New ArrivalsBack in stock

doge student borrower data lawsuit

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D682848135 second hand :D682848135 |

Manufacturer | doge student | release date | 2025-05-15 | List price | $38 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | student borrower | ||||||||

| category | |||||||||

Pet Healthcare#Vital Monitoring Systems

Pet insurance has become an increasingly popular option for pet owners looking to protect their furry friends from unexpected medical expenses. As the cost of veterinary care continues to rise, many people are turning to pet insurance packages to help manage these costs. In this article, we will explore the intricacies of pet insurance, its benefits, and some of the challenges it faces. Additionally, we will touch on a unique legal case that intersects with the world of pet insurance: the doge student borrower data lawsuit.

Pet insurance operates similarly to human health insurance. Policyholders pay a monthly premium, and in return, the insurance company covers a portion of the veterinary bills if the pet becomes sick or injured. There are various types of pet insurance packages available, each offering different levels of coverage and pricing structures. Some policies cover routine care, such as vaccinations and annual check-ups, while others focus solely on accidents and illnesses. Understanding these differences is crucial when selecting the right policy for your pet.

The primary benefit of pet insurance is financial protection. Veterinary care can be expensive, especially for serious conditions like cancer or emergency surgeries. Without insurance, pet owners may face hefty out-of-pocket expenses that could lead to difficult decisions about their pet's care. Insurance helps mitigate these costs, allowing owners to provide necessary treatment without worrying about the financial burden.

Another advantage is peace of mind. Knowing that your pet is covered in case of an accident or illness can alleviate stress and anxiety. It also encourages proactive care, as insured pets often receive more regular check-ups and preventive treatments. This can lead to better overall health and longer lifespans for pets.

However, pet insurance is not without its challenges. One common issue is understanding the fine print. Policies can vary significantly in terms of what is covered, exclusions, and limitations. For example, pre-existing conditions are typically not covered, and certain breeds may have higher premiums due to their susceptibility to specific health issues. It's essential for pet owners to thoroughly read and understand their policy before purchasing.

Additionally, there can be disputes over claims. Sometimes, insurance companies deny claims based on exclusions or misunderstandings about the policy's terms. This can lead to frustration and additional costs for pet owners. To avoid these situations, it's important to keep detailed records of your pet's medical history and communicate clearly with the insurance provider.

Now, let's shift gears slightly and discuss a peculiar legal case that has garnered attention in recent years: the doge student borrower data lawsuit. While seemingly unrelated to pet insurance, this case highlights some interesting parallels regarding data privacy and consumer rights.

The doge student borrower data lawsuit revolves around allegations that a financial institution improperly shared sensitive information about student loan borrowers. The plaintiffs argue that their personal data was used without consent, potentially leading to unauthorized transactions or identity theft. This lawsuit raises significant questions about how institutions handle sensitive information and the implications for consumers.

In the context of pet insurance, data privacy is becoming increasingly relevant. As more companies move towards digital platforms for managing policies and claims, they collect vast amounts of personal and medical data about both pets and their owners. Ensuring this data is secure and used appropriately is crucial. If mishandled, it could lead to similar lawsuits or breaches of trust between pet owners and insurance providers.

Moreover, the doge student borrower data lawsuit underscores the importance of transparency in contractual agreements. Just as student borrowers need clear terms regarding their loans, pet owners require transparent policies when purchasing insurance. Ambiguities or hidden clauses can lead to dissatisfaction and potential legal action. Therefore, it's imperative for insurance companies to provide straightforward, easily understandable contracts that outline exactly what is covered and under what circumstances.

