New ArrivalsBack in stock

hachi a dog's tale

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D859045435 second hand :D859045435 |

Manufacturer | hachi a | release date | 2025-05-15 | List price | $36 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | a dog's | ||||||||

| category | |||||||||

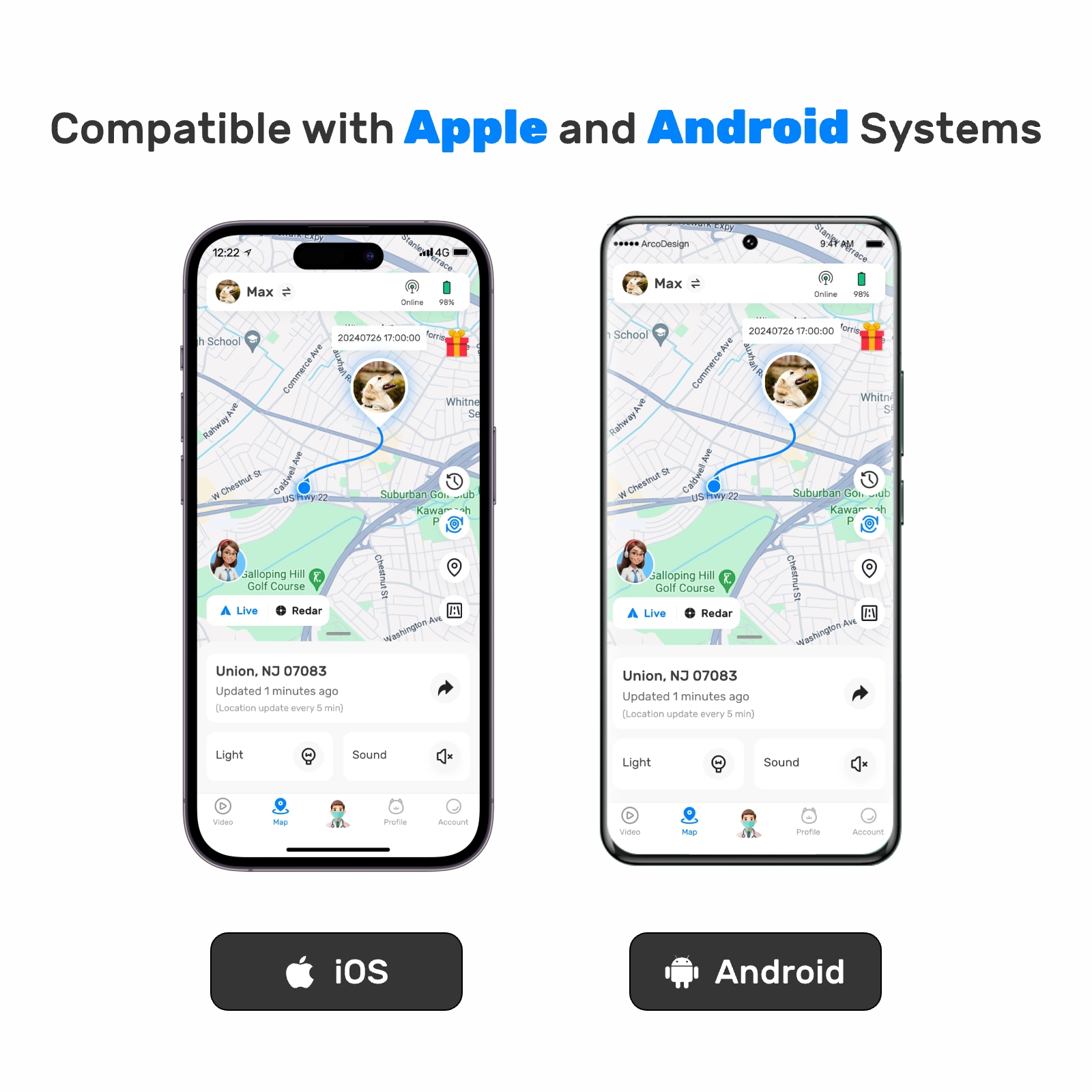

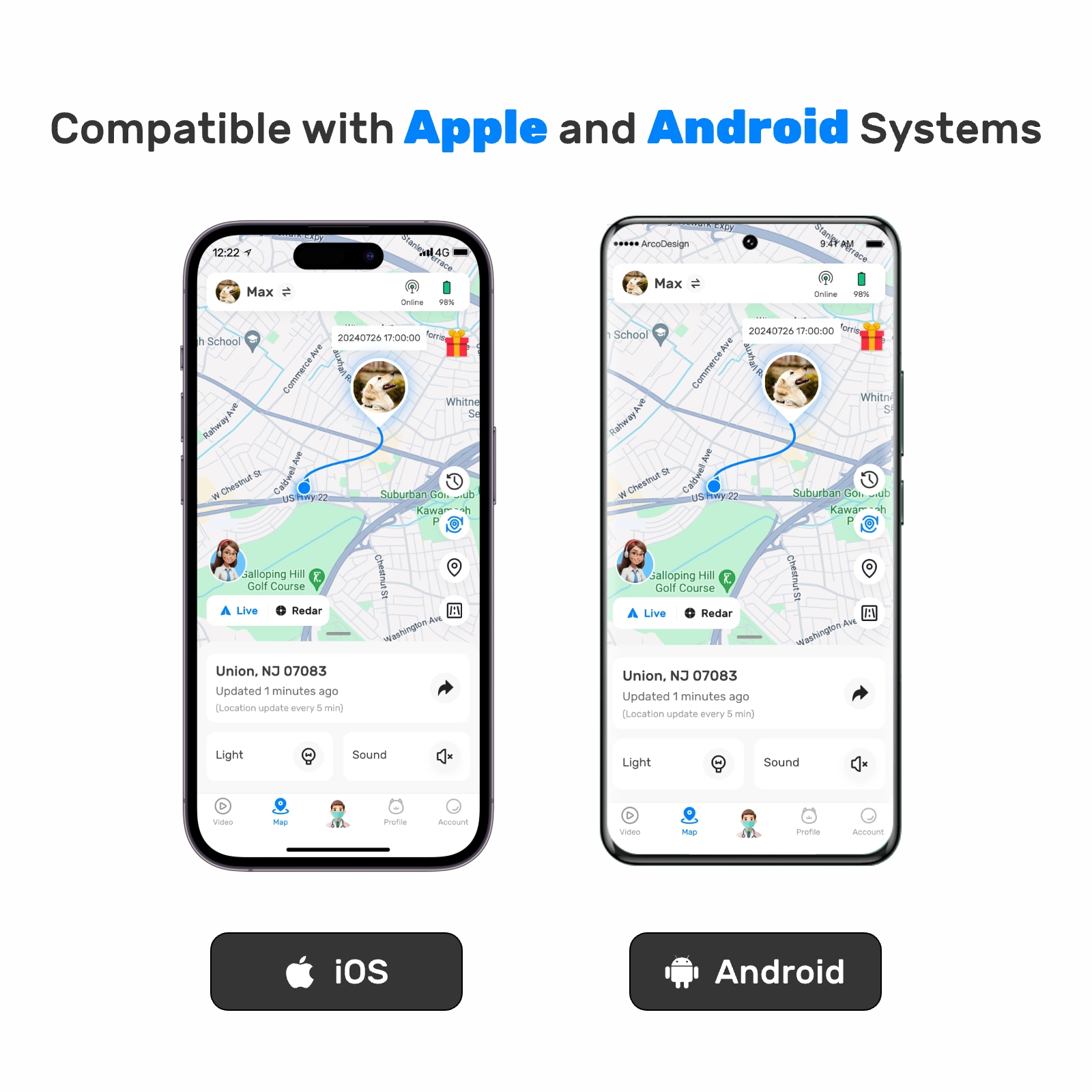

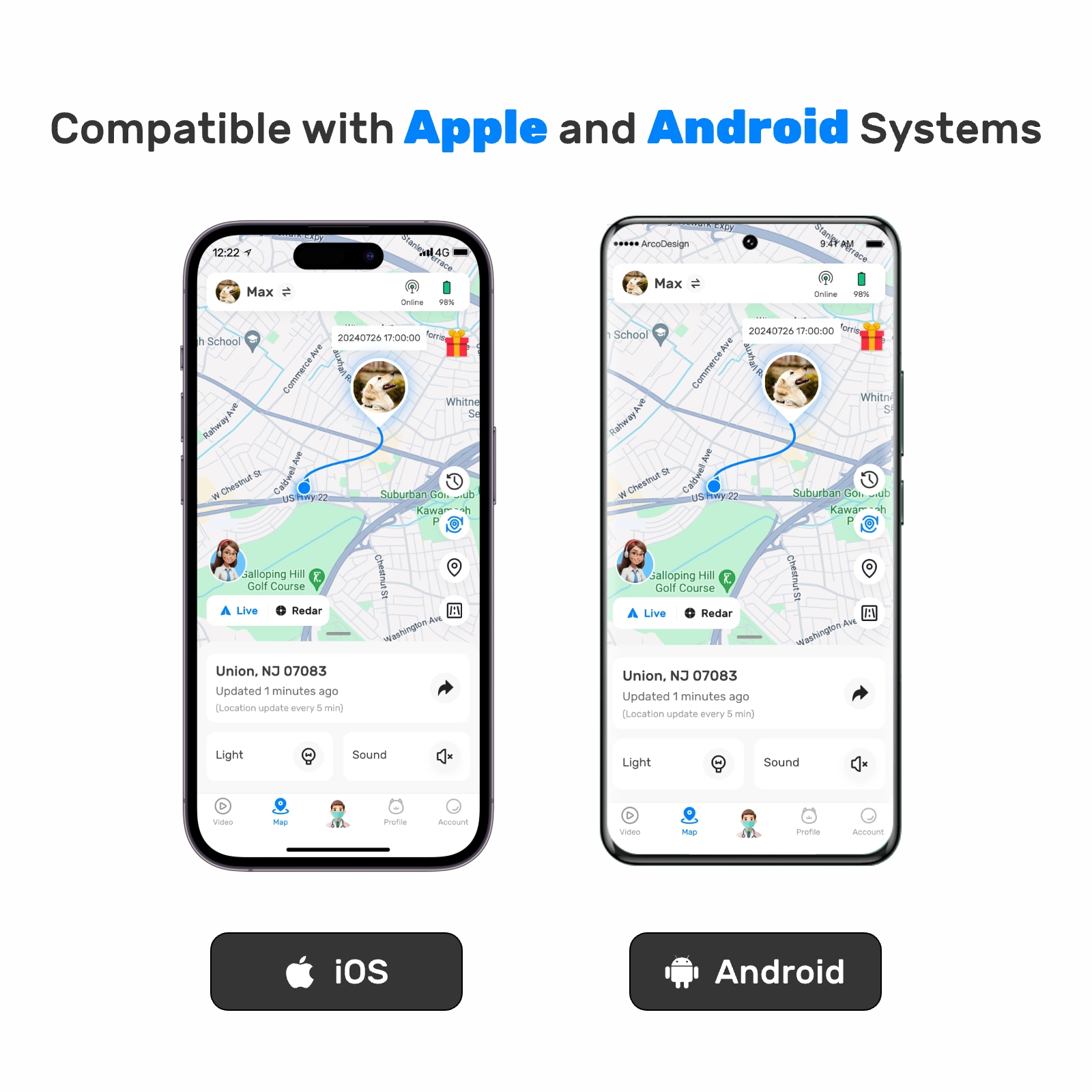

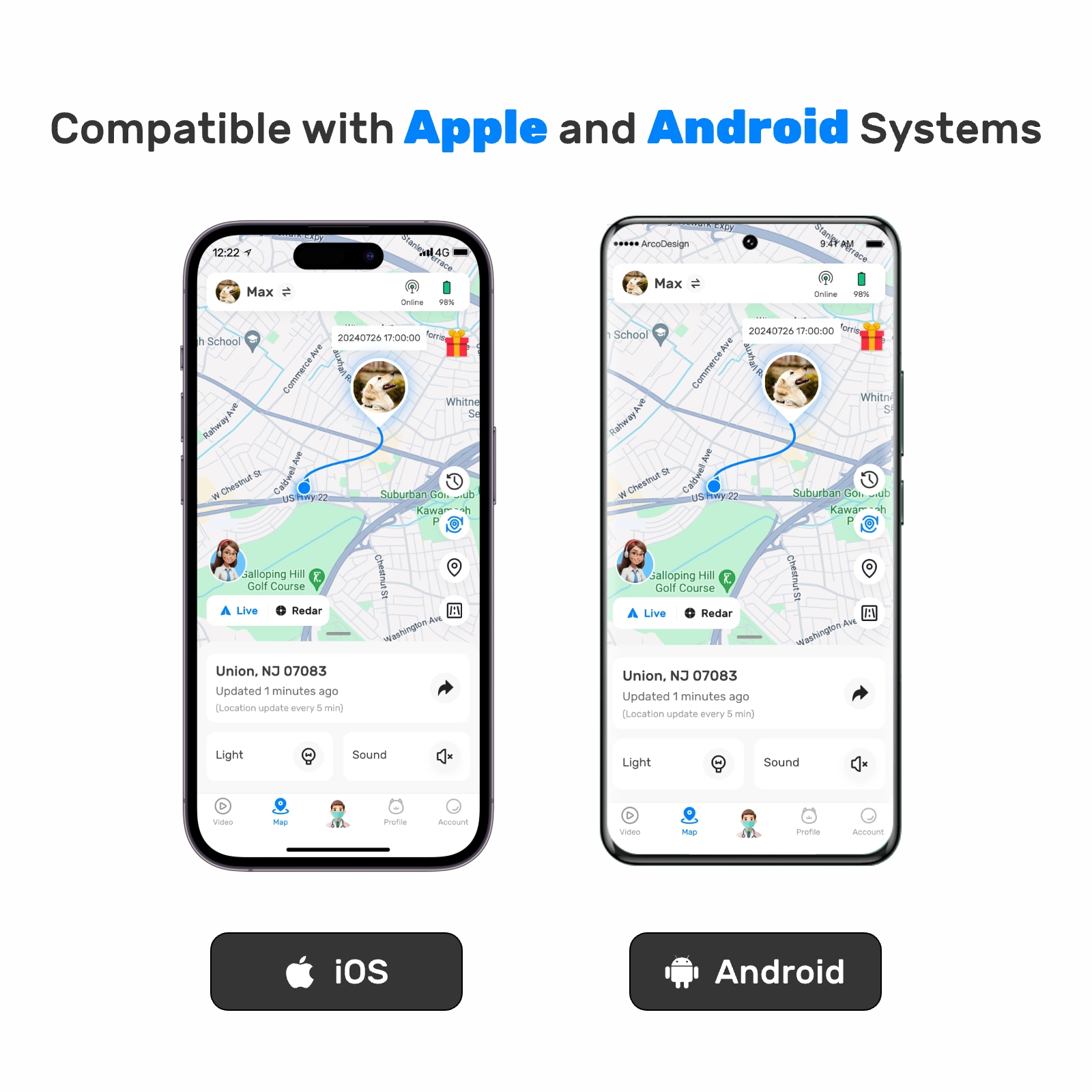

Mobile Tech#Bluetooth Tracking Accessories

Pet insurance has become an increasingly popular option for pet owners in recent years, offering peace of mind and financial protection when it comes to the health and well-being of beloved animals. This type of coverage is particularly relevant when considering the emotional bonds that develop between humans and their pets. One such story that perfectly encapsulates this bond is Hachi: A Dog's Tale. The film, based on a true story, highlights the loyalty and devotion of a dog named Hachiko toward his owner, Professor Parker Wilson. As we delve into the intricacies of pet insurance packages, it becomes clear how crucial these plans can be in ensuring that dogs like Hachi receive the care they need.

