New ArrivalsBack in stock

doge price

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D540620473 second hand :D540620473 |

Manufacturer | doge price | release date | 2025-05-15 | List price | $45 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | doge price | ||||||||

| category | |||||||||

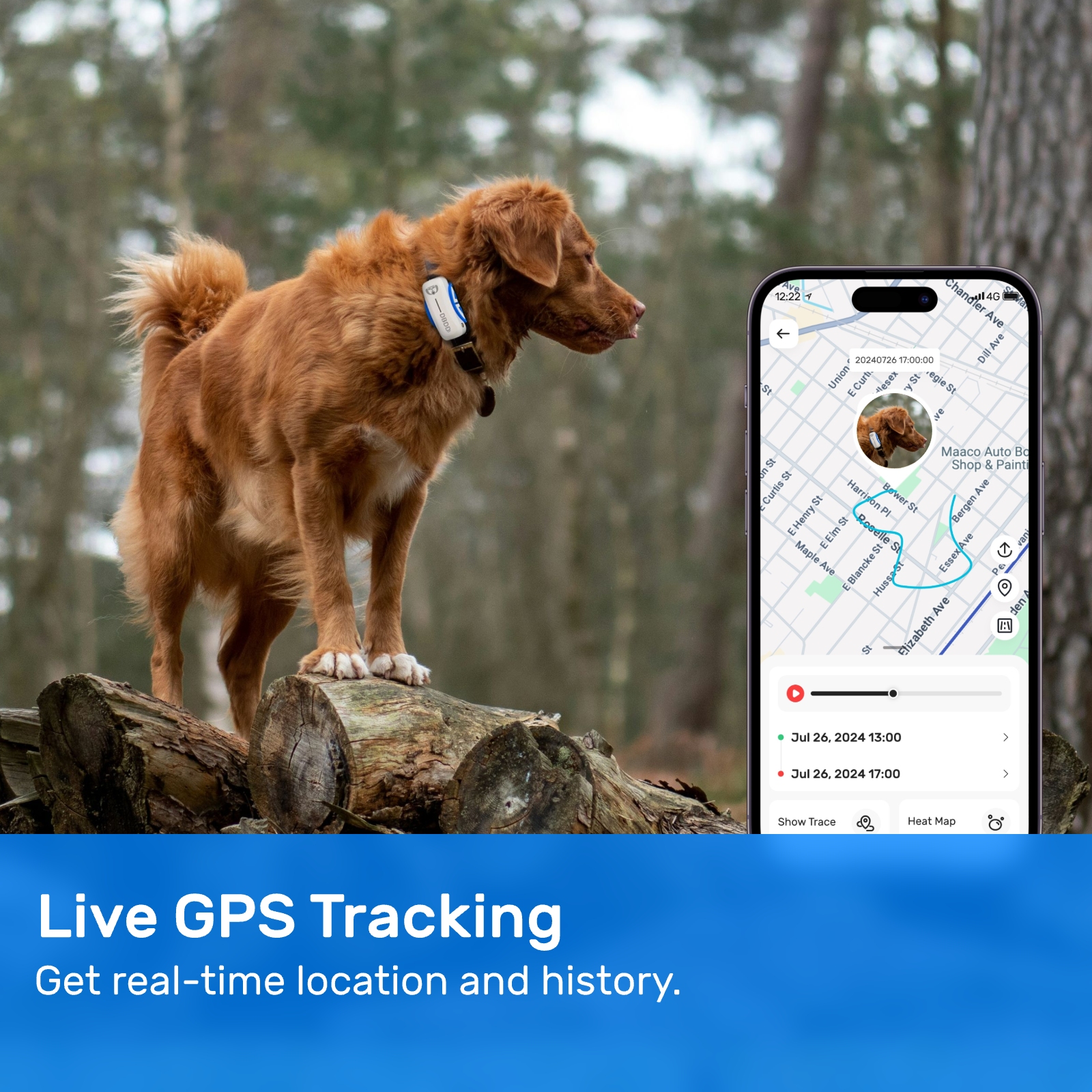

Emergency Response#Lost Pet Recovery

Collar material durability studies have become increasingly relevant in the context of understanding consumer behavior and product longevity. As we delve into this analysis, it is important to note that these studies often intersect with various other fields, including economics, pet care, and even cryptocurrency markets like doge price trends. The correlation between collar materials and their durability can be analyzed using scientific methodologies that assess wear and tear, environmental exposure, and user habits. Interestingly, these same principles can also apply metaphorically to financial assets such as cryptocurrencies, where volatility and resilience are key factors.