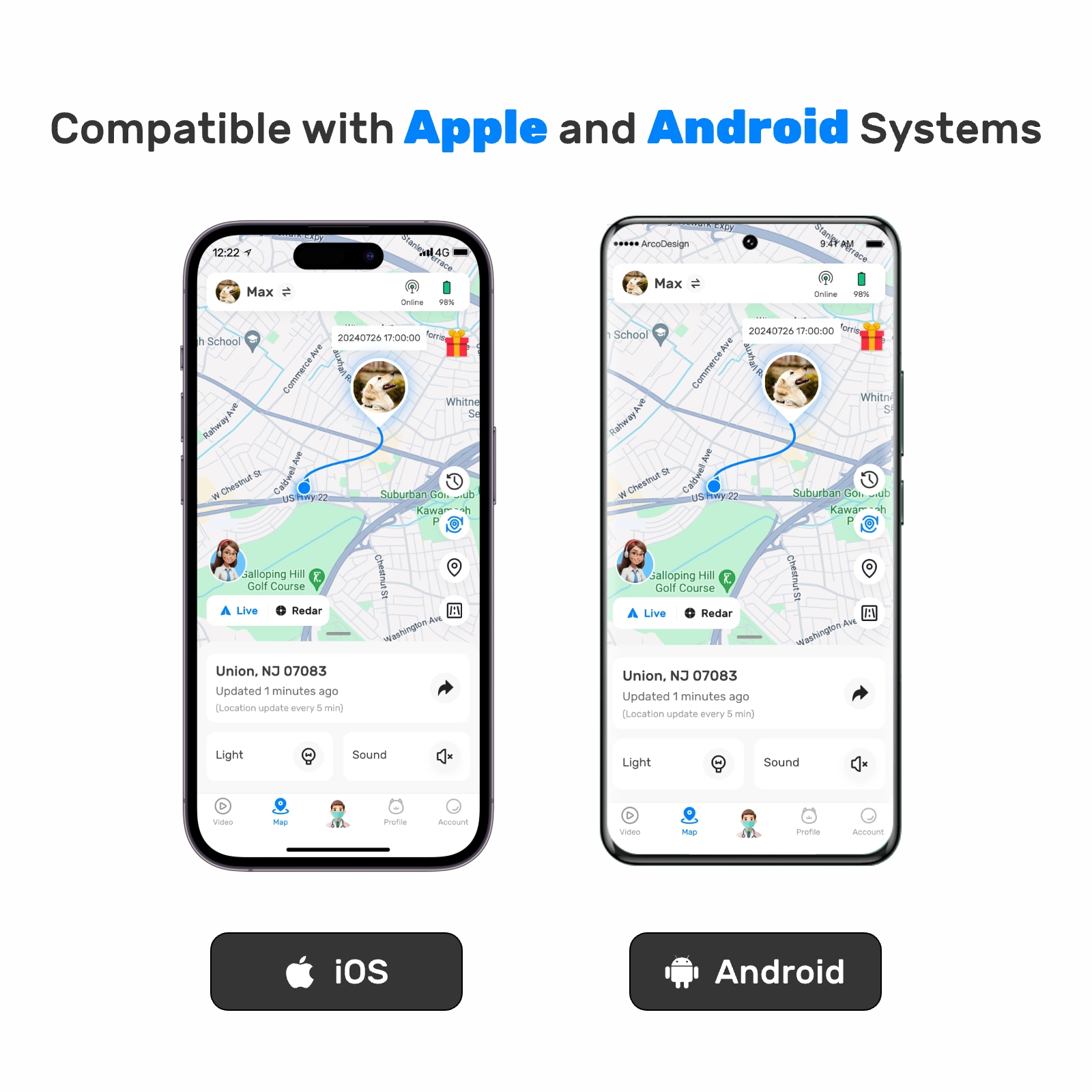

Another aspect to consider is the role of technology in enhancing pet insurance services. Many companies now offer mobile apps that allow policyholders to manage their accounts, submit claims, and access resources conveniently. These technological advancements improve user experience but also increase the amount of data collected by insurers. Balancing innovation with data security is a challenge all industries must address, including pet insurance.

Furthermore, the doge student borrower data lawsuit highlights the growing concern over third-party data sharing. In the realm of pet insurance, partnerships with veterinarians or other service providers might involve sharing client information. Ensuring that such sharing complies with regulations and respects consumer privacy is paramount. Pet owners should inquire about data-sharing practices when evaluating insurance options.

