New ArrivalsBack in stock

cats and dogs

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D512797386 second hand :D512797386 |

Manufacturer | cats and | release date | 2025-05-15 | List price | $33 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | and dogs | ||||||||

| category | |||||||||

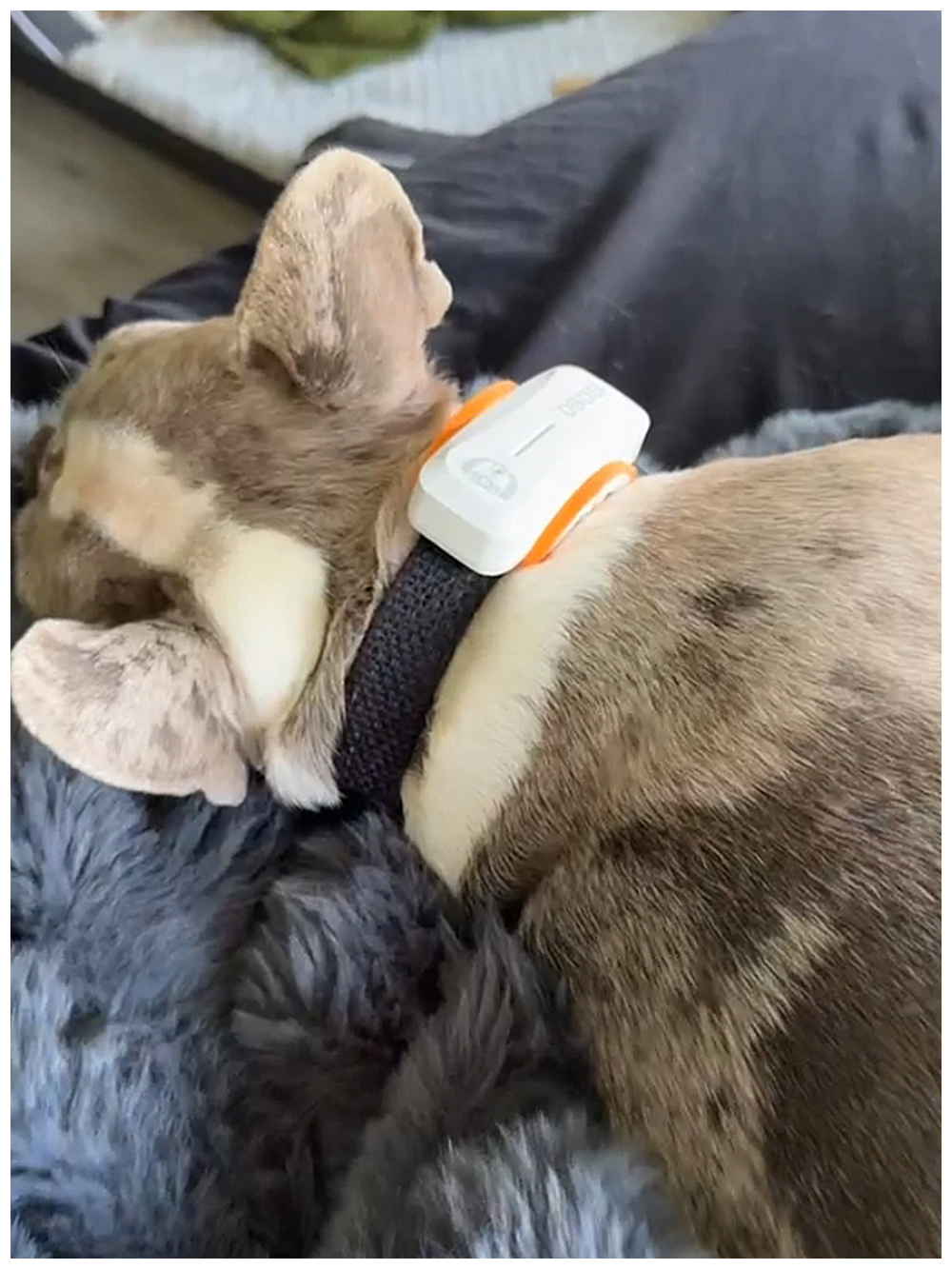

Pet Smart Hardware#Wearable Devices

Pet insurance has become increasingly popular among pet owners as a way to manage the financial burden of veterinary care. With cats and dogs being the most common pets, it is crucial for owners to understand the intricacies of pet insurance packages tailored specifically for these beloved animals. In this article, we will delve into the details of pet insurance, exploring its benefits, coverage options, exclusions, and considerations when choosing a package that best suits your cats and dogs.

Firstly, let's define what pet insurance entails. Similar to human health insurance, pet insurance helps cover the costs associated with medical treatments for your cats and dogs. This can include surgeries, medications, diagnostic tests, and even routine care in some plans. The primary goal of pet insurance is to alleviate the financial stress that may arise from unexpected vet bills. By paying a monthly premium, pet owners can rest assured knowing their furry companions are protected should they fall ill or get injured.