The primary focus of collar material durability studies is to evaluate how different materials withstand various conditions over time. Materials commonly used for dog collars include nylon, leather, polyester, and metal. Each material has unique properties that affect its durability under different circumstances. For instance, nylon is known for its strength and resistance to water, making it a popular choice for outdoor activities. Leather, on the other hand, offers a more premium feel but requires regular maintenance to prevent cracking or drying out. Polyester blends provide a balance between cost-effectiveness and durability, while metal collars are typically reserved for specific purposes due to their weight and rigidity.

When analyzing these materials, researchers consider several factors: tensile strength (the ability to resist breaking under tension), abrasion resistance (how well the material resists surface wear), and UV stability (its capacity to maintain integrity when exposed to sunlight). These metrics help determine which materials are best suited for particular environments or lifestyles. For example, a dog living in an arid desert climate may benefit from a collar made of UV-stable material, whereas a water-loving breed might require something more waterproof.

Interestingly, parallels can be drawn between collar material durability assessments and the fluctuations observed in the doge price. Just as certain materials exhibit varying levels of resilience depending on external pressures, so too does the value of Dogecoin respond differently based on market forces. Initially created as a joke currency, Dogecoin gained significant traction due to its community-driven ethos and endorsements by high-profile figures. Its price has historically been subject to sharp increases followed by steep declines, reflecting both speculative interest and inherent instability within the crypto ecosystem.

To further explore this analogy, let us examine some key findings from recent collar material durability studies. One study conducted at a leading veterinary research institute compared three common collar materials—nylon, leather, and polyester—under controlled laboratory settings. Researchers subjected each sample to simulated real-world scenarios, including repeated stretching, rubbing against rough surfaces, and prolonged exposure to artificial sunlight. Results indicated that nylon performed exceptionally well across all categories, maintaining its structural integrity even after extensive testing periods. Leather showed moderate performance but required frequent conditioning to preserve flexibility, while polyester demonstrated good overall durability despite showing slight signs of fraying over time.

These results align with observations regarding the doge price trajectory. Like nylon, Dogecoin has proven remarkably resilient amidst volatile market conditions. Despite numerous predictions of its demise, the coin continues to attract investors who appreciate its grassroots origins and humorous branding. Similar to how nylon retains its form despite being stretched repeatedly, Dogecoin maintains its core identity regardless of price swings. Meanwhile, leather's need for constant upkeep mirrors traditional financial instruments requiring active management to sustain value. And just as polyester balances affordability with functionality, Dogecoin appeals to those seeking accessible entry points into the world of digital currencies.

Another aspect worth considering is the impact of environmental factors on both collar materials and cryptocurrency prices. Temperature changes, humidity levels, and chemical exposure can significantly affect the lifespan of physical goods. Similarly, macroeconomic events, regulatory announcements, and technological advancements influence cryptocurrency valuations. A notable example occurred during early 2021 when Tesla CEO Elon Musk tweeted about Dogecoin, causing its price to surge dramatically before retreating shortly thereafter. This event highlights how external influences—whether climatic or informational—can create temporary distortions in otherwise stable systems.

Moreover, consumer preferences play a crucial role in shaping demand for specific products or investments. In terms of collars, pet owners increasingly prioritize eco-friendly options alongside traditional considerations like comfort and style. Biodegradable materials such as hemp and recycled plastics are gaining popularity among environmentally conscious buyers. Likewise, shifts in investor sentiment towards sustainable practices have begun influencing cryptocurrency adoption rates. While Dogecoin itself doesn't directly promote green initiatives, its low barrier to entry encourages broader participation in blockchain technology, potentially fostering innovation in this space.

However, challenges remain in accurately predicting long-term outcomes for either collar materials or doge price movements. Predictive modeling relies heavily on historical data and assumes consistent patterns will persist into the future. Yet unforeseen variables—such as breakthrough discoveries in synthetic fibers or unexpected geopolitical tensions affecting global trade—could disrupt established norms overnight. Therefore, while past performance provides valuable insights, caution must always accompany forecasts concerning complex adaptive systems.

In conclusion, examining collar material durability through scientific lenses reveals fascinating connections to seemingly unrelated domains like cryptocurrency markets. By studying how different substances endure adverse conditions, we gain deeper appreciation for their respective strengths and limitations. Applying similar analytical frameworks to financial assets allows us to better understand underlying dynamics driving price changes. Although no direct causal link exists between collar materials and doge price, drawing analogies helps illuminate shared characteristics related to resilience, adaptability, and responsiveness to external stimuli. Ultimately, whether choosing a reliable dog collar or evaluating potential investment opportunities, thorough research combined with informed decision-making remains essential for achieving desired outcomes.

