New ArrivalsBack in stock

heartgard for dogs

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D679393877 second hand :D679393877 |

Manufacturer | heartgard for | release date | 2025-05-15 | List price | $45 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | for dogs | ||||||||

| category | |||||||||

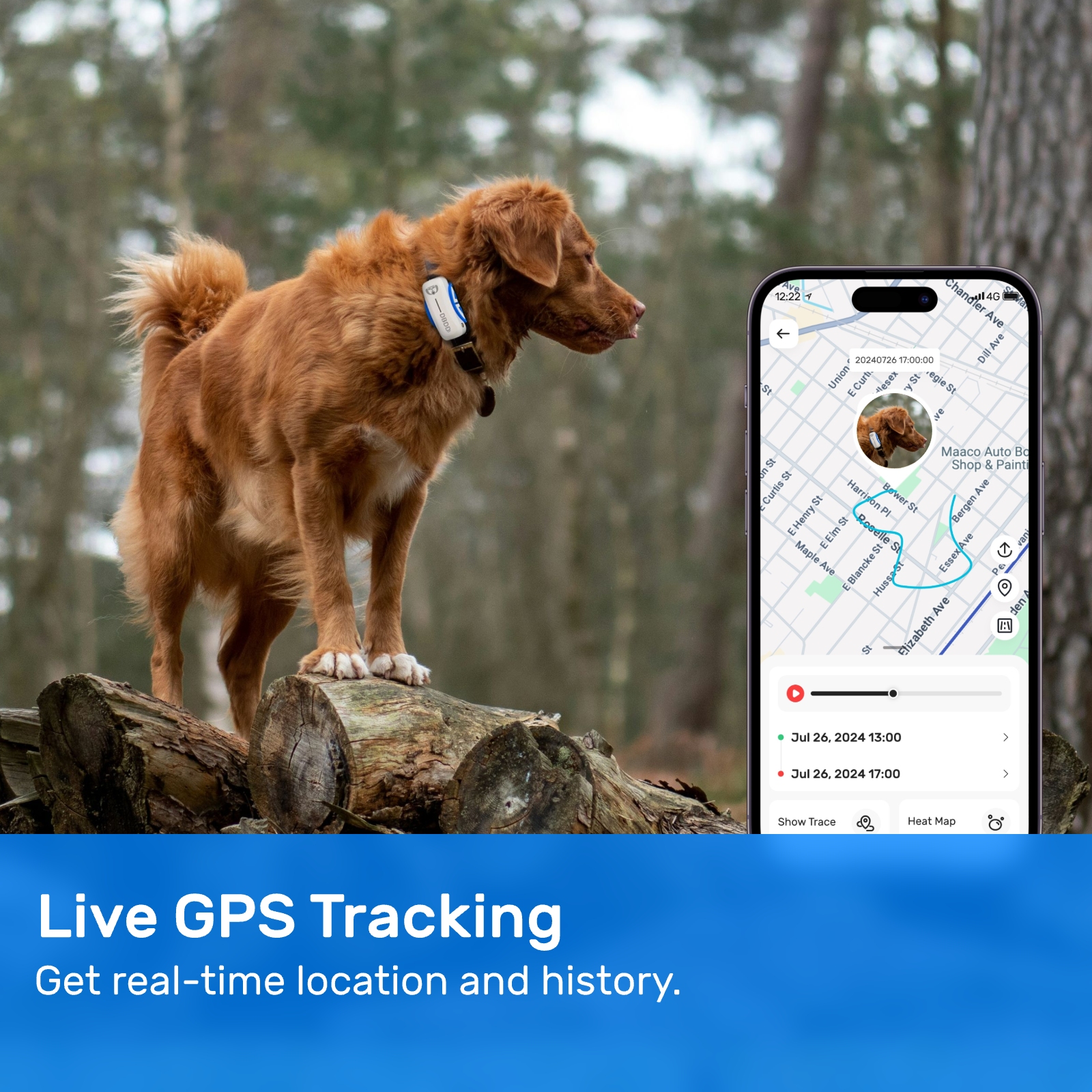

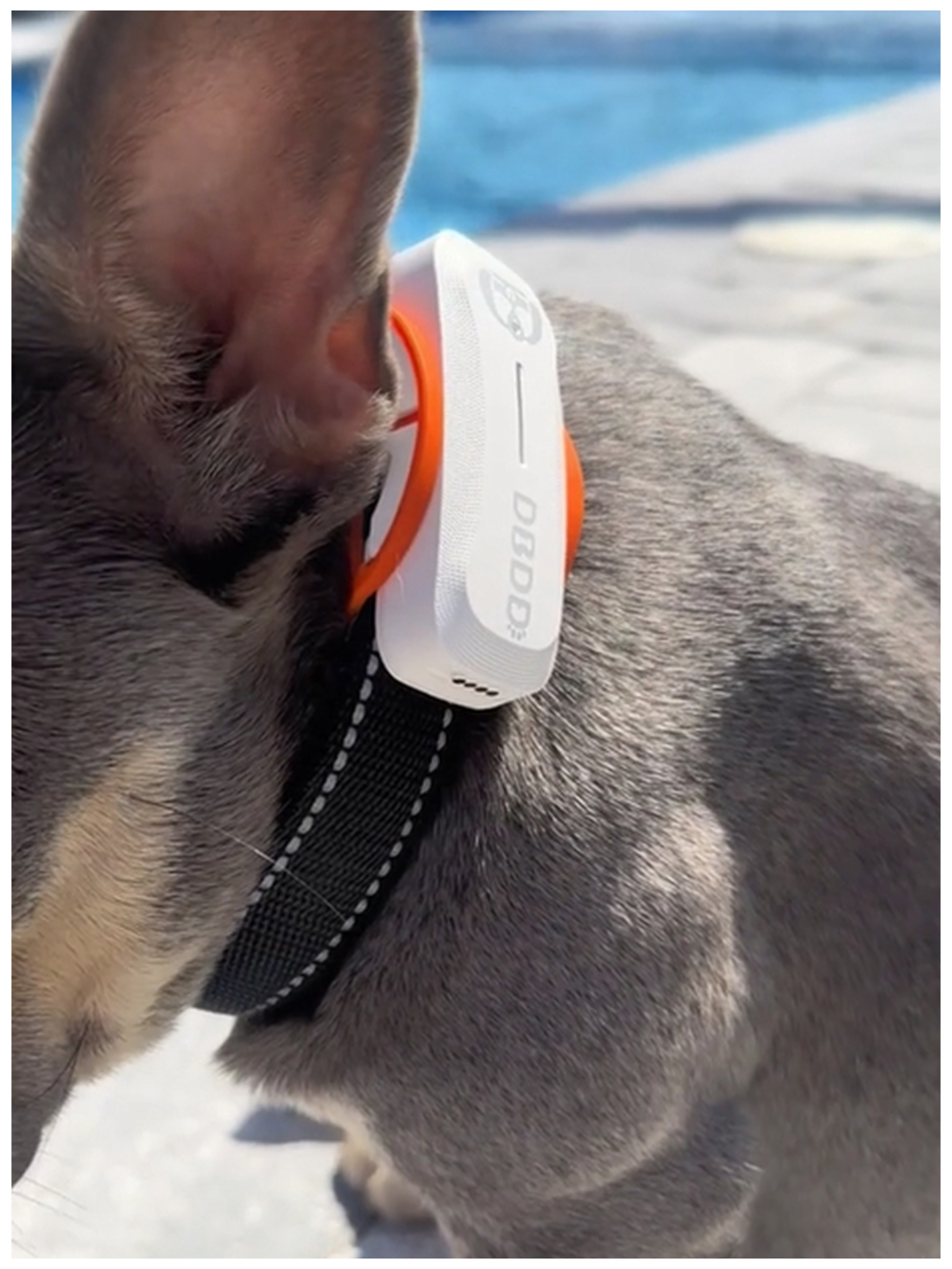

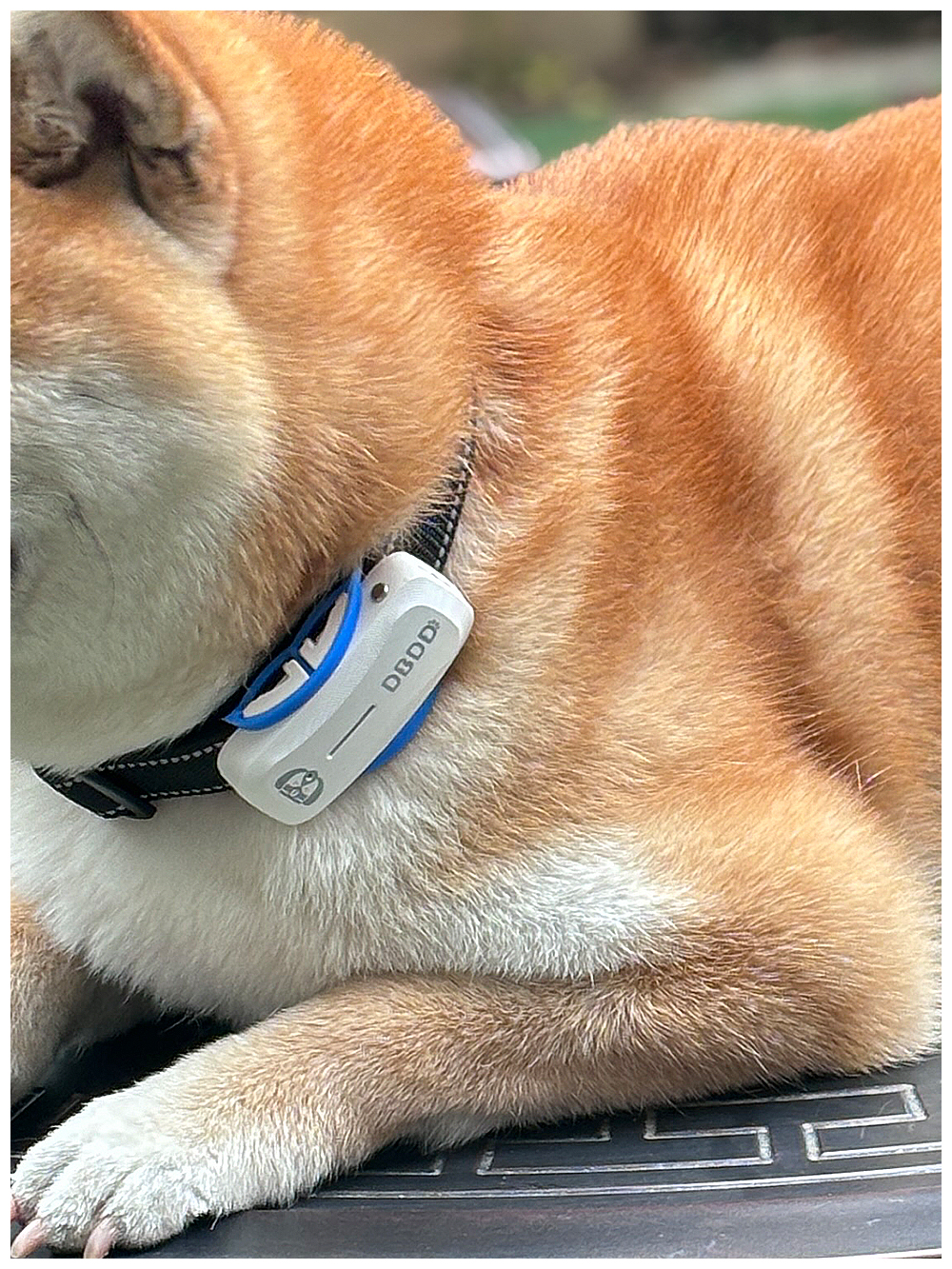

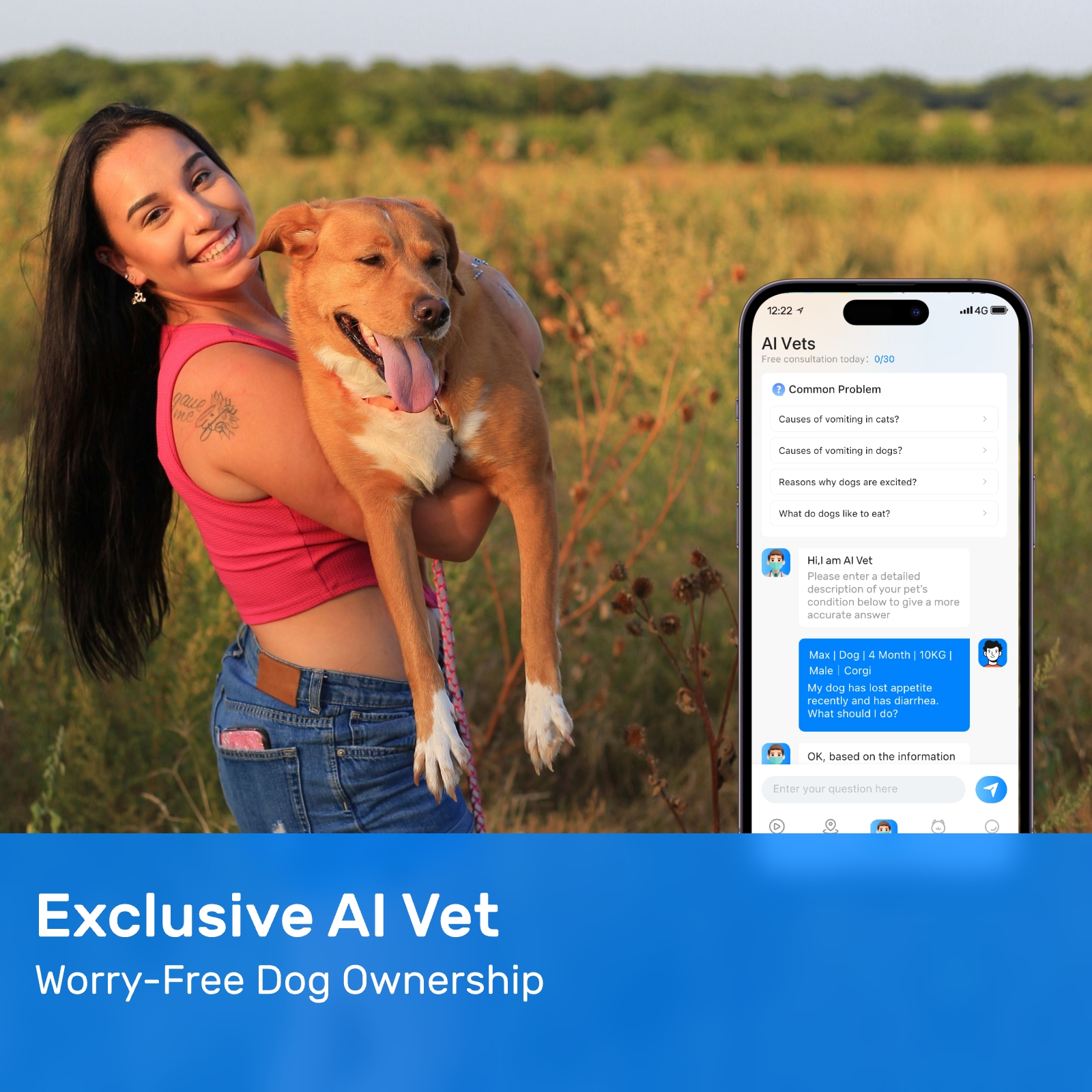

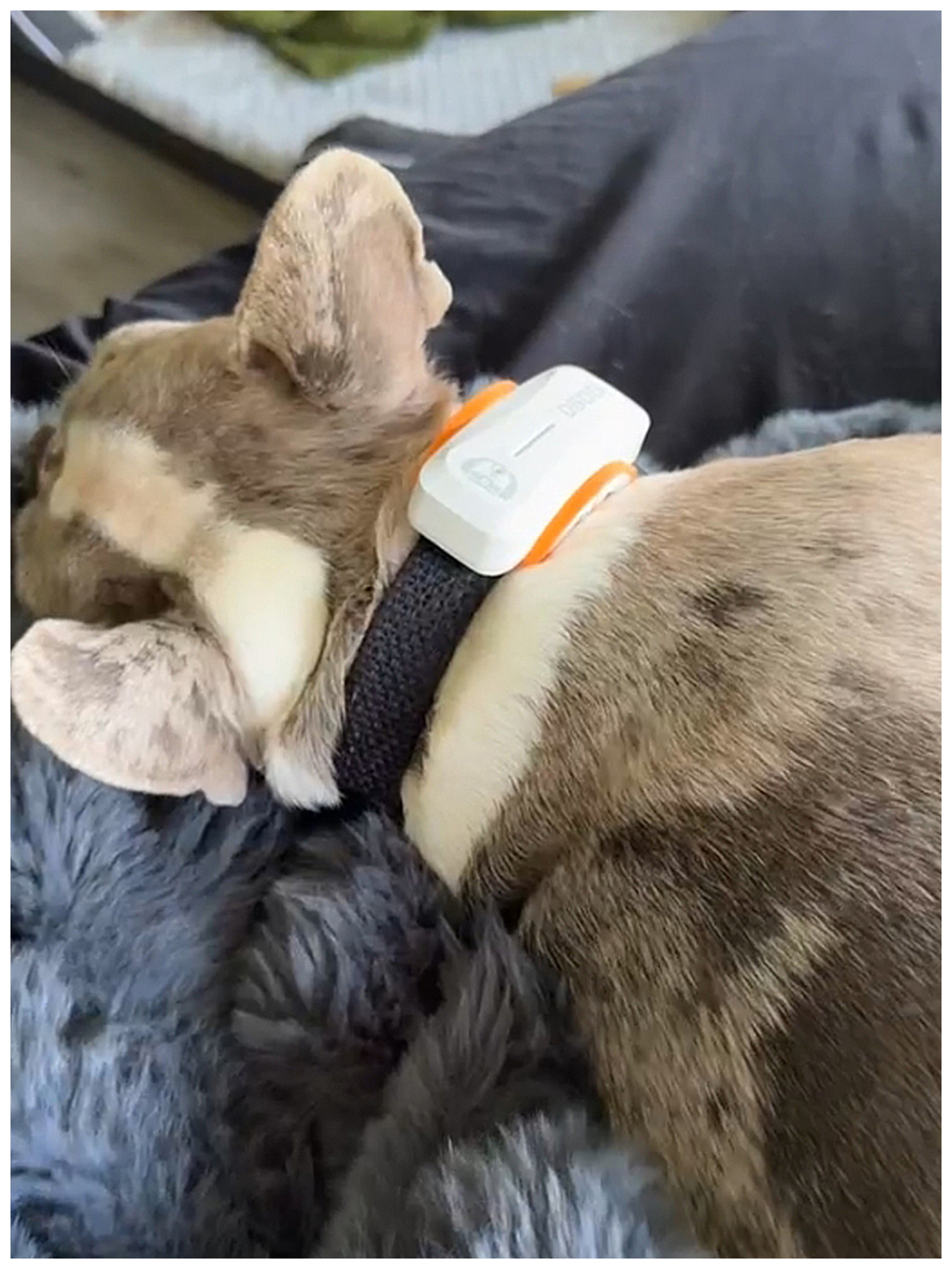

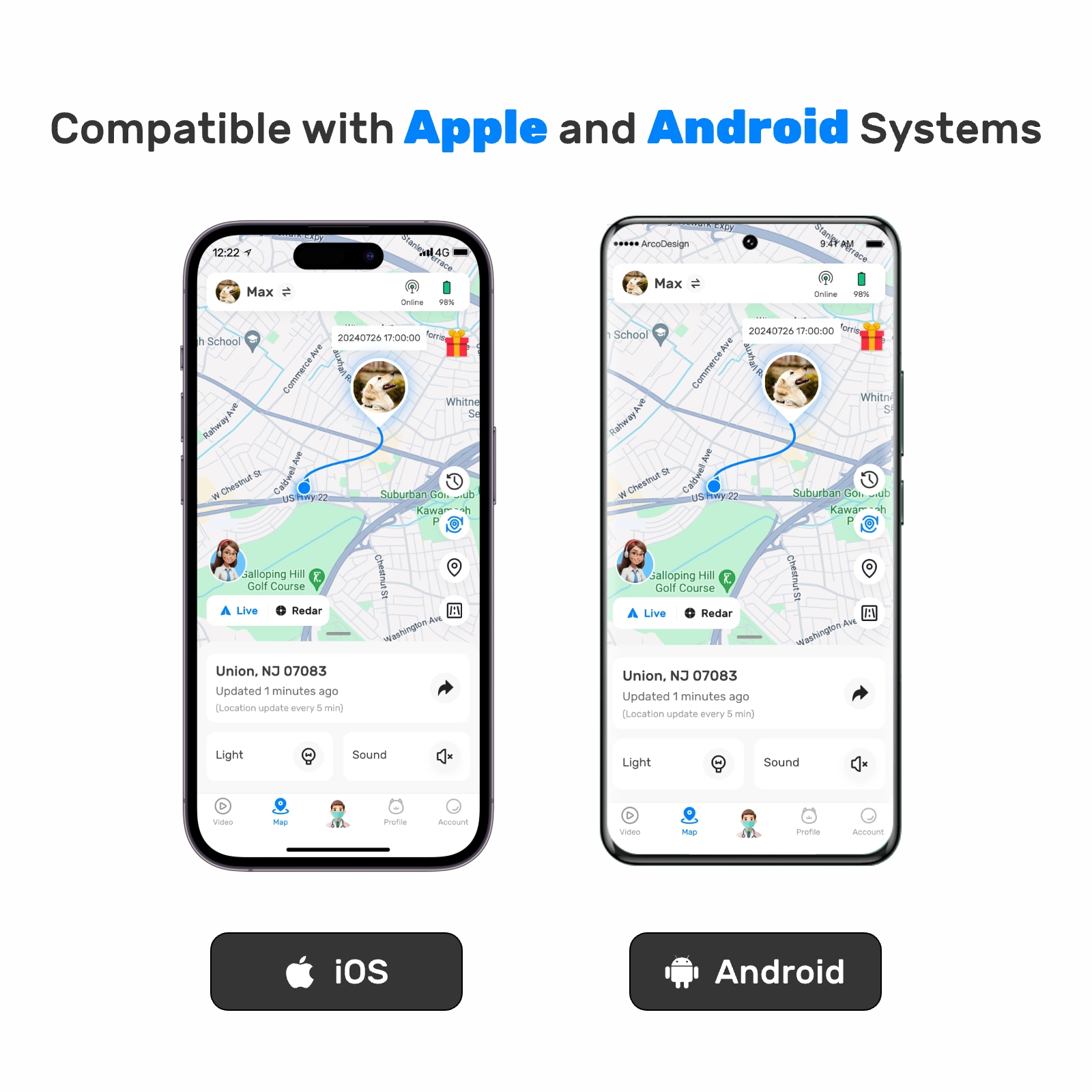

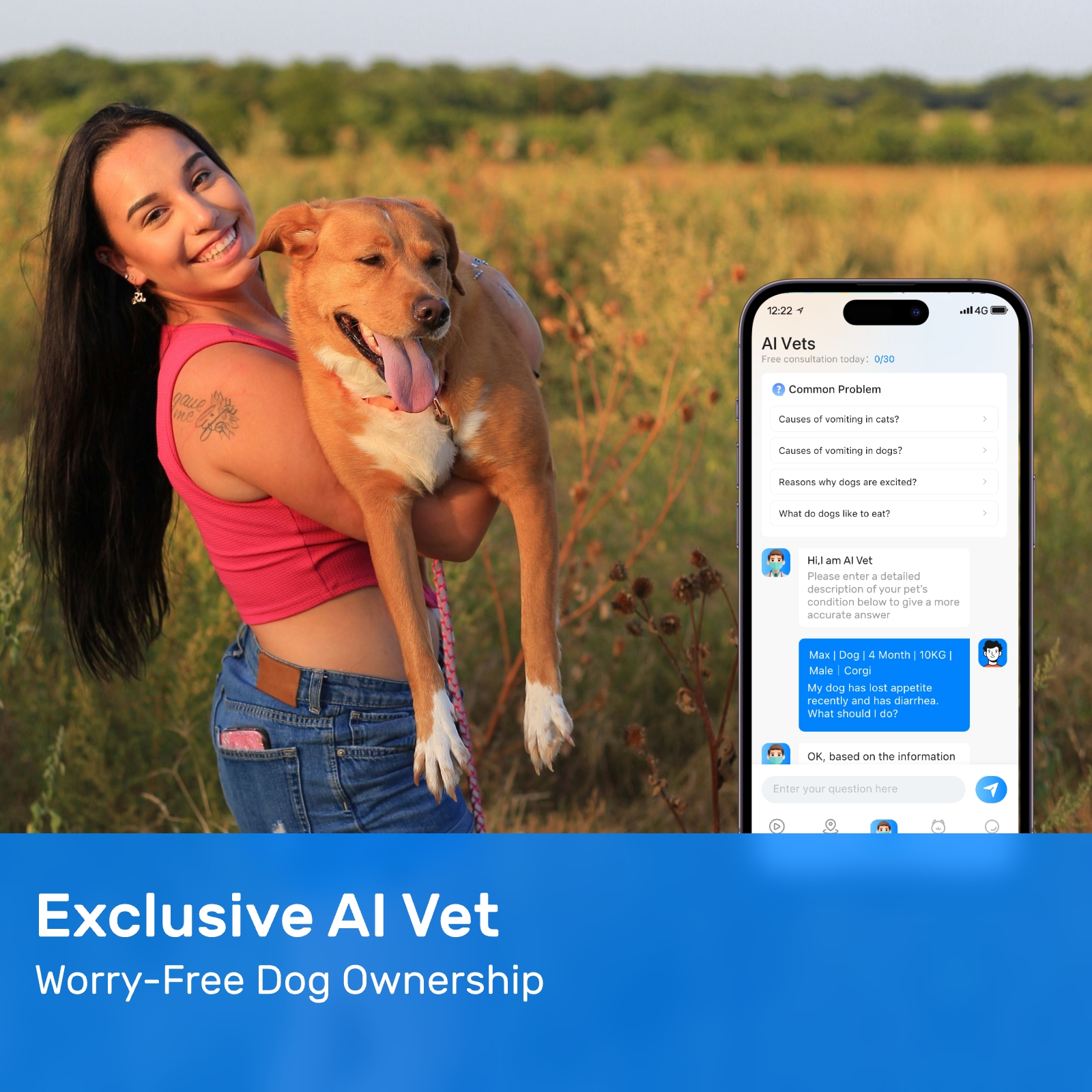

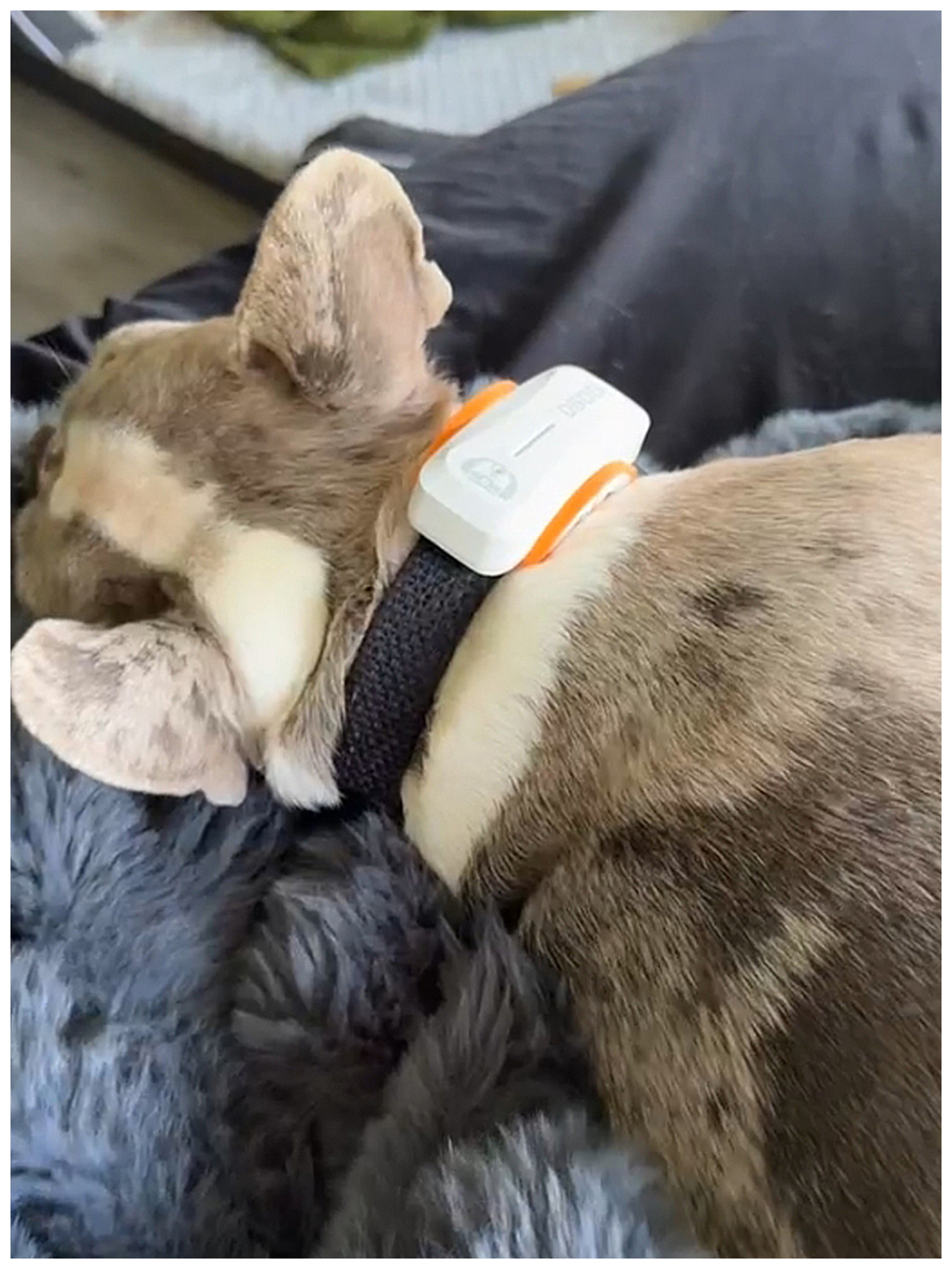

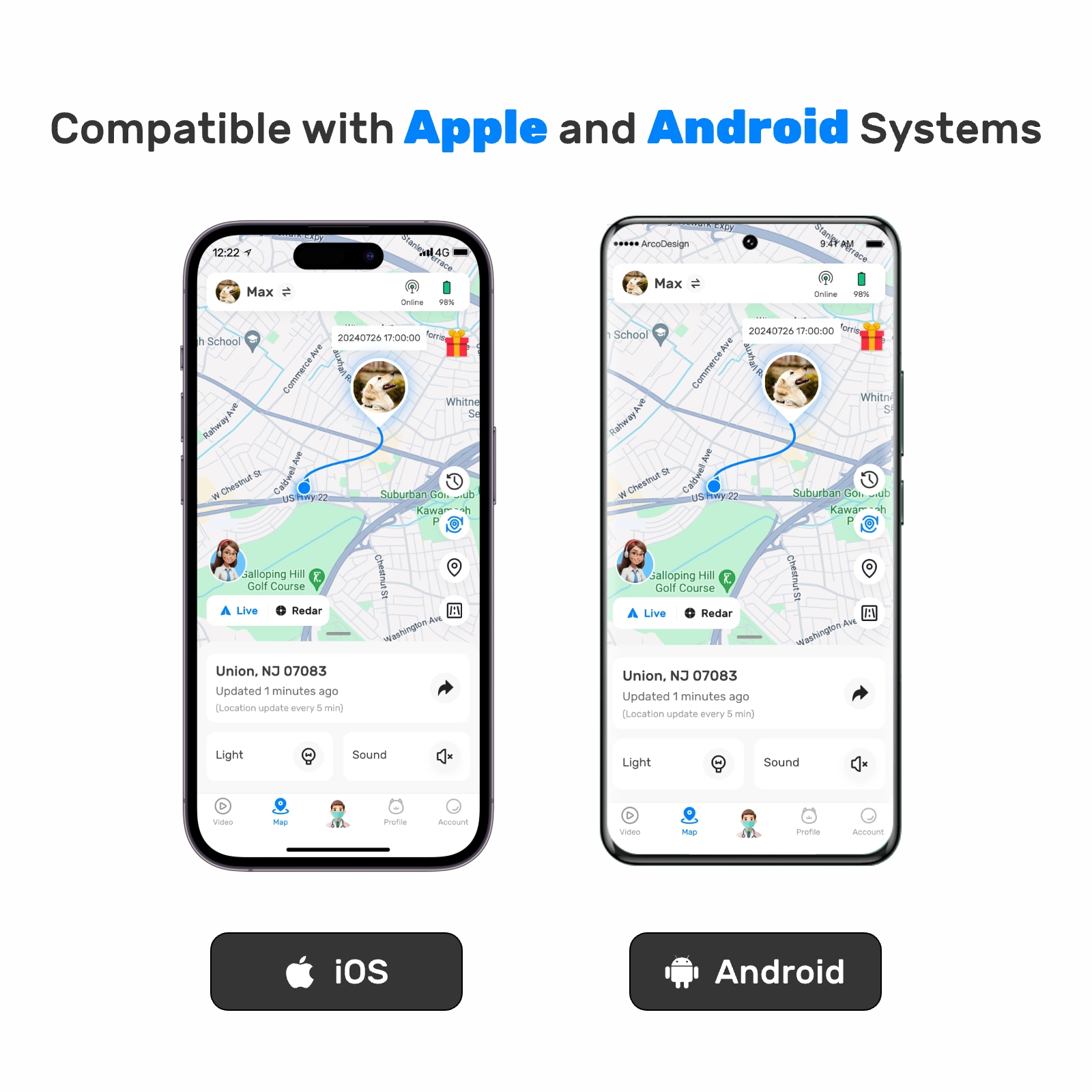

Pet Smart Hardware#Wearable Devices

Pet insurance has become an increasingly popular option for pet owners who want to ensure their furry friends receive the best possible care without breaking the bank. As veterinary medicine advances, treatments and medications like Heartgard for dogs have become more accessible but can also come with a higher price