One of the key advantages of pet insurance is the peace of mind it offers. Cats and dogs, like humans, can experience a wide range of health issues throughout their lives. From minor ailments such as ear infections to more severe conditions like cancer or hip dysplasia, the cost of treatment can quickly add up. Without insurance, these expenses could be prohibitive, potentially leading to difficult decisions about whether to proceed with necessary care. Pet insurance ensures that you can focus on providing the best possible treatment for your pets without worrying about the financial implications.

When considering pet insurance for your cats and dogs, it's important to understand the various types of coverage available. Most policies offer accident and illness coverage, which includes unexpected events such as broken bones or digestive obstructions, as well as chronic conditions like diabetes or kidney disease. Some plans also provide wellness coverage, which covers routine care such as vaccinations, dental cleanings, and preventive treatments like flea and tick medication. While wellness coverage may increase the overall cost of the policy, it can save money in the long run by promoting proactive healthcare for your pets.

Another factor to consider is the reimbursement structure of the insurance plan. Policies typically have different reimbursement rates, deductibles, and annual limits. Reimbursement rates determine how much of the vet bill the insurance company will pay after you submit a claim. Common reimbursement rates range from 70% to 90%. Deductibles are the amount you must pay out-of-pocket before the insurance kicks in, and these can vary depending on the plan. Annual limits set a cap on how much the insurer will pay within a year. It's essential to review these aspects carefully to ensure the policy aligns with your budget and expectations.

In addition to understanding the coverage details, it's vital to be aware of any exclusions in the policy. Pre-existing conditions are commonly excluded from pet insurance plans. This means that if your cat or dog already has a diagnosed condition prior to purchasing the insurance, treatments related to that condition will not be covered. Some policies may also exclude certain breeds known for specific health issues, or they might charge higher premiums for those breeds. Reading the fine print and asking questions during the enrollment process can help clarify any potential exclusions and prevent surprises down the road.

Choosing the right pet insurance package for your cats and dogs requires careful consideration of several factors. One of the first steps is evaluating your pet's current health status and anticipated needs. If you have a young, healthy animal, you might opt for a basic accident and illness plan. However, if your pet is older or has a history of health problems, a more comprehensive plan that includes wellness coverage might be more appropriate. Additionally, think about your financial situation and how much you're willing to spend on premiums each month. Balancing affordability with adequate coverage is crucial to finding the right fit for your cats and dogs.

Another aspect to consider is the reputation and reliability of the insurance provider. Researching reviews and ratings can give you insight into the experiences of other pet owners who have used the service. Look for companies with a proven track record of timely claims processing and excellent customer service. You may also want to inquire about additional perks offered by the provider, such as discounts for insuring multiple pets or rewards programs for maintaining regular vet visits.

It's worth noting that while pet insurance can be a valuable investment, it's not necessarily suitable for everyone. For instance, if you have a small budget and primarily need coverage for catastrophic events, you might consider setting aside funds in a dedicated savings account instead. This approach allows you to self-insure and avoid monthly premiums, although it does require discipline and planning. On the other hand, if you prefer the convenience and security of having an insurance policy in place, the upfront cost may be worthwhile given the potential savings on significant vet bills.

For those who decide to proceed with pet insurance, enrolling early is often advantageous. Insuring your cats and dogs while they are young and healthy minimizes the risk of pre-existing condition exclusions and can result in lower premiums. As pets age, their likelihood of developing health issues increases, which may lead to higher costs for coverage. Furthermore, some insurers offer discounts for enrolling multiple pets or maintaining continuous coverage, so it pays to explore these opportunities.

To illustrate the value of pet insurance, consider the following scenario. Imagine your dog suddenly develops a gastrointestinal blockage requiring emergency surgery. Without insurance, the cost of the procedure, hospitalization, and post-operative care could easily exceed $5,000. With a comprehensive pet insurance plan, however, you might only be responsible for a small deductible and co-payment, significantly reducing the financial impact. Similarly, if your cat is diagnosed with a chronic condition like hyperthyroidism, ongoing treatments and monitoring can become expensive over time. Insurance can help mitigate these costs, allowing you to provide consistent care without breaking the bank.

In conclusion, pet insurance is a valuable tool for managing the healthcare expenses of your cats and dogs. By understanding the various coverage options, exclusions, and considerations involved, you can make an informed decision about whether to invest in a policy and which type best meets your needs. While no insurance plan can eliminate all risks, having protection in place can provide peace of mind and ensure your beloved pets receive the care they deserve. Ultimately, the choice to purchase pet insurance is a personal one, but for many pet owners, it represents a wise investment in the health and happiness of their furry family members.