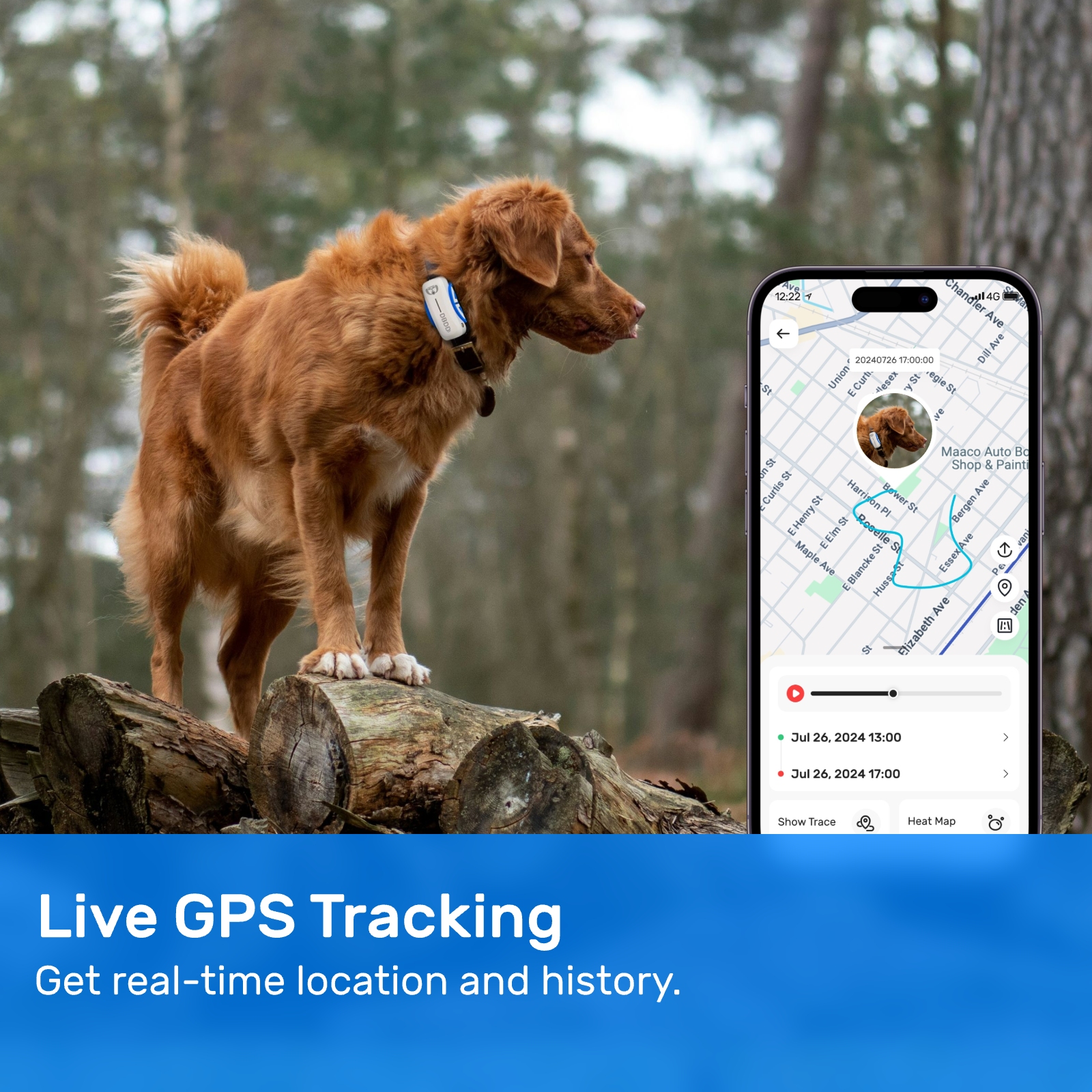

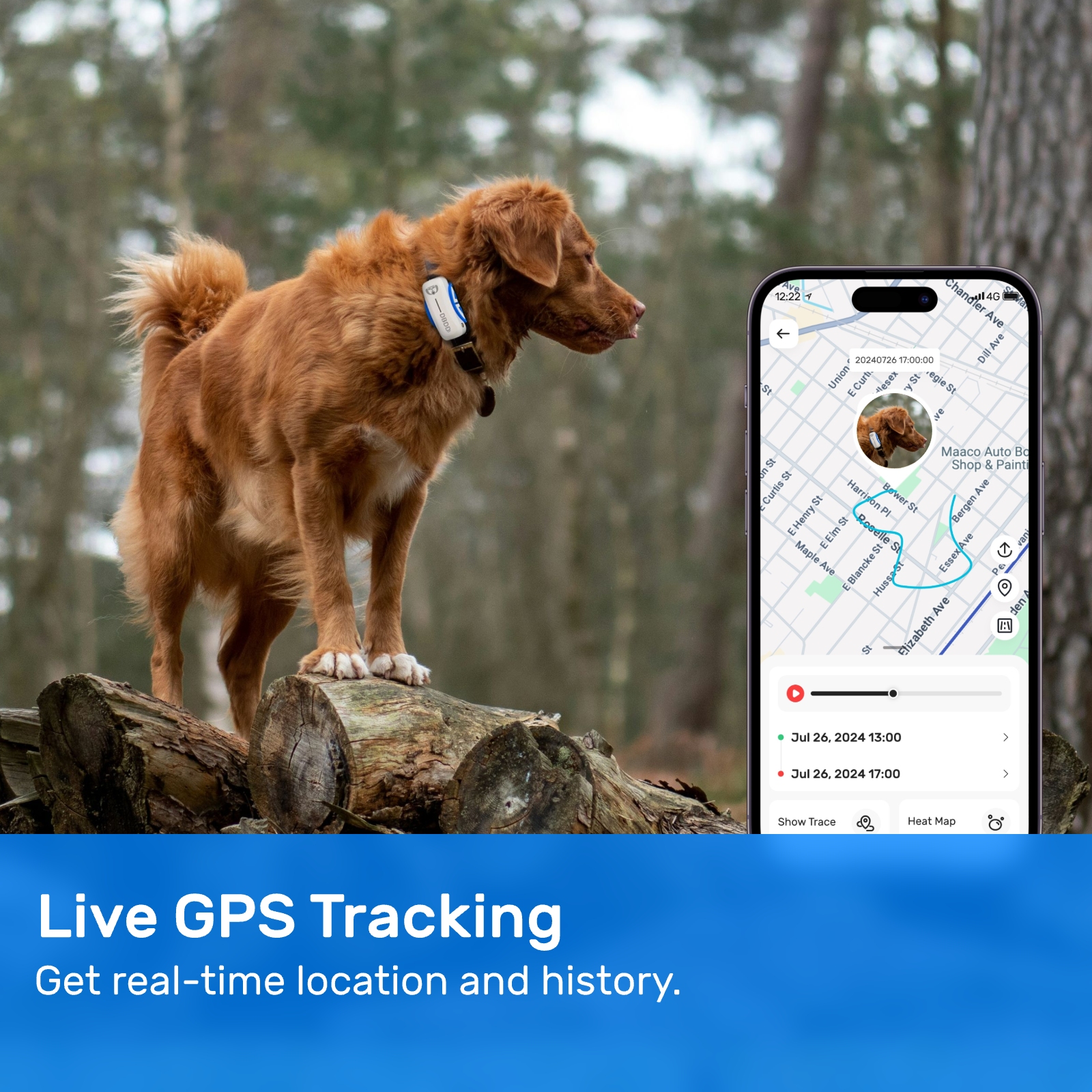

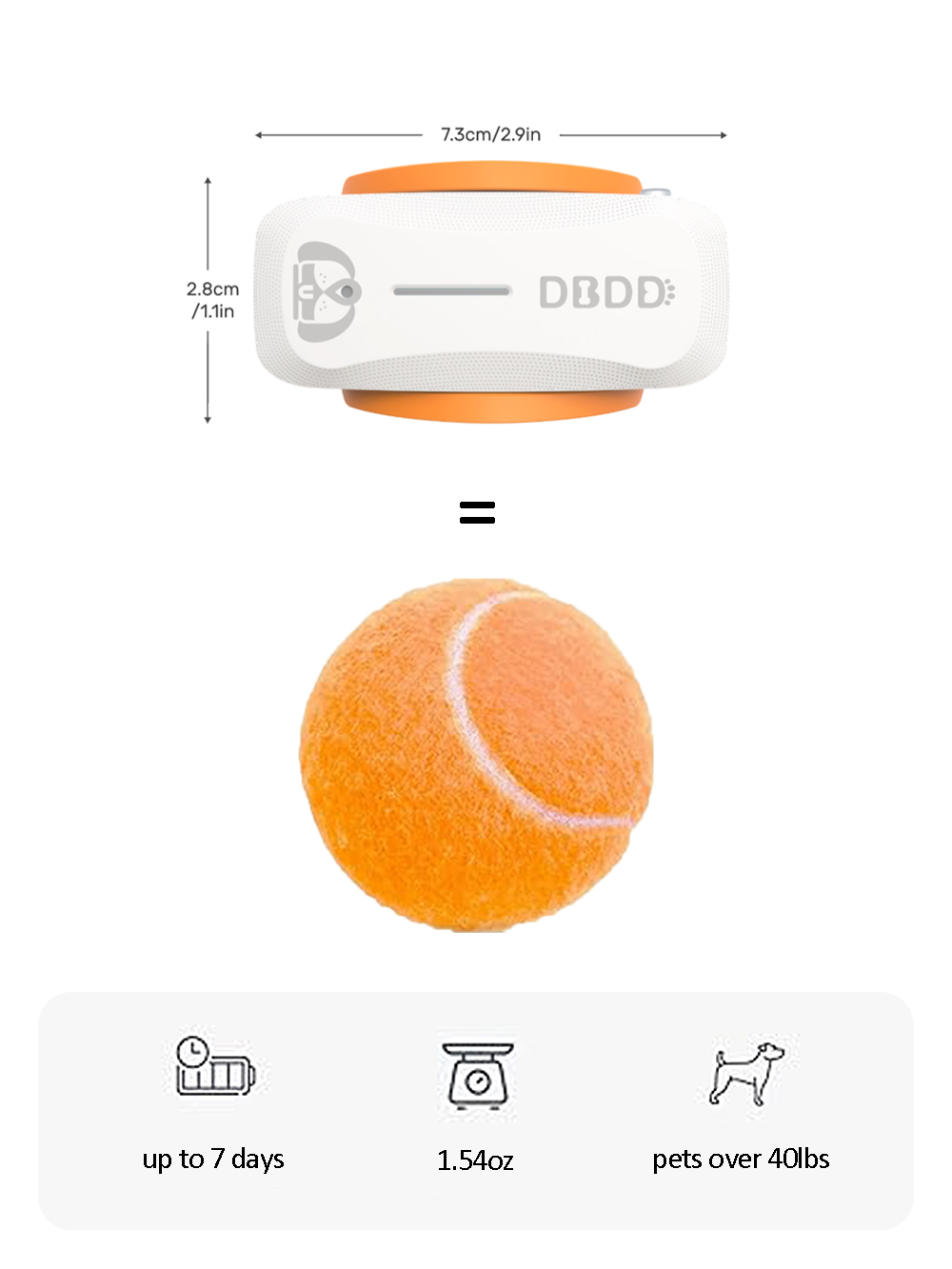

Looking ahead, the future of pet insurance seems promising yet complex. With advancements in genetics and personalized medicine, insurers may begin offering tailored policies based on a pet's DNA profile. While this could enhance coverage accuracy, it also raises ethical concerns about genetic discrimination. Similarly, wearable technology for pets could provide real-time health monitoring, but again, data privacy must be carefully managed.

Returning to the doge student borrower data lawsuit, one takeaway is the necessity of robust legal frameworks to protect consumers' rights. Just as student borrowers deserve protection from improper data usage, so too do pet owners. Advocacy groups and regulatory bodies play vital roles in establishing standards and holding companies accountable.

In conclusion, pet insurance offers valuable protections and benefits for pet owners, but navigating the landscape requires diligence and awareness. From understanding policy specifics to safeguarding personal data, informed decisions are key. The doge student borrower data lawsuit serves as a reminder of the broader implications surrounding data privacy and consumer rights. As both pet insurance and digital technologies evolve, maintaining transparency, security, and fairness will remain critical components of ensuring successful relationships between insurers and their clients.

Update Time:2025-05-15 05:34:16

Pet insurance operates similarly to human health insurance. Policyholders pay a monthly premium, and in return, the insurance company covers a portion of the veterinary bills if the pet becomes sick or injured. There are various types of pet insurance packages available, each offering different levels of coverage and pricing structures. Some policies cover routine care, such as vaccinations and annual check-ups, while others focus solely on accidents and illnesses. Understanding these differences is crucial when selecting the right policy for your pet.