tag. This is where pet insurance packages play a crucial role in helping pet owners manage costs while providing peace of mind that their pets will receive necessary medical attention when needed.

Heartgard for dogs is a well-known medication designed to prevent heartworm disease, which can be deadly if left untreated. Heartworms are transmitted through mosquito bites, and once inside a dog's body, they can grow into large worms that live in the heart, lungs, and associated blood vessels. These parasites can cause severe lung disease, heart failure, and damage to other organs. Prevention is far better than cure in this case, as treating heartworm infection can be expensive and risky. Heartgard works by killing the larvae of heartworms before they mature into adult worms, thus preventing the disease from taking hold.

When considering pet insurance packages, it’s important to understand what types of coverage are available and how they might apply to preventive care such as Heartgard for dogs. Most pet insurance plans focus on covering accidents and illnesses, but some offer additional options for wellness and preventive care. While not all policies include routine preventive treatments like Heartgard, many insurers provide add-ons or discounts for these services. It pays to shop around and compare different plans to find one that suits your needs and budget.

One common type of pet insurance package is accident and illness coverage. This plan typically covers unexpected vet visits due to accidents or sudden illnesses. For example, if your dog swallows something dangerous or develops an ear infection, this kind of policy would help cover the cost of diagnosis and treatment. However, basic accident and illness plans usually do not cover preventive care items such as vaccines, dental cleanings, or parasite prevention like Heartgard for dogs. If you're looking for comprehensive coverage that includes these elements, you may need to opt for a more extensive plan or purchase a separate wellness rider.

