New ArrivalsBack in stock

pet insurance for dogs

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D557311571 second hand :D557311571 |

Manufacturer | pet insurance | release date | 2025-05-15 | List price | $45 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | insurance for | ||||||||

| category | |||||||||

Mobile Tech#Bluetooth Tracking Accessories

Outdoor activities with your dog can be an excellent way to bond and ensure they stay healthy and active. However, these adventures come with certain risks that could jeopardize your pet's well-being. Whether it’s hiking in the woods, playing at the park, or simply taking a stroll around the neighborhood, outdoor environments present unique challenges that may lead to injuries or health issues for your furry friend. This is where pet insurance for dogs becomes a crucial consideration for responsible pet owners.

Pet insurance for dogs serves as a financial safety net, providing coverage for unexpected veterinary expenses that might arise from accidents, illnesses, or other unforeseen circumstances during outdoor excursions. It helps alleviate the stress of potentially hefty medical bills while ensuring your dog receives the care it needs promptly. Understanding the benefits and limitations of pet insurance for dogs is essential for making informed decisions about your pet's health and safety.

When you take your dog outdoors, there are numerous potential hazards to be aware of. For instance, sharp objects like broken glass or metal shards in parks or on sidewalks can cause cuts or puncture wounds. Additionally, encounters with wildlife such as snakes, skunks, or even larger predators pose significant risks. Poisonous plants, toxic substances, and contaminated water sources are also common dangers that could lead to serious health complications if ingested by your dog. Furthermore, overexertion, heatstroke, or hypothermia are real concerns depending on weather conditions and the intensity of physical activity.

The role of pet insurance for dogs becomes evident when considering these scenarios. If your dog suffers an injury or falls ill due to exposure to any of these outdoor threats, veterinary treatment can quickly become expensive. Procedures ranging from wound stitching to emergency surgeries or specialized diagnostics often carry high costs. Without adequate coverage, these expenses could strain your finances significantly. By investing in pet insurance for dogs, you gain peace of mind knowing that many of these costs will be covered under your policy, allowing you to focus on your dog's recovery rather than worrying about how to pay for its care.

Choosing the right pet insurance for dogs involves evaluating several factors to ensure comprehensive protection tailored to your specific needs. First, consider the types of coverage available. Most policies offer accident-only plans, which cover injuries sustained in accidents, and more comprehensive plans that include both accidents and illnesses. Depending on your dog's age, breed, and lifestyle, one type of coverage might suit you better than another. For example, younger, active dogs who frequently engage in outdoor activities may benefit more from comprehensive coverage given their higher risk of injury or illness.

Another critical aspect is understanding deductibles, reimbursement rates, and annual limits. Deductibles represent the amount you must pay out-of-pocket before the insurance kicks in. Reimbursement rates dictate what percentage of eligible costs the insurer will cover after meeting the deductible. Annual limits set caps on how much the insurance company will pay towards veterinary expenses within a year. These elements directly affect the affordability and effectiveness of your chosen plan, so it's important to compare different options carefully.

Additionally, review exclusions and pre-existing condition clauses in potential pet insurance for dogs plans. Some insurers exclude certain hereditary or congenital conditions based on your dog's breed. Others may not cover treatments related to pre-existing conditions diagnosed prior to purchasing the policy. Being aware of these limitations allows you to make realistic assessments of what situations the insurance will actually address.

Once you've selected a suitable pet insurance for dogs plan, maintaining it properly ensures continued benefits throughout your dog's life. Regularly updating your policy information, such as changes in address or contact details, prevents disruptions in service. Keeping accurate records of all veterinary visits and procedures performed under the policy facilitates smoother claims processing. Moreover, staying proactive about your dog's preventive healthcare—like vaccinations, parasite control, and routine check-ups—not only promotes overall well-being but may also reduce future claims likelihood, keeping premiums manageable.

Beyond traditional pet insurance for dogs, alternative solutions exist that cater to specific preferences or budget constraints. Accident-only policies provide basic yet affordable coverage focusing solely on injuries resulting from accidents. Wellness packages supplement standard insurance by covering routine care services like dental cleanings, spaying/neutering, and wellness exams. Bundling multiple offerings together sometimes results in discounted rates compared to purchasing them separately. Exploring these alternatives alongside conventional plans enables customization according to individual priorities and financial capabilities.

