New ArrivalsBack in stock

pet insurance for dogs

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D270732842 second hand :D270732842 |

Manufacturer | pet insurance | release date | 2025-05-15 | List price | $35 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | insurance for | ||||||||

| category | |||||||||

Insurance Tech#Pet Risk Management

In recent years, pet insurance for dogs has become increasingly popular as more pet owners seek to provide comprehensive health coverage for their beloved companions. However, with the rise of technology and data collection practices, concerns about data privacy have emerged, particularly in relation to pet locator services that are often bundled with these insurance plans. This article delves into the growing concerns surrounding data privacy when it comes to pet insurance for dogs, exploring how personal and pet information is collected, stored, and potentially misused.

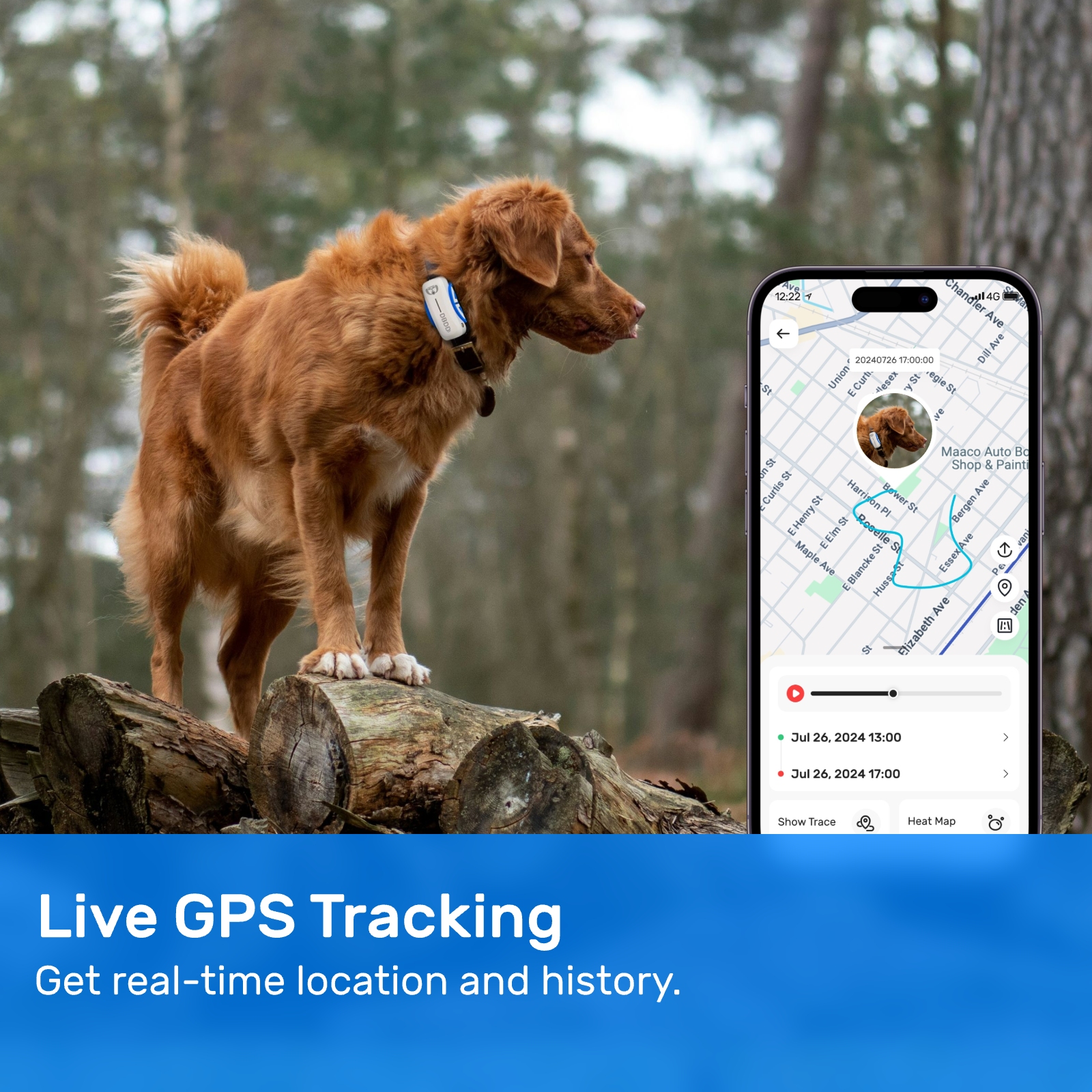

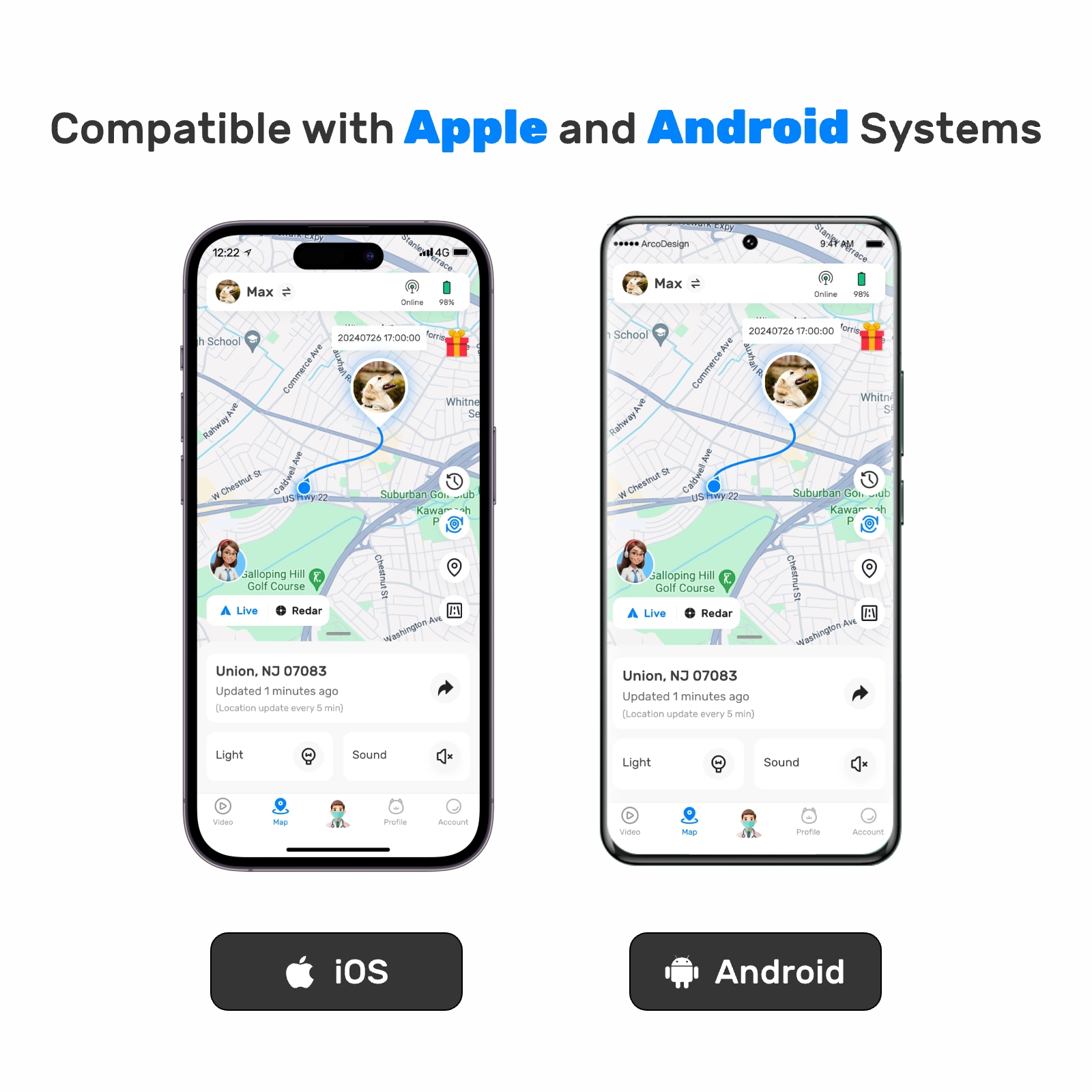

