New ArrivalsBack in stock

racoon dog

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D175176607 second hand :D175176607 |

Manufacturer | racoon dog | release date | 2025-05-14 | List price | $36 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | racoon dog | ||||||||

| category | |||||||||

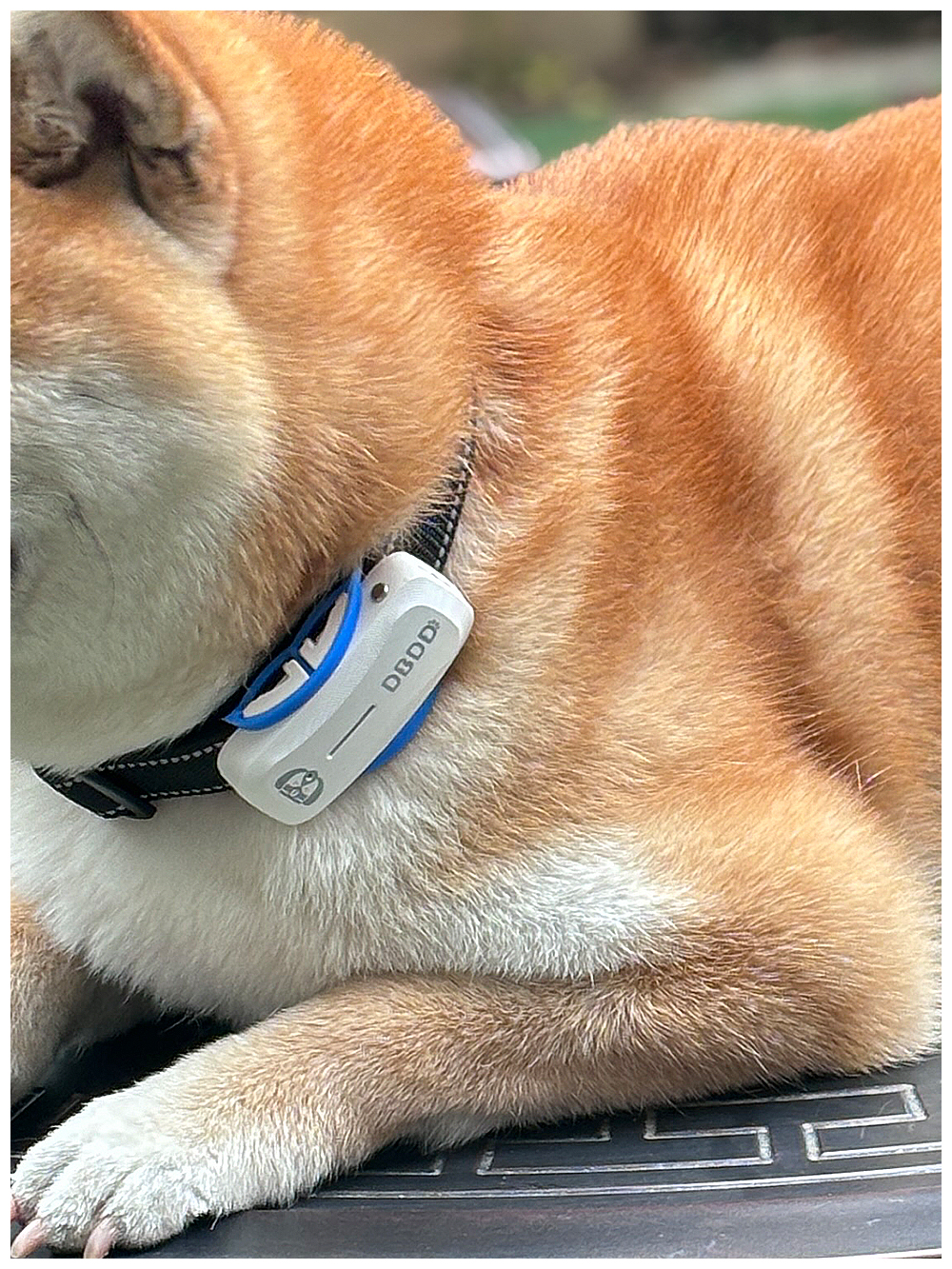

Outdoor Gear#Pet Safety Equipment

The world of pets is as diverse as the animal kingdom itself, and with this diversity comes a need for specialized care and insurance. One such unique pet, the raccoon dog, also known as the tanuki in Japanese culture, is a fascinating creature that deserves attention when it comes to insurance packages. These small, intelligent, and sometimes mischievous animals require a tailored approach to pet insurance to ensure their well-being and the financial protection of their owners.