Hachi: A Dog's Tale tells the heartwarming yet poignant story of a loyal Akita who waits patiently every day at the train station for his owner, even after the professor’s untimely death. The film serves as a powerful reminder of the deep connection shared between people and their pets. It also raises questions about what happens when unforeseen circumstances arise—such as illness or injury—that could jeopardize a pet's health. This is where pet insurance steps in, providing essential support during challenging times.

The Importance of Pet Insurance

Pet insurance works similarly to human health insurance but is tailored specifically to address the medical needs of animals. Policies typically cover accidents, illnesses, surgeries, and other veterinary expenses. For many pet owners, the cost of unexpected vet bills can quickly add up, sometimes reaching thousands of dollars depending on the severity of the condition. With pet insurance, however, these costs are significantly reduced, allowing owners to focus on their pet's recovery rather than worrying about finances.

There are several reasons why purchasing a pet insurance package makes sense:

1. **Financial Security**: Veterinary care can be expensive, especially if your pet requires emergency treatment or specialized procedures. Having insurance ensures you're prepared for any eventuality without compromising your pet's health due to budget constraints.

2. **Peace of Mind**: Knowing that your furry friend is covered gives you reassurance that no matter what happens, they will receive the best possible care. This is especially important for pets like Hachi, whose loyalty and companionship mean so much to their owners.

3. **Comprehensive Coverage**: Many policies offer extensive coverage options, including preventive care, chronic conditions, alternative therapies, and more. These features allow you to customize a plan that suits both your pet's specific needs and your financial situation.

Types of Pet Insurance Packages

When exploring pet insurance options, it's essential to understand the different types of packages available. Here are some common categories:

- **Accident-Only Plans**: These basic plans cover injuries resulting from accidents such as broken bones, lacerations, or poisoning. They tend to be less expensive compared to broader policies but still provide valuable protection against sudden mishaps.

- **Illness & Accident Plans**: Combining coverage for both accidents and illnesses, these plans are more comprehensive and often include diagnostic tests, surgeries, hospitalization, medications, and ongoing treatments for chronic conditions.

- **Wellness Plans**: In addition to accident and illness coverage, wellness plans may include routine check-ups, vaccinations, dental cleanings, flea/tick prevention, and other preventive services. While slightly pricier, these plans promote long-term health by addressing issues before they escalate.

Factors to Consider When Choosing a Plan

Selecting the right pet insurance package involves careful consideration of various factors:

1. **Pet Breed and Age**: Certain breeds are predisposed to particular health issues, while older pets generally require more frequent medical attention. Understanding your pet's potential risks helps determine which level of coverage is most appropriate.

2. **Coverage Limits and Deductibles**: Each policy comes with its own set of limits, deductibles, and co-pays. Evaluate these carefully to ensure the plan aligns with your expectations and budget.

3. **Pre-existing Conditions**: Most insurers do not cover pre-existing conditions, so it's crucial to enroll your pet early in life to maximize benefits.

4. **Reimbursement Process**: Some companies pay veterinarians directly, while others reimburse owners after submission of receipts. Knowing how payments work simplifies the claims process.

5. **Customer Service and Reputation**: Research reviews and ratings of insurance providers to gauge their reliability and responsiveness in handling claims.

Real-Life Applications of Pet Insurance

To better illustrate the value of pet insurance, let us consider a hypothetical scenario inspired by Hachi: A Dog's Tale. Imagine Professor Parker discovers that Hachi has developed hip dysplasia, a common orthopedic issue among large-breed dogs. Without insurance, treating this condition might involve costly surgeries, physical therapy sessions, and lifelong pain management strategies. However, with a robust pet insurance plan in place, much of the expense would be mitigated, enabling Parker to prioritize Hachi's comfort and quality of life.

Another example involves a sudden accident—perhaps Hachi ingests something toxic during one of his daily walks. Emergency room visits, bloodwork, and antidotes could easily run into hundreds or even thousands of dollars. Thanks to pet insurance, though, the burden of these fees would be substantially lighter, allowing Parker to concentrate solely on nursing Hachi back to health.