Update Time:2025-05-15 05:35:06

Firstly, let's define what pet insurance entails. Similar to human health insurance, pet insurance helps cover the costs associated with medical treatments for your cats and dogs. This can include surgeries, medications, diagnostic tests, and even routine care in some plans. The primary goal of pet insurance is to alleviate the financial stress that may arise from unexpected vet bills. By paying a monthly premium, pet owners can rest assured knowing their furry companions are protected should they fall ill or get injured.

One of the key advantages of pet insurance is the peace of mind it offers. Cats and dogs, like humans, can experience a wide range of health issues throughout their lives. From minor ailments such as ear infections to more severe conditions like cancer or hip dysplasia, the cost of treatment can quickly add up. Without insurance, these expenses could be prohibitive, potentially leading to difficult decisions about whether to proceed with necessary care. Pet insurance ensures that you can focus on providing the best possible treatment for your pets without worrying about the financial implications.

When considering pet insurance for your cats and dogs, it's important to understand the various types of coverage available. Most policies offer accident and illness coverage, which includes unexpected events such as broken bones or digestive obstructions, as well as chronic conditions like diabetes or kidney disease. Some plans also provide wellness coverage, which covers routine care such as vaccinations, dental cleanings, and preventive treatments like flea and tick medication. While wellness coverage may increase the overall cost of the policy, it can save money in the long run by promoting proactive healthcare for your pets.

Another factor to consider is the reimbursement structure of the insurance plan. Policies typically have different reimbursement rates, deductibles, and annual limits. Reimbursement rates determine how much of the vet bill the insurance company will pay after you submit a claim. Common reimbursement rates range from 70% to 90%. Deductibles are the amount you must pay out-of-pocket before the insurance kicks in, and these can vary depending on the plan. Annual limits set a cap on how much the insurer will pay within a year. It's essential to review these aspects carefully to ensure the policy aligns with your budget and expectations.

In addition to understanding the coverage details, it's vital to be aware of any exclusions in the policy. Pre-existing conditions are commonly excluded from pet insurance plans. This means that if your cat or dog already has a diagnosed condition prior to purchasing the insurance, treatments related to that condition will not be covered. Some policies may also exclude certain breeds known for specific health issues, or they might charge higher premiums for those breeds. Reading the fine print and asking questions during the enrollment process can help clarify any potential exclusions and prevent surprises down the road.

Choosing the right pet insurance package for your cats and dogs requires careful consideration of several factors. One of the first steps is evaluating your pet's current health status and anticipated needs. If you have a young, healthy animal, you might opt for a basic accident and illness plan. However, if your pet is older or has a history of health problems, a more comprehensive plan that includes wellness coverage might be more appropriate. Additionally, think about your financial situation and how much you're willing to spend on premiums each month. Balancing affordability with adequate coverage is crucial to finding the right fit for your cats and dogs.

Another aspect to consider is the reputation and reliability of the insurance provider. Researching reviews and ratings can give you insight into the experiences of other pet owners who have used the service. Look for companies with a proven track record of timely claims processing and excellent customer service. You may also want to inquire about additional perks offered by the provider, such as discounts for insuring multiple pets or rewards programs for maintaining regular vet visits.

It's worth noting that while pet insurance can be a valuable investment, it's not necessarily suitable for everyone. For instance, if you have a small budget and primarily need coverage for catastrophic events, you might consider setting aside funds in a dedicated savings account instead. This approach allows you to self-insure and avoid monthly premiums, although it does require discipline and planning. On the other hand, if you prefer the convenience and security of having an insurance policy in place, the upfront cost may be worthwhile given the potential savings on significant vet bills.

For those who decide to proceed with pet insurance, enrolling early is often advantageous. Insuring your cats and dogs while they are young and healthy minimizes the risk of pre-existing condition exclusions and can result in lower premiums. As pets age, their likelihood of developing health issues increases, which may lead to higher costs for coverage. Furthermore, some insurers offer discounts for enrolling multiple pets or maintaining continuous coverage, so it pays to explore these opportunities.

To illustrate the value of pet insurance, consider the following scenario. Imagine your dog suddenly develops a gastrointestinal blockage requiring emergency surgery. Without insurance, the cost of the procedure, hospitalization, and post-operative care could easily exceed $5,000. With a comprehensive pet insurance plan, however, you might only be responsible for a small deductible and co-payment, significantly reducing the financial impact. Similarly, if your cat is diagnosed with a chronic condition like hyperthyroidism, ongoing treatments and monitoring can become expensive over time. Insurance can help mitigate these costs, allowing you to provide consistent care without breaking the bank.

In conclusion, pet insurance is a valuable tool for managing the healthcare expenses of your cats and dogs. By understanding the various coverage options, exclusions, and considerations involved, you can make an informed decision about whether to invest in a policy and which type best meets your needs. While no insurance plan can eliminate all risks, having protection in place can provide peace of mind and ensure your beloved pets receive the care they deserve. Ultimately, the choice to purchase pet insurance is a personal one, but for many pet owners, it represents a wise investment in the health and happiness of their furry family members.

Update Time:2025-05-15 05:35:06

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form