Understanding the Raccoon Dog

The raccoon dog, scientifically known as Nyctereutes procyonoides, is native to East Asia and is known for its distinctive raccoon-like face and bushy tail. They are medium-sized canines, typically weighing between 5 to 14 kilograms, and are known for their playful and curious nature. Raccoon dogs are omnivorous, with a diet that includes fruits, insects, small mammals, and birds.

Due to their adaptability and resourcefulness, raccoon dogs have been kept as exotic pets in some parts of the world. However, owning a raccoon dog is not without its challenges. They require a large outdoor space to roam and play, a diet that mimics their natural eating habits, and regular veterinary care to ensure their health. This is where a comprehensive pet insurance package comes into play.

Key Considerations for Raccoon Dog Insurance

1. Coverage for Exotic Species: Traditional pet insurance policies often exclude exotic species, so it's crucial to find a provider that specifically covers raccoon dogs. This ensures that any medical expenses or unexpected incidents are covered.

2. Comprehensive Health Care: Raccoon dogs, like any other pet, can suffer from illnesses or injuries. Comprehensive health care coverage is essential to ensure that your raccoon dog receives the best possible care without breaking the bank.

3. Behavior and Training: Raccoon dogs are intelligent but can also be quite mischievous. Coverage for behavior modification and training can be beneficial to help manage their natural instincts and ensure they are well-behaved members of your household.

4. Escape Prevention: Given their resourcefulness, raccoon dogs are known to be escape artists. Insurance that covers the cost of找回 services if your raccoon dog goes missing can provide peace of mind.

5. Third-Party Liability: Just like any other pet, raccoon dogs can cause damage to property or harm to other animals. Third-party liability coverage can protect you from financial losses resulting from such incidents.

6. Regular Veterinary Check-ups: Preventative care is crucial for maintaining the health of your raccoon dog. Look for insurance that covers regular veterinary check-ups, vaccinations, and routine dental cleanings.

7. Emergency and Critical Care: Emergencies can happen at any time, and critical care for raccoon dogs can be expensive. Insurance that covers emergency and critical care treatments is a must.

8. Quarantine and Travel: If you travel with your raccoon dog, the costs associated with quarantine and travel can add up. Some insurance policies offer coverage for these expenses, which can be a significant benefit for owners who travel frequently.

9. End of Life Care: The final days of a pet's life should be as comfortable and dignified as possible. Insurance that covers end of life care and euthanasia can help alleviate some of the financial burden during this difficult time.

10. Customized Packages: Every raccoon dog and owner's situation is unique. Look for an insurance provider that offers customizable packages to meet the specific needs of your raccoon dog.

Finding the Right Insurance Provider

When looking for the right pet insurance package for your raccoon dog, it's important to do thorough research. Here are some steps to help you find the best fit:

1. Research Providers: Start by researching pet insurance providers that specialize in exotic species. Look for reviews and testimonials from other raccoon dog owners to gauge the quality of service and coverage.

2. Compare Policies: Once you have a list of potential providers, compare their policies side by side. Take note of the coverage, exclusions, deductibles, and any additional benefits they offer.

3. Consult with a Veterinarian: Speak with your raccoon dog's veterinarian about their recommendations for insurance providers. They may have firsthand experience with certain companies and can provide valuable insights.

4. Budget Considerations: Insurance can be a significant investment, so it's important to find a policy that fits within your budget. Be sure to consider the cost of premiums as well as any out-of-pocket expenses that may arise.

5. Customer Service: A good insurance provider should have responsive and helpful customer service. Test this by reaching out to potential providers with questions or concerns to see how they handle your inquiries.

6. Claims Process: The claims process should be straightforward and efficient. Ask providers about their claims process and how long it typically takes to receive reimbursement for covered expenses.