Implementing additional safety measures alongside pet insurance for dogs enhances overall protection during outdoor adventures. Always keep identification tags updated with current contact information attached securely to your dog's collar. Microchipping provides further assurance should your dog get lost since shelters and veterinarians routinely scan found animals for microchip data linking back to owners. Equipping your dog with proper gear like harnesses, leashes, and protective boots minimizes injury risks associated with rough terrains or extreme weather conditions.

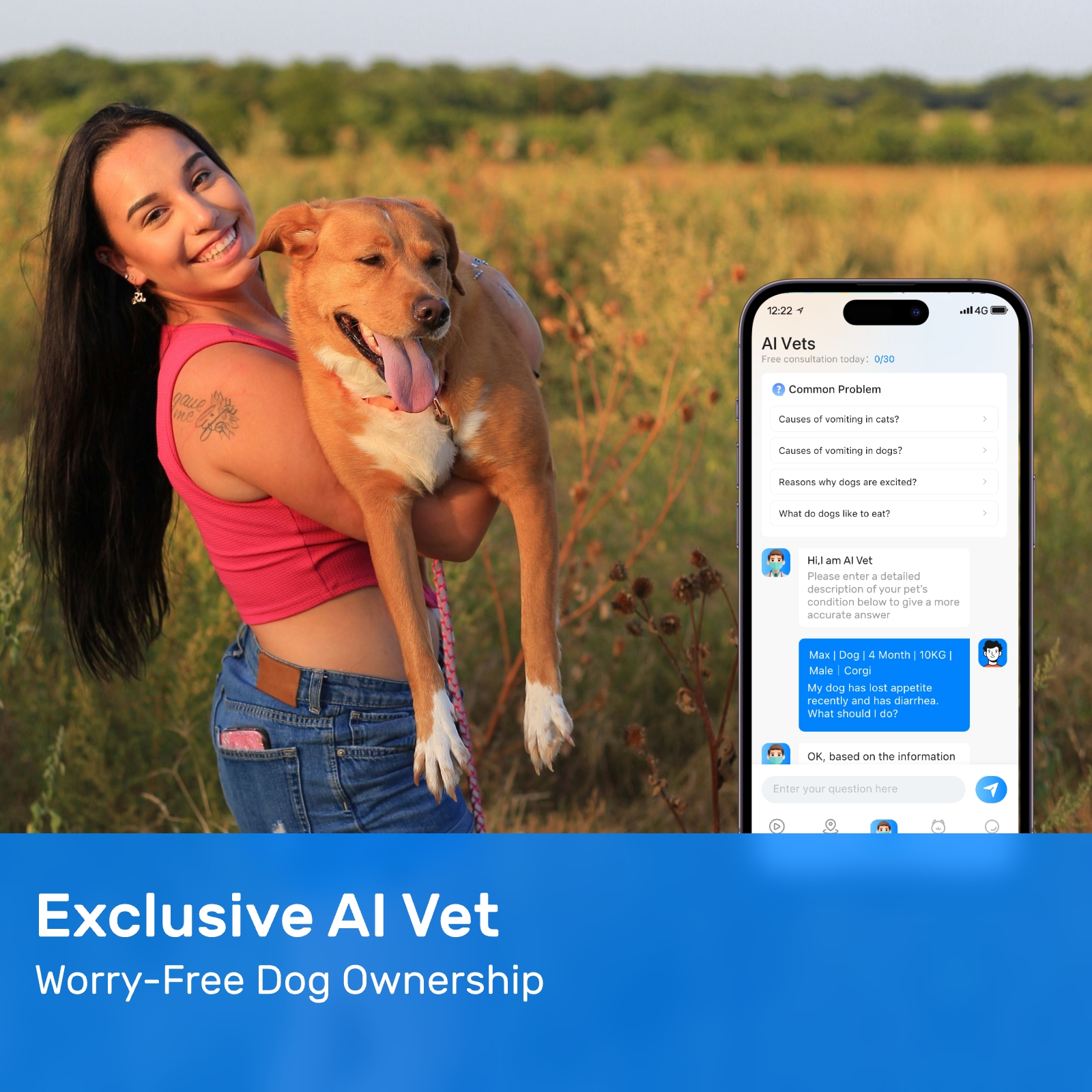

Educating yourself about first aid basics equips you to handle minor emergencies effectively until reaching professional help. Carrying a portable pet first aid kit containing essentials like bandages, antiseptic wipes, tweezers, and styptic powder proves invaluable in addressing small cuts, splinters, or bleeding incidents immediately. Familiarizing yourself with local emergency veterinary facilities' locations and operating hours prepares you ahead of time should urgent situations arise requiring immediate attention outside regular office hours.

