New ArrivalsBack in stock

doge stimulus checks

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D388516817 second hand :D388516817 |

Manufacturer | doge stimulus | release date | 2025-05-15 | List price | $36 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | stimulus checks | ||||||||

| category | |||||||||

Outdoor Gear#Pet Safety Equipment

In the realm of digital currency, few innovations have captured public imagination quite like Dogecoin. Originally created as a parody of Bitcoin and other cryptocurrencies, Dogecoin (DOGE) has grown to become a serious contender in the market. The term "doge stimulus checks" has emerged as a playful yet insightful reference to the financial opportunities that DOGE presents. This article delves into an analysis of dog locator accuracy, particularly focusing on how this concept can be applied to understanding the dynamics behind doge stimulus checks. By examining the underlying mechanisms, we aim to provide a comprehensive overview of the subject matter.

To begin with, it is crucial to understand what doge stimulus checks are. These refer to the potential financial benefits that individuals may gain through investments in Dogecoin. As cryptocurrency markets fluctuate, investors often seek ways to capitalize on these changes. In some instances, the rise in DOGE value can be likened to receiving a form of economic relief or stimulus, hence the term "doge stimulus checks." This analogy underscores the importance of accurately tracking and predicting market movements, akin to using a dog locator to find a lost pet.

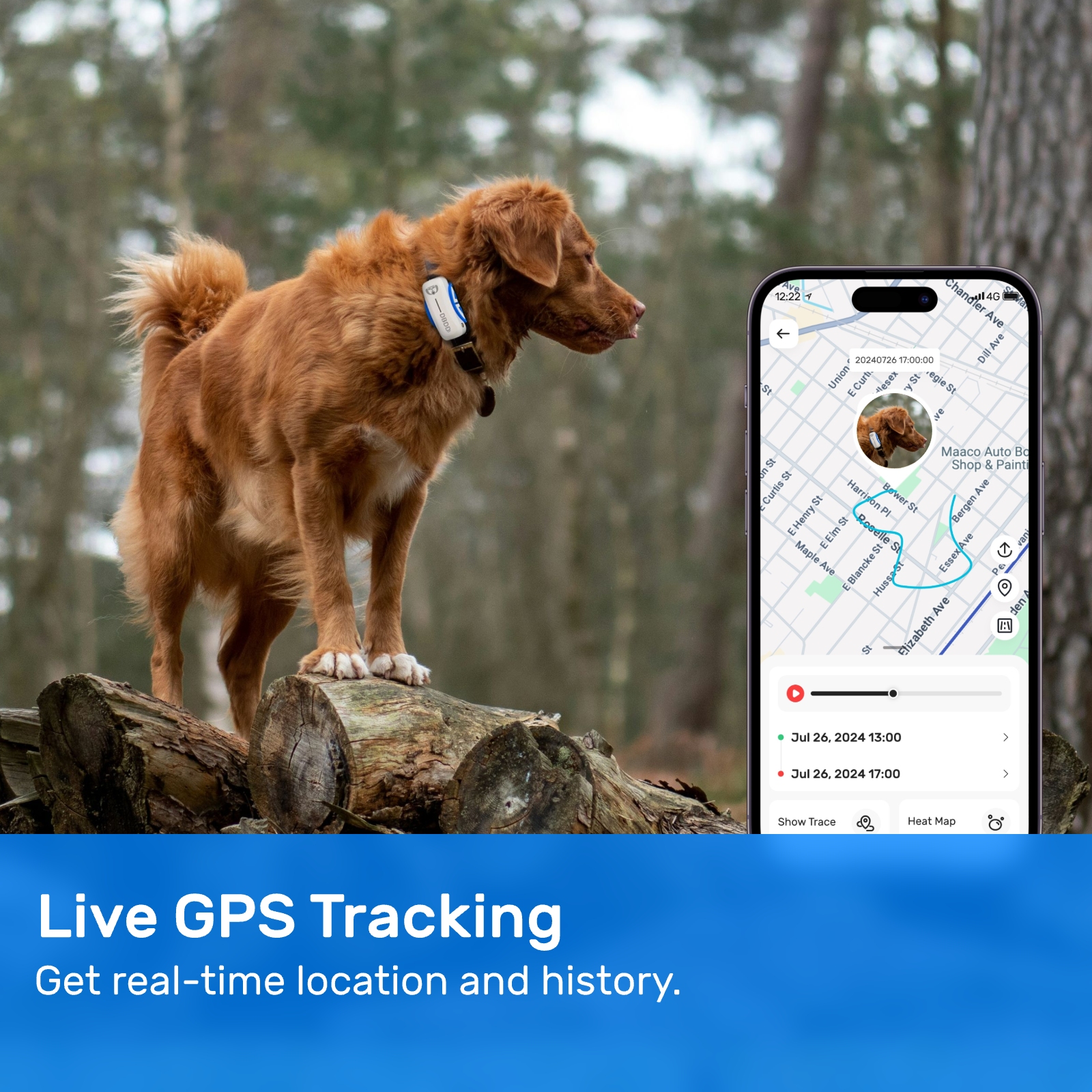

The concept of a dog locator involves employing various technologies to pinpoint the exact location of a dog. Similarly, in the context of cryptocurrencies, locating the right time to invest or divest requires precision and foresight. Accuracy in this area can significantly impact the success of one's investment strategy. For instance, just as a GPS system enhances the efficiency of a dog locator, advanced algorithms and data analytics improve the accuracy of predicting cryptocurrency trends.

Dog locator accuracy analysis typically involves several key components: signal strength, geographical coverage, and real-time updates. In parallel, the analysis of doge stimulus checks considers volatility, trading volume, and market sentiment. Each of these elements plays a critical role in determining the overall effectiveness of the respective systems. For example, a strong signal in a dog locator ensures reliable communication between the device and the target, much like how high trading volumes in DOGE indicate robust market activity and confidence.