7.灵活性 and Adaptability: As your raccoon dog grows and their needs change, your insurance coverage may need to adapt as well. Choose a provider that allows for flexibility in adjusting your policy as needed.

8. Policy Details

Update Time:2025-05-14 23:54:51

Understanding the Raccoon Dog

The raccoon dog, scientifically known as Nyctereutes procyonoides, is native to East Asia and is known for its distinctive raccoon-like face and bushy tail. They are medium-sized canines, typically weighing between 5 to 14 kilograms, and are known for their playful and curious nature. Raccoon dogs are omnivorous, with a diet that includes fruits, insects, small mammals, and birds.

Due to their adaptability and resourcefulness, raccoon dogs have been kept as exotic pets in some parts of the world. However, owning a raccoon dog is not without its challenges. They require a large outdoor space to roam and play, a diet that mimics their natural eating habits, and regular veterinary care to ensure their health. This is where a comprehensive pet insurance package comes into play.

Key Considerations for Raccoon Dog Insurance

1. Coverage for Exotic Species: Traditional pet insurance policies often exclude exotic species, so it's crucial to find a provider that specifically covers raccoon dogs. This ensures that any medical expenses or unexpected incidents are covered.

2. Comprehensive Health Care: Raccoon dogs, like any other pet, can suffer from illnesses or injuries. Comprehensive health care coverage is essential to ensure that your raccoon dog receives the best possible care without breaking the bank.

3. Behavior and Training: Raccoon dogs are intelligent but can also be quite mischievous. Coverage for behavior modification and training can be beneficial to help manage their natural instincts and ensure they are well-behaved members of your household.

4. Escape Prevention: Given their resourcefulness, raccoon dogs are known to be escape artists. Insurance that covers the cost of找回 services if your raccoon dog goes missing can provide peace of mind.

5. Third-Party Liability: Just like any other pet, raccoon dogs can cause damage to property or harm to other animals. Third-party liability coverage can protect you from financial losses resulting from such incidents.

6. Regular Veterinary Check-ups: Preventative care is crucial for maintaining the health of your raccoon dog. Look for insurance that covers regular veterinary check-ups, vaccinations, and routine dental cleanings.

7. Emergency and Critical Care: Emergencies can happen at any time, and critical care for raccoon dogs can be expensive. Insurance that covers emergency and critical care treatments is a must.

8. Quarantine and Travel: If you travel with your raccoon dog, the costs associated with quarantine and travel can add up. Some insurance policies offer coverage for these expenses, which can be a significant benefit for owners who travel frequently.

9. End of Life Care: The final days of a pet's life should be as comfortable and dignified as possible. Insurance that covers end of life care and euthanasia can help alleviate some of the financial burden during this difficult time.

10. Customized Packages: Every raccoon dog and owner's situation is unique. Look for an insurance provider that offers customizable packages to meet the specific needs of your raccoon dog.

Finding the Right Insurance Provider

When looking for the right pet insurance package for your raccoon dog, it's important to do thorough research. Here are some steps to help you find the best fit:

1. Research Providers: Start by researching pet insurance providers that specialize in exotic species. Look for reviews and testimonials from other raccoon dog owners to gauge the quality of service and coverage.

2. Compare Policies: Once you have a list of potential providers, compare their policies side by side. Take note of the coverage, exclusions, deductibles, and any additional benefits they offer.

3. Consult with a Veterinarian: Speak with your raccoon dog's veterinarian about their recommendations for insurance providers. They may have firsthand experience with certain companies and can provide valuable insights.

4. Budget Considerations: Insurance can be a significant investment, so it's important to find a policy that fits within your budget. Be sure to consider the cost of premiums as well as any out-of-pocket expenses that may arise.

5. Customer Service: A good insurance provider should have responsive and helpful customer service. Test this by reaching out to potential providers with questions or concerns to see how they handle your inquiries.

6. Claims Process: The claims process should be straightforward and efficient. Ask providers about their claims process and how long it typically takes to receive reimbursement for covered expenses.

7.灵活性 and Adaptability: As your raccoon dog grows and their needs change, your insurance coverage may need to adapt as well. Choose a provider that allows for flexibility in adjusting your policy as needed.

8. Policy Details

Update Time:2025-05-14 23:54:51

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form