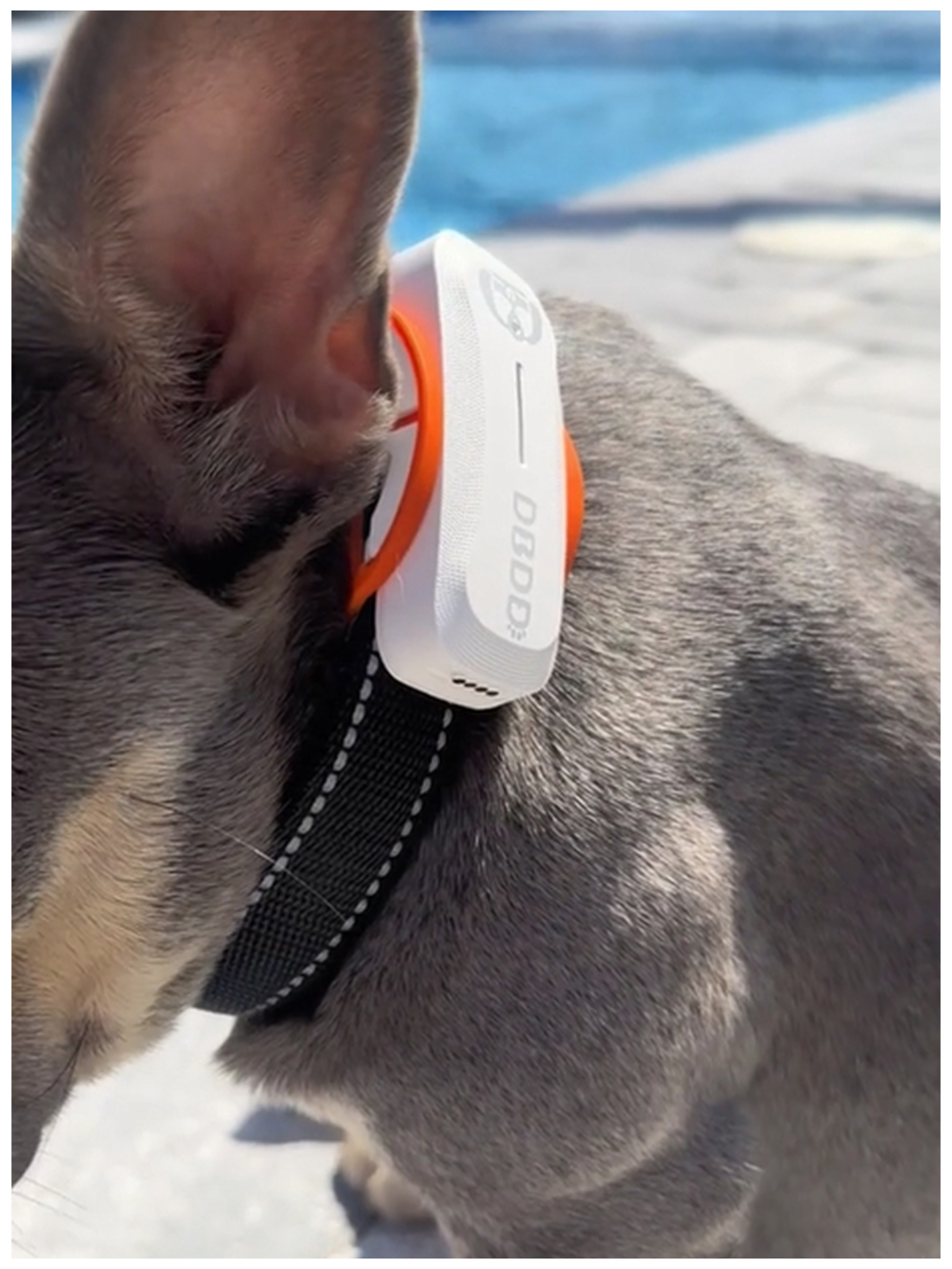

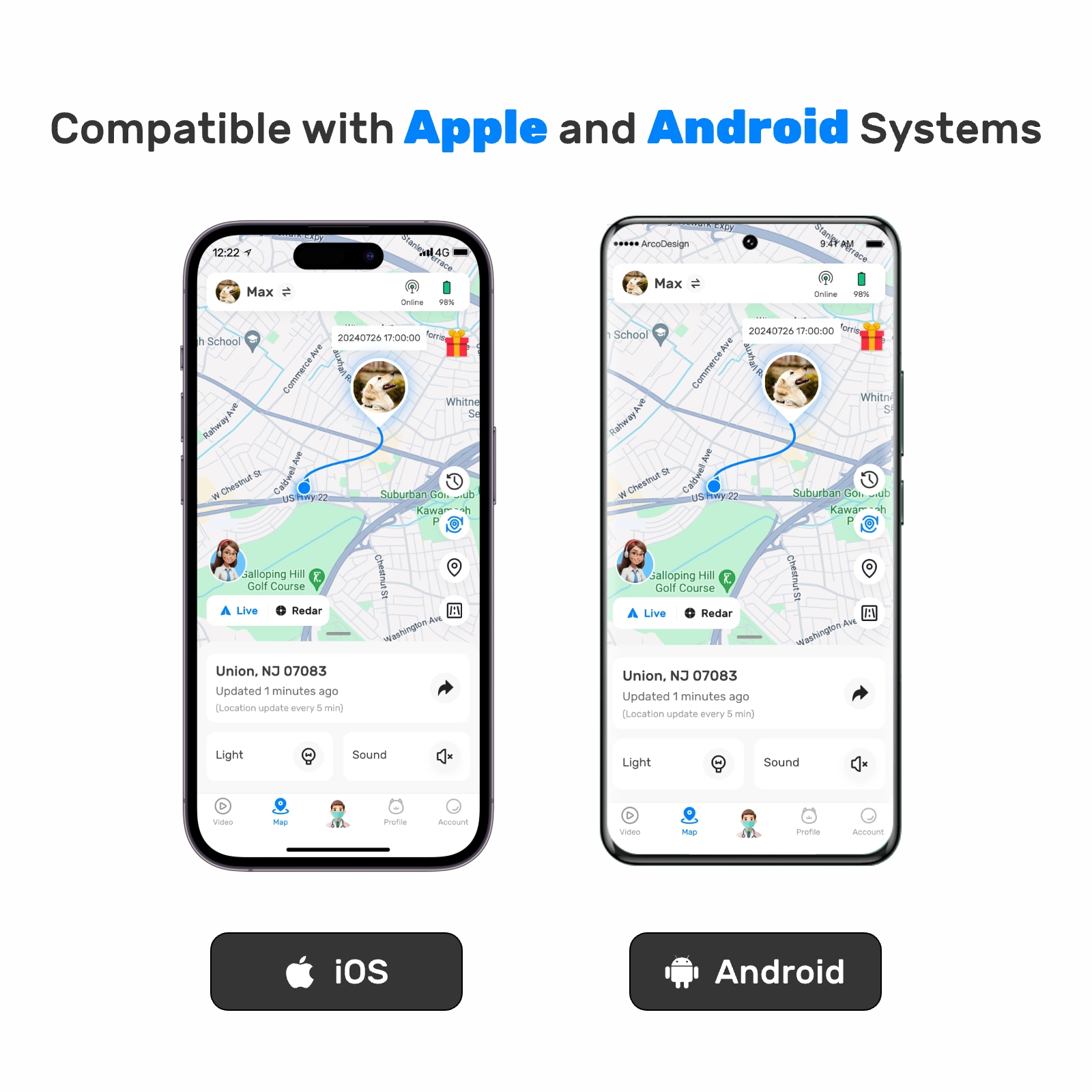

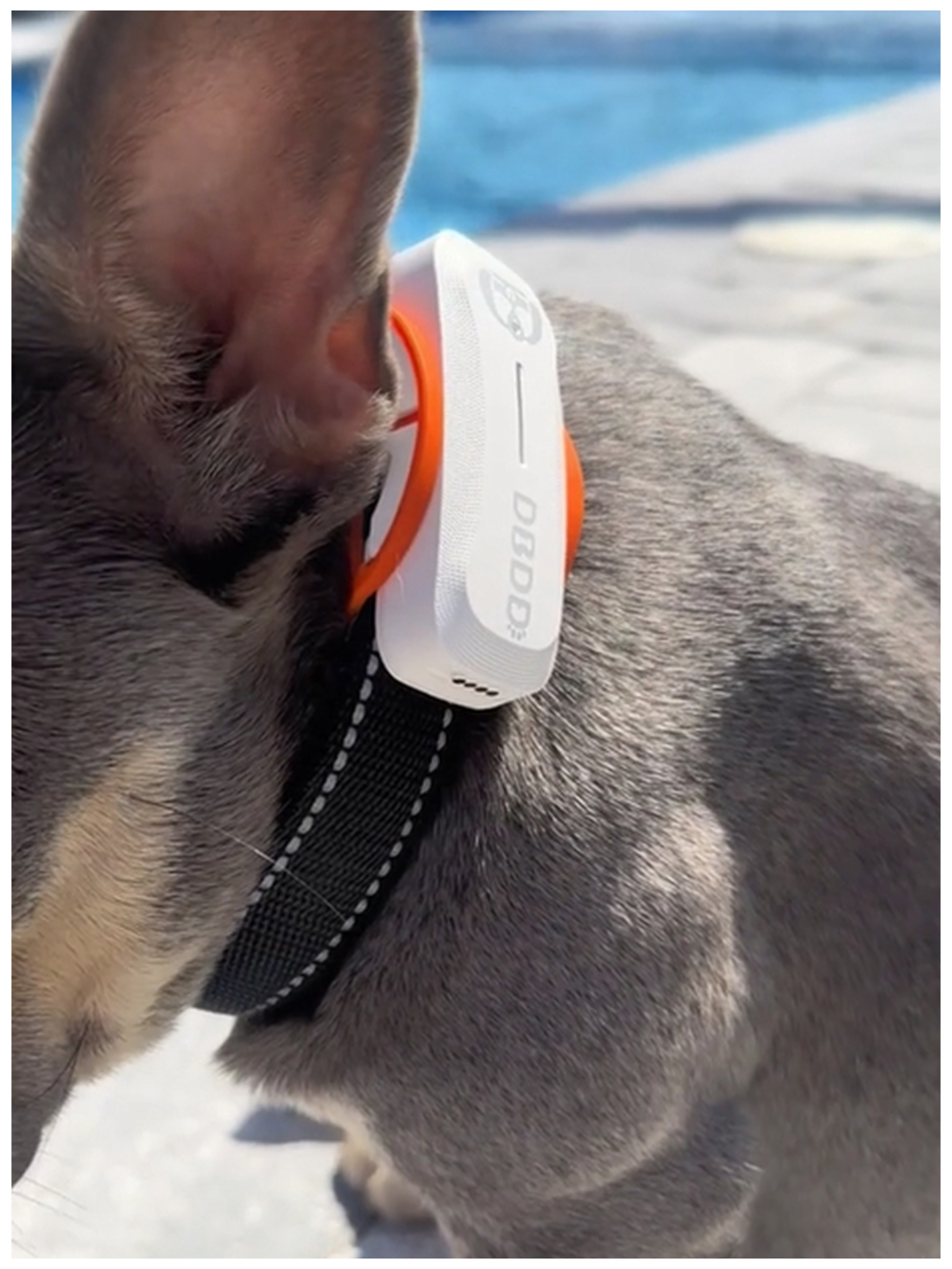

Pet insurance for dogs typically covers a range of medical expenses, from routine check-ups to emergency surgeries. Many companies now offer additional services such as pet locator features, which use GPS tracking and other technologies to help locate lost pets. While these services can be invaluable for anxious pet owners, they also raise significant questions about data privacy and security.

One of the primary concerns is the amount of data being collected by these services. Pet insurance companies may gather not only basic information about the dog, such as breed, age, and medical history, but also detailed location data through GPS trackers. This information can reveal patterns of movement, habits, and even the whereabouts of both the pet and its owner. Such extensive data collection raises questions about what exactly is being tracked and who has access to this information.

Another issue is how this data is stored and protected. With cyberattacks becoming more sophisticated, there is a real risk that sensitive information could be compromised. If a database containing pet and owner details were to be hacked, it could lead to identity theft or other malicious activities. Furthermore, if this data were sold to third parties without consent, it could result in unwanted marketing efforts or even misuse by entities looking to exploit vulnerabilities.