Wellness plans are another category of pet insurance that focuses specifically on routine healthcare needs. They often include annual check-ups, vaccinations, spaying/neutering, flea/tick control, and sometimes even parasite prevention like Heartgard for dogs. The advantage of adding a wellness component to your pet insurance package is that it allows you to budget consistently for regular veterinary expenses throughout the year. Instead of paying out-of-pocket for each service, you pay a fixed monthly premium that spreads the cost over time. Some insurers even bundle accident/illness and wellness coverage together at a discounted rate, making it easier to manage both unexpected and predictable veterinary bills.

It’s worth noting that not all pet insurance companies treat Heartgard for dogs the same way. Some may classify it as a preventive medication and include it under a wellness plan, while others might exclude it entirely unless you buy a specific add-on. Therefore, it’s essential to read the fine print carefully before committing to any particular policy. Look for details about what’s covered, any exclusions or limitations, and whether there are restrictions based on age, breed, or pre-existing conditions. Additionally, consider asking your veterinarian for recommendations regarding which insurance providers they trust most, as they often have firsthand experience dealing with claims and reimbursements.

Another factor to keep in mind when choosing a pet insurance package is the reimbursement process. Many policies require you to pay upfront for veterinary services and then submit a claim to get reimbursed later. This means you should ensure that you have enough cash flow to cover initial costs until the insurer processes your claim. On the other hand, some insurers work directly with veterinarians, allowing them to bill the company directly for covered services. This arrangement can simplify things considerably, especially for ongoing treatments like Heartgard for dogs where consistent administration is key.

