimbursement rates vary between 70% and 90%. It's essential to choose a plan offering high enough reimbursement so that you won't face overwhelming financial burdens during emergencies involving your droopy dog.

Moreover, annual limits set boundaries on how much money the insurance provider will contribute towards treating your pet annually. Many standard plans offer maximum payouts ranging from $5,000 to $20,000 per year. However, some companies impose lifetime caps instead of yearly ones. When dealing with a droopy dog susceptible to recurring health problems like ear infections or hip dysplasia, unlimited or generous annual/lifetime limits prove beneficial since they reduce risks associated with hitting these thresholds prematurely.

Pre-existing conditions pose another challenge when purchasing pet insurance. Most insurers do not cover pre-existing ailments unless explicitly stated otherwise in their terms. Therefore, enrolling your droopy dog early in life maximizes chances of obtaining full coverage across all potential future health concerns. Additionally, reading through exclusion clauses carefully helps avoid surprises later regarding excluded treatments related to congenital defects common within certain breeds.

Wellness add-ons represent optional extras available under many pet insurance packages. They typically encompass services such as spaying/neutering procedures, flea/tick prevention medications, heartworm tests, teeth cleaning sessions, and nutritional consultations. While these additions increase overall premium costs, they promote proactive maintenance strategies aimed at keeping your droopy dog healthy over time. As preventative measures often lead to reduced likelihood of severe diseases manifesting later, investing in wellness packages could translate into long-term savings.

Comparing multiple providers before committing to one particular policy ensures you secure optimal value based on individual circumstances surrounding your droopy dog. Each carrier presents distinct advantages/disadvantages depending upon factors like ease of claims processing, customer service quality, network size (whether they work directly with local veterinarians), and flexibility around customizing plans according to desired features. Conduct thorough research online via reviews, comparison tools, and direct inquiries addressed toward representatives representing competing brands.

In addition to traditional pet insurance offerings, alternative solutions exist worth exploring too. Pet discount programs function similarly to group buying initiatives where members gain access to negotiated pricing arrangements established between program administrators and participating clinics nationwide. Although no actual "insurance" exists here, participants still enjoy substantial reductions off regular prices charged for numerous services benefiting their droopy dogs. Another emerging trend involves subscription-based models delivering ongoing supplies of prescription drugs alongside other perks bundled together conveniently shipped straight home monthly.

Regardless of whichever route ultimately chosen, always remember to maintain accurate records documenting every interaction concerning your droopy dog's healthcare journey. Keeping detailed logs including dates, descriptions, amounts paid, receipts etc., simplifies filing claims accurately whenever necessary. Furthermore, staying vigilant about renewal deadlines prevents lapses leading to loss of continuous coverage potentially resulting in denial of subsequent claims filed afterward.

To summarize, protecting your droopy dog through appropriate pet insurance requires careful consideration of several key elements: type of coverage needed, deductible levels, reimbursement percentages, annual limits, treatment exclusions, availability of wellness supplements, comparisons amongst providers, exploration of alternatives, diligent documentation practices, and timely management of administrative tasks. By taking the time upfront to analyze each component thoroughly, you position yourself well prepared to navigate challenges ahead ensuring lifelong happiness shared together remains uninterrupted financially speaking. Remember, just like humans deserve proper safeguarding mechanisms guarding against unforeseen medical crises, our four-legged companions equally merit similar protections tailored specifically addressing their unique requirements.

Update Time:2025-05-15 06:00:26

When it comes to insuring your beloved pet, there are several factors to consider. The first step is identifying what kind of coverage suits your specific situation. For instance, if you have a droopy dog, which may be predisposed to certain health conditions due to its unique physical characteristics, specialized insurance plans can provide peace of mind. Droopy dogs, characterized by their long ears and saggy facial features, often require additional attention when it comes to eye care, ear infections, and skin issues. These breeds include Bassett Hounds, Bloodhounds, and Cocker Spaniels, among others.

Choosing the right pet insurance package involves evaluating various options that cater to different needs. Most policies cover accidents, illnesses, surgeries, and chronic conditions. Some even extend to wellness programs that include routine check-ups, vaccinations, dental cleanings, and preventive care. Depending on your droopy dog’s age, breed, and medical history, selecting a plan with comprehensive benefits can save you significant expenses down the road.