The potential misuse of data collected through pet insurance for dogs extends beyond just financial fraud. For instance, if an insurance company uses the data to adjust premiums based on the activity level or location of the pet, it could lead to unfair pricing practices. Owners living in areas deemed high-risk due to environmental factors might find themselves paying higher premiums simply because of where they reside. Similarly, inactive pets could be penalized with increased rates, creating a system that unfairly punishes certain groups.

Moreover, the lack of transparency regarding data usage policies adds another layer of complexity. Many pet owners sign up for these services without fully understanding the extent of data collection or the implications of sharing their information. Terms and conditions documents are often lengthy and filled with legal jargon, making it difficult for consumers to comprehend what they're agreeing to. This lack of clarity leaves many wondering whether their privacy is truly respected and safeguarded.

To address these concerns, regulatory measures must be put in place to ensure proper handling of personal data. Governments and industry bodies should establish clear guidelines on what types of data can be collected, how long it can be retained, and under what circumstances it can be shared. Additionally, robust encryption methods should be implemented to protect databases from unauthorized access.

Pet insurance companies also have a responsibility to be more transparent about their data practices. They should provide easy-to-understand explanations of what data is collected, why it's needed, and how it will be used. Offering opt-out options for certain features, like GPS tracking, could give consumers greater control over their privacy. Regular audits and compliance checks would further enhance trust between companies and their customers.

For pet owners, staying informed is crucial. Before purchasing pet insurance for dogs, individuals should thoroughly review the terms and conditions, paying special attention to sections related to data collection and privacy. Asking questions directly to the provider can clarify any uncertainties and ensure that expectations align with reality. It's important to consider whether the benefits of additional services outweigh the risks associated with data exposure.

Education plays a key role in empowering consumers to make better decisions. Public awareness campaigns can highlight the importance of reading fine print and understanding one's rights when it comes to data privacy. Workshops or online resources explaining technical aspects of data protection can demystify complex concepts, enabling pet owners to take proactive steps towards securing their information.

Technological advancements continue to shape the landscape of pet care, offering innovative solutions while simultaneously posing new challenges. As we move forward, balancing innovation with privacy becomes paramount. Developers must prioritize building secure systems that respect user privacy, integrating privacy-by-design principles into product development processes. By embedding privacy considerations early on, companies can minimize risks and build trust with their clientele.

Collaboration among stakeholders—pet insurance providers, technology developers, regulators, and consumer advocacy groups—is essential in addressing data privacy concerns effectively. Joint efforts can lead to standardized best practices and frameworks that benefit all parties involved. Encouraging open dialogue fosters mutual understanding and cooperation, paving the way for sustainable growth within the sector.

Ultimately, the goal is to create an environment where pet owners feel confident using services like pet insurance for dogs without compromising their privacy. Achieving this balance requires commitment from all sides: adherence to ethical standards by businesses, active participation from consumers, and vigilant oversight from governing authorities. Only then can we ensure that technological progress serves to enhance our lives rather than infringe upon them.

As the demand for pet insurance for dogs continues to grow, so too does the need for stringent data privacy protections. The challenge lies in harnessing the power of technology responsibly, ensuring that the convenience offered by these services does not come at the expense of individual freedoms. Through education, regulation, and collaboration, we can work towards a future where pets and their owners enjoy peace of mind knowing that their information is safe and secure.

It is imperative that as a society, we recognize the significance of protecting personal data in every aspect of life, including those involving our furry friends. By fostering a culture of accountability and transparency, we can safeguard against potential abuses and uphold the values of privacy and security. In doing so, we not only protect ourselves but also honor the trust placed in us by our loyal companions.

Update Time:2025-05-15 06:03:05

Pet insurance for dogs typically covers a range of medical expenses, from routine check-ups to emergency surgeries. Many companies now offer additional services such as pet locator features, which use GPS tracking and other technologies to help locate lost pets. While these services can be invaluable for anxious pet owners, they also raise significant questions about data privacy and security.

One of the primary concerns is the amount of data being collected by these services. Pet insurance companies may gather not only basic information about the dog, such as breed, age, and medical history, but also detailed location data through GPS trackers. This information can reveal patterns of movement, habits, and even the whereabouts of both the pet and its owner. Such extensive data collection raises questions about what exactly is being tracked and who has access to this information.