The primary benefit of pet insurance is financial protection. Veterinary care can be expensive, especially for serious conditions like cancer or emergency surgeries. Without insurance, pet owners may face hefty out-of-pocket expenses that could lead to difficult decisions about their pet's care. Insurance helps mitigate these costs, allowing owners to provide necessary treatment without worrying about the financial burden.

Another advantage is peace of mind. Knowing that your pet is covered in case of an accident or illness can alleviate stress and anxiety. It also encourages proactive care, as insured pets often receive more regular check-ups and preventive treatments. This can lead to better overall health and longer lifespans for pets.

However, pet insurance is not without its challenges. One common issue is understanding the fine print. Policies can vary significantly in terms of what is covered, exclusions, and limitations. For example, pre-existing conditions are typically not covered, and certain breeds may have higher premiums due to their susceptibility to specific health issues. It's essential for pet owners to thoroughly read and understand their policy before purchasing.

Additionally, there can be disputes over claims. Sometimes, insurance companies deny claims based on exclusions or misunderstandings about the policy's terms. This can lead to frustration and additional costs for pet owners. To avoid these situations, it's important to keep detailed records of your pet's medical history and communicate clearly with the insurance provider.

Now, let's shift gears slightly and discuss a peculiar legal case that has garnered attention in recent years: the doge student borrower data lawsuit. While seemingly unrelated to pet insurance, this case highlights some interesting parallels regarding data privacy and consumer rights.

The doge student borrower data lawsuit revolves around allegations that a financial institution improperly shared sensitive information about student loan borrowers. The plaintiffs argue that their personal data was used without consent, potentially leading to unauthorized transactions or identity theft. This lawsuit raises significant questions about how institutions handle sensitive information and the implications for consumers.

In the context of pet insurance, data privacy is becoming increasingly relevant. As more companies move towards digital platforms for managing policies and claims, they collect vast amounts of personal and medical data about both pets and their owners. Ensuring this data is secure and used appropriately is crucial. If mishandled, it could lead to similar lawsuits or breaches of trust between pet owners and insurance providers.

Moreover, the doge student borrower data lawsuit underscores the importance of transparency in contractual agreements. Just as student borrowers need clear terms regarding their loans, pet owners require transparent policies when purchasing insurance. Ambiguities or hidden clauses can lead to dissatisfaction and potential legal action. Therefore, it's imperative for insurance companies to provide straightforward, easily understandable contracts that outline exactly what is covered and under what circumstances.

Another aspect to consider is the role of technology in enhancing pet insurance services. Many companies now offer mobile apps that allow policyholders to manage their accounts, submit claims, and access resources conveniently. These technological advancements improve user experience but also increase the amount of data collected by insurers. Balancing innovation with data security is a challenge all industries must address, including pet insurance.

Furthermore, the doge student borrower data lawsuit highlights the growing concern over third-party data sharing. In the realm of pet insurance, partnerships with veterinarians or other service providers might involve sharing client information. Ensuring that such sharing complies with regulations and respects consumer privacy is paramount. Pet owners should inquire about data-sharing practices when evaluating insurance options.

Looking ahead, the future of pet insurance seems promising yet complex. With advancements in genetics and personalized medicine, insurers may begin offering tailored policies based on a pet's DNA profile. While this could enhance coverage accuracy, it also raises ethical concerns about genetic discrimination. Similarly, wearable technology for pets could provide real-time health monitoring, but again, data privacy must be carefully managed.

Returning to the doge student borrower data lawsuit, one takeaway is the necessity of robust legal frameworks to protect consumers' rights. Just as student borrowers deserve protection from improper data usage, so too do pet owners. Advocacy groups and regulatory bodies play vital roles in establishing standards and holding companies accountable.

In conclusion, pet insurance offers valuable protections and benefits for pet owners, but navigating the landscape requires diligence and awareness. From understanding policy specifics to safeguarding personal data, informed decisions are key. The doge student borrower data lawsuit serves as a reminder of the broader implications surrounding data privacy and consumer rights. As both pet insurance and digital technologies evolve, maintaining transparency, security, and fairness will remain critical components of ensuring successful relationships between insurers and their clients.

Update Time:2025-05-15 05:34:16

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form