Cost is obviously a major consideration when selecting a pet insurance package. Premiums vary widely depending on factors such as the dog's age, breed, location, and level of coverage desired. Younger animals generally cost less to insure because they tend to be healthier, whereas older dogs may require more frequent visits and treatments, driving up premiums. Similarly, certain breeds are predisposed to genetic disorders, which could affect pricing. When evaluating quotes, don’t forget to factor in deductibles, co-pays, and maximum payout limits. A lower monthly premium might seem attractive initially, but if it comes with high out-of-pocket expenses or restrictive caps on benefits, it could end up being less cost-effective overall.

To illustrate the value of pet insurance in conjunction with Heartgard for dogs, let’s examine a hypothetical scenario. Suppose you own a three-year-old Labrador Retriever named Max. You enroll him in a standard accident and illness policy costing $30 per month, along with an optional wellness rider for an extra $15 per month. Under this setup, Max’s routine care—including his monthly dose of Heartgard—is fully covered within the wellness portion of the plan. One day, Max starts showing symptoms of Lyme disease after being bitten by a tick. Thanks to your insurance, diagnostic tests and antibiotics are largely taken care of, sparing you significant financial stress. Meanwhile, knowing that Heartgard protects him against heartworms gives you added reassurance that he remains protected from another potentially devastating condition.

Of course, no single pet insurance package will fit every situation perfectly. What works for one family might not suit another’s circumstances. That’s why doing thorough research and comparing multiple options is so important. Start by identifying your priorities: Do you primarily want protection against catastrophic events, or would you prefer broader coverage encompassing everyday healthcare needs? Once you’ve clarified your goals, gather quotes from several reputable insurers and analyze them side by side. Pay attention not only to price but also to terms and conditions, customer service reputation, and ease of filing claims.