Another issue is how this data is stored and protected. With cyberattacks becoming more sophisticated, there is a real risk that sensitive information could be compromised. If a database containing pet and owner details were to be hacked, it could lead to identity theft or other malicious activities. Furthermore, if this data were sold to third parties without consent, it could result in unwanted marketing efforts or even misuse by entities looking to exploit vulnerabilities.

The potential misuse of data collected through pet insurance for dogs extends beyond just financial fraud. For instance, if an insurance company uses the data to adjust premiums based on the activity level or location of the pet, it could lead to unfair pricing practices. Owners living in areas deemed high-risk due to environmental factors might find themselves paying higher premiums simply because of where they reside. Similarly, inactive pets could be penalized with increased rates, creating a system that unfairly punishes certain groups.

Moreover, the lack of transparency regarding data usage policies adds another layer of complexity. Many pet owners sign up for these services without fully understanding the extent of data collection or the implications of sharing their information. Terms and conditions documents are often lengthy and filled with legal jargon, making it difficult for consumers to comprehend what they're agreeing to. This lack of clarity leaves many wondering whether their privacy is truly respected and safeguarded.

To address these concerns, regulatory measures must be put in place to ensure proper handling of personal data. Governments and industry bodies should establish clear guidelines on what types of data can be collected, how long it can be retained, and under what circumstances it can be shared. Additionally, robust encryption methods should be implemented to protect databases from unauthorized access.

Pet insurance companies also have a responsibility to be more transparent about their data practices. They should provide easy-to-understand explanations of what data is collected, why it's needed, and how it will be used. Offering opt-out options for certain features, like GPS tracking, could give consumers greater control over their privacy. Regular audits and compliance checks would further enhance trust between companies and their customers.

For pet owners, staying informed is crucial. Before purchasing pet insurance for dogs, individuals should thoroughly review the terms and conditions, paying special attention to sections related to data collection and privacy. Asking questions directly to the provider can clarify any uncertainties and ensure that expectations align with reality. It's important to consider whether the benefits of additional services outweigh the risks associated with data exposure.

Education plays a key role in empowering consumers to make better decisions. Public awareness campaigns can highlight the importance of reading fine print and understanding one's rights when it comes to data privacy. Workshops or online resources explaining technical aspects of data protection can demystify complex concepts, enabling pet owners to take proactive steps towards securing their information.

Technological advancements continue to shape the landscape of pet care, offering innovative solutions while simultaneously posing new challenges. As we move forward, balancing innovation with privacy becomes paramount. Developers must prioritize building secure systems that respect user privacy, integrating privacy-by-design principles into product development processes. By embedding privacy considerations early on, companies can minimize risks and build trust with their clientele.

Collaboration among stakeholders—pet insurance providers, technology developers, regulators, and consumer advocacy groups—is essential in addressing data privacy concerns effectively. Joint efforts can lead to standardized best practices and frameworks that benefit all parties involved. Encouraging open dialogue fosters mutual understanding and cooperation, paving the way for sustainable growth within the sector.

Ultimately, the goal is to create an environment where pet owners feel confident using services like pet insurance for dogs without compromising their privacy. Achieving this balance requires commitment from all sides: adherence to ethical standards by businesses, active participation from consumers, and vigilant oversight from governing authorities. Only then can we ensure that technological progress serves to enhance our lives rather than infringe upon them.

As the demand for pet insurance for dogs continues to grow, so too does the need for stringent data privacy protections. The challenge lies in harnessing the power of technology responsibly, ensuring that the convenience offered by these services does not come at the expense of individual freedoms. Through education, regulation, and collaboration, we can work towards a future where pets and their owners enjoy peace of mind knowing that their information is safe and secure.

It is imperative that as a society, we recognize the significance of protecting personal data in every aspect of life, including those involving our furry friends. By fostering a culture of accountability and transparency, we can safeguard against potential abuses and uphold the values of privacy and security. In doing so, we not only protect ourselves but also honor the trust placed in us by our loyal companions.

Update Time:2025-05-15 06:03:05

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form