Cost vs. Value Proposition

While pet insurance does come with monthly premiums, it is important to weigh the costs against the potential savings and security provided. On average, basic plans start around $10-$20 per month, whereas more inclusive options might range anywhere from $30-$70+. Although these figures may seem significant initially, they pale in comparison to the astronomical sums associated with major surgeries or prolonged treatments.

Moreover, investing in pet insurance reflects a commitment to responsible pet ownership. By preparing financially for future uncertainties, you demonstrate respect for your animal companion's well-being—a sentiment beautifully captured in Hachi: A Dog's Tale through the unwavering bond between man and dog.

Challenges and Misconceptions Surrounding Pet Insurance

Despite its advantages, pet insurance isn't without challenges. Common misconceptions include believing that all policies are prohibitively expensive or that younger, healthier pets don't need coverage. Additionally, there exists confusion regarding exclusions, waiting periods, and claim processes—all of which necessitate thorough research prior to purchase.

Furthermore, some critics argue that certain plans lack sufficient flexibility or fail to adequately address niche scenarios (e.g., exotic pets). Nevertheless, advancements in the industry continue to expand offerings, making it easier than ever to find a suitable match for almost any pet.

Conclusion

In conclusion, pet insurance represents a vital tool for safeguarding the health and happiness of our four-legged friends. Inspired by stories like Hachi: A Dog's Tale, we recognize the profound impact animals have on our lives and the importance of reciprocating that care. Whether opting for an accident-only plan or a fully loaded wellness package, choosing the right coverage empowers owners to make informed decisions about their pet's healthcare needs.

Ultimately, pet insurance isn't merely about numbers; it's about fostering relationships built on trust, love, and mutual responsibility. Just as Hachiko waited faithfully for his master, so too should we strive to protect and cherish those who bring joy and meaning into our world. Through thoughtful planning and proactive measures, we honor this sacred connection and ensure brighter futures for all creatures great and small.

Update Time:2025-05-15 18:48:34

Hachi: A Dog's Tale tells the heartwarming yet poignant story of a loyal Akita who waits patiently every day at the train station for his owner, even after the professor’s untimely death. The film serves as a powerful reminder of the deep connection shared between people and their pets. It also raises questions about what happens when unforeseen circumstances arise—such as illness or injury—that could jeopardize a pet's health. This is where pet insurance steps in, providing essential support during challenging times.

The Importance of Pet Insurance

Pet insurance works similarly to human health insurance but is tailored specifically to address the medical needs of animals. Policies typically cover accidents, illnesses, surgeries, and other veterinary expenses. For many pet owners, the cost of unexpected vet bills can quickly add up, sometimes reaching thousands of dollars depending on the severity of the condition. With pet insurance, however, these costs are significantly reduced, allowing owners to focus on their pet's recovery rather than worrying about finances.

There are several reasons why purchasing a pet insurance package makes sense:

1. **Financial Security**: Veterinary care can be expensive, especially if your pet requires emergency treatment or specialized procedures. Having insurance ensures you're prepared for any eventuality without compromising your pet's health due to budget constraints.

2. **Peace of Mind**: Knowing that your furry friend is covered gives you reassurance that no matter what happens, they will receive the best possible care. This is especially important for pets like Hachi, whose loyalty and companionship mean so much to their owners.

3. **Comprehensive Coverage**: Many policies offer extensive coverage options, including preventive care, chronic conditions, alternative therapies, and more. These features allow you to customize a plan that suits both your pet's specific needs and your financial situation.

Types of Pet Insurance Packages

When exploring pet insurance options, it's essential to understand the different types of packages available. Here are some common categories:

- **Accident-Only Plans**: These basic plans cover injuries resulting from accidents such as broken bones, lacerations, or poisoning. They tend to be less expensive compared to broader policies but still provide valuable protection against sudden mishaps.

- **Illness & Accident Plans**: Combining coverage for both accidents and illnesses, these plans are more comprehensive and often include diagnostic tests, surgeries, hospitalization, medications, and ongoing treatments for chronic conditions.