Geographical coverage is another critical factor in both scenarios. Just as a wide-reaching network enhances the capabilities of a dog locator, global acceptance and usage of Dogecoin contribute to its stability and growth. A dog locator that operates effectively across different terrains and environments mirrors the adaptability required for DOGE to thrive in diverse markets worldwide. This adaptability is crucial for realizing the full potential of doge stimulus checks, allowing investors from various regions to benefit equally.

Real-time updates are indispensable in both dog locators and cryptocurrency analysis. For a dog locator, instant notifications about a dog's whereabouts can prevent anxiety and ensure swift recovery. Likewise, real-time data on DOGE prices and market conditions empower investors to make informed decisions promptly. The rapid evolution of technology has made it possible to access such information at one's fingertips, enhancing the accuracy of predictions and the likelihood of successful outcomes.

The interplay between these components—signal strength, geographical coverage, and real-time updates—creates a framework for assessing dog locator accuracy. Translating this framework to the world of cryptocurrencies provides valuable insights into the mechanics of doge stimulus checks. Investors can use similar principles to navigate the complex landscape of DOGE, ensuring they maximize their returns while minimizing risks.

Moreover, understanding the psychology behind doge stimulus checks adds another layer to this analysis. Human emotions often drive market behavior, influencing the rise and fall of cryptocurrency values. Fear, greed, and hope are potent forces that can either amplify or mitigate the effects of doge stimulus checks. For instance, widespread optimism about DOGE's future might lead to increased buying, boosting its value and delivering substantial returns to early adopters.

On the flip side, fear of missing out (FOMO) or panic selling can destabilize the market, causing fluctuations that challenge even the most seasoned investors. Recognizing these psychological factors is essential for maintaining a balanced approach to investing in DOGE. It also highlights the importance of accurate analysis, as reliable data can help counteract emotional biases and lead to more rational decision-making.