In conclusion, investing in a suitable pet insurance package can make a substantial difference in maintaining your dog’s health and happiness. By safeguarding against unforeseen medical emergencies and supporting routine preventive measures like Heartgard for dogs, you empower yourself to provide top-notch care without worrying excessively about costs. Remember to review your policy regularly, adjusting it as needed to reflect changes in your pet’s life stage or health status. Ultimately, the right combination of coverage and proactive management ensures that your beloved companion enjoys a long, healthy life filled with joyous moments shared with you.

Update Time:2025-05-15 07:50:08

Heartgard for dogs is a well-known medication designed to prevent heartworm disease, which can be deadly if left untreated. Heartworms are transmitted through mosquito bites, and once inside a dog's body, they can grow into large worms that live in the heart, lungs, and associated blood vessels. These parasites can cause severe lung disease, heart failure, and damage to other organs. Prevention is far better than cure in this case, as treating heartworm infection can be expensive and risky. Heartgard works by killing the larvae of heartworms before they mature into adult worms, thus preventing the disease from taking hold.

When considering pet insurance packages, it’s important to understand what types of coverage are available and how they might apply to preventive care such as Heartgard for dogs. Most pet insurance plans focus on covering accidents and illnesses, but some offer additional options for wellness and preventive care. While not all policies include routine preventive treatments like Heartgard, many insurers provide add-ons or discounts for these services. It pays to shop around and compare different plans to find one that suits your needs and budget.

One common type of pet insurance package is accident and illness coverage. This plan typically covers unexpected vet visits due to accidents or sudden illnesses. For example, if your dog swallows something dangerous or develops an ear infection, this kind of policy would help cover the cost of diagnosis and treatment. However, basic accident and illness plans usually do not cover preventive care items such as vaccines, dental cleanings, or parasite prevention like Heartgard for dogs. If you're looking for comprehensive coverage that includes these elements, you may need to opt for a more extensive plan or purchase a separate wellness rider.

Wellness plans are another category of pet insurance that focuses specifically on routine healthcare needs. They often include annual check-ups, vaccinations, spaying/neutering, flea/tick control, and sometimes even parasite prevention like Heartgard for dogs. The advantage of adding a wellness component to your pet insurance package is that it allows you to budget consistently for regular veterinary expenses throughout the year. Instead of paying out-of-pocket for each service, you pay a fixed monthly premium that spreads the cost over time. Some insurers even bundle accident/illness and wellness coverage together at a discounted rate, making it easier to manage both unexpected and predictable veterinary bills.

It’s worth noting that not all pet insurance companies treat Heartgard for dogs the same way. Some may classify it as a preventive medication and include it under a wellness plan, while others might exclude it entirely unless you buy a specific add-on. Therefore, it’s essential to read the fine print carefully before committing to any particular policy. Look for details about what’s covered, any exclusions or limitations, and whether there are restrictions based on age, breed, or pre-existing conditions. Additionally, consider asking your veterinarian for recommendations regarding which insurance providers they trust most, as they often have firsthand experience dealing with claims and reimbursements.

Another factor to keep in mind when choosing a pet insurance package is the reimbursement process. Many policies require you to pay upfront for veterinary services and then submit a claim to get reimbursed later. This means you should ensure that you have enough cash flow to cover initial costs until the insurer processes your claim. On the other hand, some insurers work directly with veterinarians, allowing them to bill the company directly for covered services. This arrangement can simplify things considerably, especially for ongoing treatments like Heartgard for dogs where consistent administration is key.

Cost is obviously a major consideration when selecting a pet insurance package. Premiums vary widely depending on factors such as the dog's age, breed, location, and level of coverage desired. Younger animals generally cost less to insure because they tend to be healthier, whereas older dogs may require more frequent visits and treatments, driving up premiums. Similarly, certain breeds are predisposed to genetic disorders, which could affect pricing. When evaluating quotes, don’t forget to factor in deductibles, co-pays, and maximum payout limits. A lower monthly premium might seem attractive initially, but if it comes with high out-of-pocket expenses or restrictive caps on benefits, it could end up being less cost-effective overall.

To illustrate the value of pet insurance in conjunction with Heartgard for dogs, let’s examine a hypothetical scenario. Suppose you own a three-year-old Labrador Retriever named Max. You enroll him in a standard accident and illness policy costing $30 per month, along with an optional wellness rider for an extra $15 per month. Under this setup, Max’s routine care—including his monthly dose of Heartgard—is fully covered within the wellness portion of the plan. One day, Max starts showing symptoms of Lyme disease after being bitten by a tick. Thanks to your insurance, diagnostic tests and antibiotics are largely taken care of, sparing you significant financial stress. Meanwhile, knowing that Heartgard protects him against heartworms gives you added reassurance that he remains protected from another potentially devastating condition.

Of course, no single pet insurance package will fit every situation perfectly. What works for one family might not suit another’s circumstances. That’s why doing thorough research and comparing multiple options is so important. Start by identifying your priorities: Do you primarily want protection against catastrophic events, or would you prefer broader coverage encompassing everyday healthcare needs? Once you’ve clarified your goals, gather quotes from several reputable insurers and analyze them side by side. Pay attention not only to price but also to terms and conditions, customer service reputation, and ease of filing claims.

In conclusion, investing in a suitable pet insurance package can make a substantial difference in maintaining your dog’s health and happiness. By safeguarding against unforeseen medical emergencies and supporting routine preventive measures like Heartgard for dogs, you empower yourself to provide top-notch care without worrying excessively about costs. Remember to review your policy regularly, adjusting it as needed to reflect changes in your pet’s life stage or health status. Ultimately, the right combination of coverage and proactive management ensures that your beloved companion enjoys a long, healthy life filled with joyous moments shared with you.

Update Time:2025-05-15 07:50:08

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form