One important aspect to look out for when choosing a pet insurance plan is the deductible amount. A deductible represents the initial sum you must pay before the insurance company starts covering costs. Typically, deductibles range from $50 to $1,000 per year or incident. Lower deductibles usually come with higher premiums, while higher deductibles lower monthly payments but increase out-of-pocket expenses at claim time. For owners of droopy dogs, opting for a moderate deductible might strike the right balance between affordability and protection against unexpected veterinary bills.

Another critical factor to assess is the reimbursement percentage offered by the policy. This refers to how much of the eligible vet bill the insurer will refund after applying the deductible. Common reimbursement rates vary between 70% and 90%. It's essential to choose a plan offering high enough reimbursement so that you won't face overwhelming financial burdens during emergencies involving your droopy dog.

Moreover, annual limits set boundaries on how much money the insurance provider will contribute towards treating your pet annually. Many standard plans offer maximum payouts ranging from $5,000 to $20,000 per year. However, some companies impose lifetime caps instead of yearly ones. When dealing with a droopy dog susceptible to recurring health problems like ear infections or hip dysplasia, unlimited or generous annual/lifetime limits prove beneficial since they reduce risks associated with hitting these thresholds prematurely.

Pre-existing conditions pose another challenge when purchasing pet insurance. Most insurers do not cover pre-existing ailments unless explicitly stated otherwise in their terms. Therefore, enrolling your droopy dog early in life maximizes chances of obtaining full coverage across all potential future health concerns. Additionally, reading through exclusion clauses carefully helps avoid surprises later regarding excluded treatments related to congenital defects common within certain breeds.

Wellness add-ons represent optional extras available under many pet insurance packages. They typically encompass services such as spaying/neutering procedures, flea/tick prevention medications, heartworm tests, teeth cleaning sessions, and nutritional consultations. While these additions increase overall premium costs, they promote proactive maintenance strategies aimed at keeping your droopy dog healthy over time. As preventative measures often lead to reduced likelihood of severe diseases manifesting later, investing in wellness packages could translate into long-term savings.

Comparing multiple providers before committing to one particular policy ensures you secure optimal value based on individual circumstances surrounding your droopy dog. Each carrier presents distinct advantages/disadvantages depending upon factors like ease of claims processing, customer service quality, network size (whether they work directly with local veterinarians), and flexibility around customizing plans according to desired features. Conduct thorough research online via reviews, comparison tools, and direct inquiries addressed toward representatives representing competing brands.

In addition to traditional pet insurance offerings, alternative solutions exist worth exploring too. Pet discount programs function similarly to group buying initiatives where members gain access to negotiated pricing arrangements established between program administrators and participating clinics nationwide. Although no actual "insurance" exists here, participants still enjoy substantial reductions off regular prices charged for numerous services benefiting their droopy dogs. Another emerging trend involves subscription-based models delivering ongoing supplies of prescription drugs alongside other perks bundled together conveniently shipped straight home monthly.

Regardless of whichever route ultimately chosen, always remember to maintain accurate records documenting every interaction concerning your droopy dog's healthcare journey. Keeping detailed logs including dates, descriptions, amounts paid, receipts etc., simplifies filing claims accurately whenever necessary. Furthermore, staying vigilant about renewal deadlines prevents lapses leading to loss of continuous coverage potentially resulting in denial of subsequent claims filed afterward.

To summarize, protecting your droopy dog through appropriate pet insurance requires careful consideration of several key elements: type of coverage needed, deductible levels, reimbursement percentages, annual limits, treatment exclusions, availability of wellness supplements, comparisons amongst providers, exploration of alternatives, diligent documentation practices, and timely management of administrative tasks. By taking the time upfront to analyze each component thoroughly, you position yourself well prepared to navigate challenges ahead ensuring lifelong happiness shared together remains uninterrupted financially speaking. Remember, just like humans deserve proper safeguarding mechanisms guarding against unforeseen medical crises, our four-legged companions equally merit similar protections tailored specifically addressing their unique requirements.

Update Time:2025-05-15 06:00:26

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form