Another aspect worth exploring is the role of community engagement in shaping the narrative around doge stimulus checks. The vibrant DOGE community, known for its humor and inclusivity, actively participates in discussions about the coin's potential. This collective enthusiasm can fuel speculative interest, driving up demand and consequently increasing the value of DOGE. Conversely, negative sentiments or misinformation within the community could hinder progress, underscoring the need for accurate and transparent communication.

Technological advancements continue to refine both dog locators and cryptocurrency analysis tools. Innovations in artificial intelligence (AI), machine learning, and blockchain technology offer promising avenues for improving accuracy in both domains. AI-driven algorithms can analyze vast datasets to identify patterns and predict future trends, providing actionable insights for DOGE investors. Similarly, enhancements in dog locators enable more precise tracking, reducing the time and effort required to locate a missing pet.

Furthermore, the integration of blockchain technology in dog locators represents an exciting development. By leveraging blockchain's decentralized and secure nature, dog locators can ensure tamper-proof records of a pet's movements. This application demonstrates the versatility of blockchain beyond cryptocurrencies, illustrating how technological breakthroughs in one field can inspire innovations in another.

As we delve deeper into the analysis of doge stimulus checks, it becomes evident that accuracy is paramount. Investors must rely on credible sources and sophisticated tools to navigate the volatile world of cryptocurrencies successfully. The parallels drawn between dog locators and DOGE highlight the universal principles of precision, adaptability, and real-time responsiveness that underpin effective strategies in both contexts.

In conclusion, the analysis of dog locator accuracy offers valuable lessons for understanding the dynamics of doge stimulus checks. By examining the components that contribute to a dog locator's effectiveness—signal strength, geographical coverage, and real-time updates—we gain insights into the factors that influence the success of DOGE investments. Psychological aspects, community engagement, and technological advancements further enrich this analysis, emphasizing the multifaceted nature of cryptocurrency markets.

Ultimately, the journey of discovering doge stimulus checks mirrors the quest for a lost pet using a dog locator. Both require patience, perseverance, and a keen eye for detail. As the cryptocurrency landscape continues to evolve, embracing accurate analysis and adapting to changing conditions will be crucial for harnessing the full potential of DOGE and other digital currencies. With the right tools and strategies, investors can position themselves to benefit from the exciting opportunities that doge stimulus checks present.

Update Time:2025-05-15 06:26:26

To begin with, it is crucial to understand what doge stimulus checks are. These refer to the potential financial benefits that individuals may gain through investments in Dogecoin. As cryptocurrency markets fluctuate, investors often seek ways to capitalize on these changes. In some instances, the rise in DOGE value can be likened to receiving a form of economic relief or stimulus, hence the term "doge stimulus checks." This analogy underscores the importance of accurately tracking and predicting market movements, akin to using a dog locator to find a lost pet.

The concept of a dog locator involves employing various technologies to pinpoint the exact location of a dog. Similarly, in the context of cryptocurrencies, locating the right time to invest or divest requires precision and foresight. Accuracy in this area can significantly impact the success of one's investment strategy. For instance, just as a GPS system enhances the efficiency of a dog locator, advanced algorithms and data analytics improve the accuracy of predicting cryptocurrency trends.

Dog locator accuracy analysis typically involves several key components: signal strength, geographical coverage, and real-time updates. In parallel, the analysis of doge stimulus checks considers volatility, trading volume, and market sentiment. Each of these elements plays a critical role in determining the overall effectiveness of the respective systems. For example, a strong signal in a dog locator ensures reliable communication between the device and the target, much like how high trading volumes in DOGE indicate robust market activity and confidence.

Geographical coverage is another critical factor in both scenarios. Just as a wide-reaching network enhances the capabilities of a dog locator, global acceptance and usage of Dogecoin contribute to its stability and growth. A dog locator that operates effectively across different terrains and environments mirrors the adaptability required for DOGE to thrive in diverse markets worldwide. This adaptability is crucial for realizing the full potential of doge stimulus checks, allowing investors from various regions to benefit equally.