- **Wellness Plans**: In addition to accident and illness coverage, wellness plans may include routine check-ups, vaccinations, dental cleanings, flea/tick prevention, and other preventive services. While slightly pricier, these plans promote long-term health by addressing issues before they escalate.

Factors to Consider When Choosing a Plan

Selecting the right pet insurance package involves careful consideration of various factors:

1. **Pet Breed and Age**: Certain breeds are predisposed to particular health issues, while older pets generally require more frequent medical attention. Understanding your pet's potential risks helps determine which level of coverage is most appropriate.

2. **Coverage Limits and Deductibles**: Each policy comes with its own set of limits, deductibles, and co-pays. Evaluate these carefully to ensure the plan aligns with your expectations and budget.

3. **Pre-existing Conditions**: Most insurers do not cover pre-existing conditions, so it's crucial to enroll your pet early in life to maximize benefits.

4. **Reimbursement Process**: Some companies pay veterinarians directly, while others reimburse owners after submission of receipts. Knowing how payments work simplifies the claims process.

5. **Customer Service and Reputation**: Research reviews and ratings of insurance providers to gauge their reliability and responsiveness in handling claims.

Real-Life Applications of Pet Insurance

To better illustrate the value of pet insurance, let us consider a hypothetical scenario inspired by Hachi: A Dog's Tale. Imagine Professor Parker discovers that Hachi has developed hip dysplasia, a common orthopedic issue among large-breed dogs. Without insurance, treating this condition might involve costly surgeries, physical therapy sessions, and lifelong pain management strategies. However, with a robust pet insurance plan in place, much of the expense would be mitigated, enabling Parker to prioritize Hachi's comfort and quality of life.

Another example involves a sudden accident—perhaps Hachi ingests something toxic during one of his daily walks. Emergency room visits, bloodwork, and antidotes could easily run into hundreds or even thousands of dollars. Thanks to pet insurance, though, the burden of these fees would be substantially lighter, allowing Parker to concentrate solely on nursing Hachi back to health.

Cost vs. Value Proposition

While pet insurance does come with monthly premiums, it is important to weigh the costs against the potential savings and security provided. On average, basic plans start around $10-$20 per month, whereas more inclusive options might range anywhere from $30-$70+. Although these figures may seem significant initially, they pale in comparison to the astronomical sums associated with major surgeries or prolonged treatments.

Moreover, investing in pet insurance reflects a commitment to responsible pet ownership. By preparing financially for future uncertainties, you demonstrate respect for your animal companion's well-being—a sentiment beautifully captured in Hachi: A Dog's Tale through the unwavering bond between man and dog.

Challenges and Misconceptions Surrounding Pet Insurance

Despite its advantages, pet insurance isn't without challenges. Common misconceptions include believing that all policies are prohibitively expensive or that younger, healthier pets don't need coverage. Additionally, there exists confusion regarding exclusions, waiting periods, and claim processes—all of which necessitate thorough research prior to purchase.

Furthermore, some critics argue that certain plans lack sufficient flexibility or fail to adequately address niche scenarios (e.g., exotic pets). Nevertheless, advancements in the industry continue to expand offerings, making it easier than ever to find a suitable match for almost any pet.

Conclusion

In conclusion, pet insurance represents a vital tool for safeguarding the health and happiness of our four-legged friends. Inspired by stories like Hachi: A Dog's Tale, we recognize the profound impact animals have on our lives and the importance of reciprocating that care. Whether opting for an accident-only plan or a fully loaded wellness package, choosing the right coverage empowers owners to make informed decisions about their pet's healthcare needs.

Ultimately, pet insurance isn't merely about numbers; it's about fostering relationships built on trust, love, and mutual responsibility. Just as Hachiko waited faithfully for his master, so too should we strive to protect and cherish those who bring joy and meaning into our world. Through thoughtful planning and proactive measures, we honor this sacred connection and ensure brighter futures for all creatures great and small.

Update Time:2025-05-15 18:48:34

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form