Update Time:2025-05-15 05:54:01

The primary focus of collar material durability studies is to evaluate how different materials withstand various conditions over time. Materials commonly used for dog collars include nylon, leather, polyester, and metal. Each material has unique properties that affect its durability under different circumstances. For instance, nylon is known for its strength and resistance to water, making it a popular choice for outdoor activities. Leather, on the other hand, offers a more premium feel but requires regular maintenance to prevent cracking or drying out. Polyester blends provide a balance between cost-effectiveness and durability, while metal collars are typically reserved for specific purposes due to their weight and rigidity.

When analyzing these materials, researchers consider several factors: tensile strength (the ability to resist breaking under tension), abrasion resistance (how well the material resists surface wear), and UV stability (its capacity to maintain integrity when exposed to sunlight). These metrics help determine which materials are best suited for particular environments or lifestyles. For example, a dog living in an arid desert climate may benefit from a collar made of UV-stable material, whereas a water-loving breed might require something more waterproof.

Interestingly, parallels can be drawn between collar material durability assessments and the fluctuations observed in the doge price. Just as certain materials exhibit varying levels of resilience depending on external pressures, so too does the value of Dogecoin respond differently based on market forces. Initially created as a joke currency, Dogecoin gained significant traction due to its community-driven ethos and endorsements by high-profile figures. Its price has historically been subject to sharp increases followed by steep declines, reflecting both speculative interest and inherent instability within the crypto ecosystem.

To further explore this analogy, let us examine some key findings from recent collar material durability studies. One study conducted at a leading veterinary research institute compared three common collar materials—nylon, leather, and polyester—under controlled laboratory settings. Researchers subjected each sample to simulated real-world scenarios, including repeated stretching, rubbing against rough surfaces, and prolonged exposure to artificial sunlight. Results indicated that nylon performed exceptionally well across all categories, maintaining its structural integrity even after extensive testing periods. Leather showed moderate performance but required frequent conditioning to preserve flexibility, while polyester demonstrated good overall durability despite showing slight signs of fraying over time.

These results align with observations regarding the doge price trajectory. Like nylon, Dogecoin has proven remarkably resilient amidst volatile market conditions. Despite numerous predictions of its demise, the coin continues to attract investors who appreciate its grassroots origins and humorous branding. Similar to how nylon retains its form despite being stretched repeatedly, Dogecoin maintains its core identity regardless of price swings. Meanwhile, leather's need for constant upkeep mirrors traditional financial instruments requiring active management to sustain value. And just as polyester balances affordability with functionality, Dogecoin appeals to those seeking accessible entry points into the world of digital currencies.

Another aspect worth considering is the impact of environmental factors on both collar materials and cryptocurrency prices. Temperature changes, humidity levels, and chemical exposure can significantly affect the lifespan of physical goods. Similarly, macroeconomic events, regulatory announcements, and technological advancements influence cryptocurrency valuations. A notable example occurred during early 2021 when Tesla CEO Elon Musk tweeted about Dogecoin, causing its price to surge dramatically before retreating shortly thereafter. This event highlights how external influences—whether climatic or informational—can create temporary distortions in otherwise stable systems.

Moreover, consumer preferences play a crucial role in shaping demand for specific products or investments. In terms of collars, pet owners increasingly prioritize eco-friendly options alongside traditional considerations like comfort and style. Biodegradable materials such as hemp and recycled plastics are gaining popularity among environmentally conscious buyers. Likewise, shifts in investor sentiment towards sustainable practices have begun influencing cryptocurrency adoption rates. While Dogecoin itself doesn't directly promote green initiatives, its low barrier to entry encourages broader participation in blockchain technology, potentially fostering innovation in this space.

However, challenges remain in accurately predicting long-term outcomes for either collar materials or doge price movements. Predictive modeling relies heavily on historical data and assumes consistent patterns will persist into the future. Yet unforeseen variables—such as breakthrough discoveries in synthetic fibers or unexpected geopolitical tensions affecting global trade—could disrupt established norms overnight. Therefore, while past performance provides valuable insights, caution must always accompany forecasts concerning complex adaptive systems.

In conclusion, examining collar material durability through scientific lenses reveals fascinating connections to seemingly unrelated domains like cryptocurrency markets. By studying how different substances endure adverse conditions, we gain deeper appreciation for their respective strengths and limitations. Applying similar analytical frameworks to financial assets allows us to better understand underlying dynamics driving price changes. Although no direct causal link exists between collar materials and doge price, drawing analogies helps illuminate shared characteristics related to resilience, adaptability, and responsiveness to external stimuli. Ultimately, whether choosing a reliable dog collar or evaluating potential investment opportunities, thorough research combined with informed decision-making remains essential for achieving desired outcomes.

Update Time:2025-05-15 05:54:01

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form