Real-time updates are indispensable in both dog locators and cryptocurrency analysis. For a dog locator, instant notifications about a dog's whereabouts can prevent anxiety and ensure swift recovery. Likewise, real-time data on DOGE prices and market conditions empower investors to make informed decisions promptly. The rapid evolution of technology has made it possible to access such information at one's fingertips, enhancing the accuracy of predictions and the likelihood of successful outcomes.

The interplay between these components—signal strength, geographical coverage, and real-time updates—creates a framework for assessing dog locator accuracy. Translating this framework to the world of cryptocurrencies provides valuable insights into the mechanics of doge stimulus checks. Investors can use similar principles to navigate the complex landscape of DOGE, ensuring they maximize their returns while minimizing risks.

Moreover, understanding the psychology behind doge stimulus checks adds another layer to this analysis. Human emotions often drive market behavior, influencing the rise and fall of cryptocurrency values. Fear, greed, and hope are potent forces that can either amplify or mitigate the effects of doge stimulus checks. For instance, widespread optimism about DOGE's future might lead to increased buying, boosting its value and delivering substantial returns to early adopters.

On the flip side, fear of missing out (FOMO) or panic selling can destabilize the market, causing fluctuations that challenge even the most seasoned investors. Recognizing these psychological factors is essential for maintaining a balanced approach to investing in DOGE. It also highlights the importance of accurate analysis, as reliable data can help counteract emotional biases and lead to more rational decision-making.

Another aspect worth exploring is the role of community engagement in shaping the narrative around doge stimulus checks. The vibrant DOGE community, known for its humor and inclusivity, actively participates in discussions about the coin's potential. This collective enthusiasm can fuel speculative interest, driving up demand and consequently increasing the value of DOGE. Conversely, negative sentiments or misinformation within the community could hinder progress, underscoring the need for accurate and transparent communication.

Technological advancements continue to refine both dog locators and cryptocurrency analysis tools. Innovations in artificial intelligence (AI), machine learning, and blockchain technology offer promising avenues for improving accuracy in both domains. AI-driven algorithms can analyze vast datasets to identify patterns and predict future trends, providing actionable insights for DOGE investors. Similarly, enhancements in dog locators enable more precise tracking, reducing the time and effort required to locate a missing pet.

Furthermore, the integration of blockchain technology in dog locators represents an exciting development. By leveraging blockchain's decentralized and secure nature, dog locators can ensure tamper-proof records of a pet's movements. This application demonstrates the versatility of blockchain beyond cryptocurrencies, illustrating how technological breakthroughs in one field can inspire innovations in another.

As we delve deeper into the analysis of doge stimulus checks, it becomes evident that accuracy is paramount. Investors must rely on credible sources and sophisticated tools to navigate the volatile world of cryptocurrencies successfully. The parallels drawn between dog locators and DOGE highlight the universal principles of precision, adaptability, and real-time responsiveness that underpin effective strategies in both contexts.

In conclusion, the analysis of dog locator accuracy offers valuable lessons for understanding the dynamics of doge stimulus checks. By examining the components that contribute to a dog locator's effectiveness—signal strength, geographical coverage, and real-time updates—we gain insights into the factors that influence the success of DOGE investments. Psychological aspects, community engagement, and technological advancements further enrich this analysis, emphasizing the multifaceted nature of cryptocurrency markets.

Ultimately, the journey of discovering doge stimulus checks mirrors the quest for a lost pet using a dog locator. Both require patience, perseverance, and a keen eye for detail. As the cryptocurrency landscape continues to evolve, embracing accurate analysis and adapting to changing conditions will be crucial for harnessing the full potential of DOGE and other digital currencies. With the right tools and strategies, investors can position themselves to benefit from the exciting opportunities that doge stimulus checks present.

Update Time:2025-05-15 06:26:26

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form