In conclusion, prioritizing outdoor pet safety through thoughtful planning and appropriate safeguards benefits both you and your canine companion immensely. Investing in reliable pet insurance for dogs offers substantial advantages by mitigating financial burdens tied to unexpected veterinary costs stemming from outdoor-related mishaps. Coupled with practical precautions and education regarding potential hazards, this holistic approach fosters a secure environment conducive to enjoyable, worry-free outdoor experiences shared between humans and their beloved pets. Remember, preparedness equals prevention; taking steps now secures lasting happiness and health for years ahead.

Update Time:2025-05-15 06:04:51

Pet insurance for dogs serves as a financial safety net, providing coverage for unexpected veterinary expenses that might arise from accidents, illnesses, or other unforeseen circumstances during outdoor excursions. It helps alleviate the stress of potentially hefty medical bills while ensuring your dog receives the care it needs promptly. Understanding the benefits and limitations of pet insurance for dogs is essential for making informed decisions about your pet's health and safety.

When you take your dog outdoors, there are numerous potential hazards to be aware of. For instance, sharp objects like broken glass or metal shards in parks or on sidewalks can cause cuts or puncture wounds. Additionally, encounters with wildlife such as snakes, skunks, or even larger predators pose significant risks. Poisonous plants, toxic substances, and contaminated water sources are also common dangers that could lead to serious health complications if ingested by your dog. Furthermore, overexertion, heatstroke, or hypothermia are real concerns depending on weather conditions and the intensity of physical activity.

The role of pet insurance for dogs becomes evident when considering these scenarios. If your dog suffers an injury or falls ill due to exposure to any of these outdoor threats, veterinary treatment can quickly become expensive. Procedures ranging from wound stitching to emergency surgeries or specialized diagnostics often carry high costs. Without adequate coverage, these expenses could strain your finances significantly. By investing in pet insurance for dogs, you gain peace of mind knowing that many of these costs will be covered under your policy, allowing you to focus on your dog's recovery rather than worrying about how to pay for its care.

Choosing the right pet insurance for dogs involves evaluating several factors to ensure comprehensive protection tailored to your specific needs. First, consider the types of coverage available. Most policies offer accident-only plans, which cover injuries sustained in accidents, and more comprehensive plans that include both accidents and illnesses. Depending on your dog's age, breed, and lifestyle, one type of coverage might suit you better than another. For example, younger, active dogs who frequently engage in outdoor activities may benefit more from comprehensive coverage given their higher risk of injury or illness.

Another critical aspect is understanding deductibles, reimbursement rates, and annual limits. Deductibles represent the amount you must pay out-of-pocket before the insurance kicks in. Reimbursement rates dictate what percentage of eligible costs the insurer will cover after meeting the deductible. Annual limits set caps on how much the insurance company will pay towards veterinary expenses within a year. These elements directly affect the affordability and effectiveness of your chosen plan, so it's important to compare different options carefully.

Additionally, review exclusions and pre-existing condition clauses in potential pet insurance for dogs plans. Some insurers exclude certain hereditary or congenital conditions based on your dog's breed. Others may not cover treatments related to pre-existing conditions diagnosed prior to purchasing the policy. Being aware of these limitations allows you to make realistic assessments of what situations the insurance will actually address.

Once you've selected a suitable pet insurance for dogs plan, maintaining it properly ensures continued benefits throughout your dog's life. Regularly updating your policy information, such as changes in address or contact details, prevents disruptions in service. Keeping accurate records of all veterinary visits and procedures performed under the policy facilitates smoother claims processing. Moreover, staying proactive about your dog's preventive healthcare—like vaccinations, parasite control, and routine check-ups—not only promotes overall well-being but may also reduce future claims likelihood, keeping premiums manageable.

Beyond traditional pet insurance for dogs, alternative solutions exist that cater to specific preferences or budget constraints. Accident-only policies provide basic yet affordable coverage focusing solely on injuries resulting from accidents. Wellness packages supplement standard insurance by covering routine care services like dental cleanings, spaying/neutering, and wellness exams. Bundling multiple offerings together sometimes results in discounted rates compared to purchasing them separately. Exploring these alternatives alongside conventional plans enables customization according to individual priorities and financial capabilities.

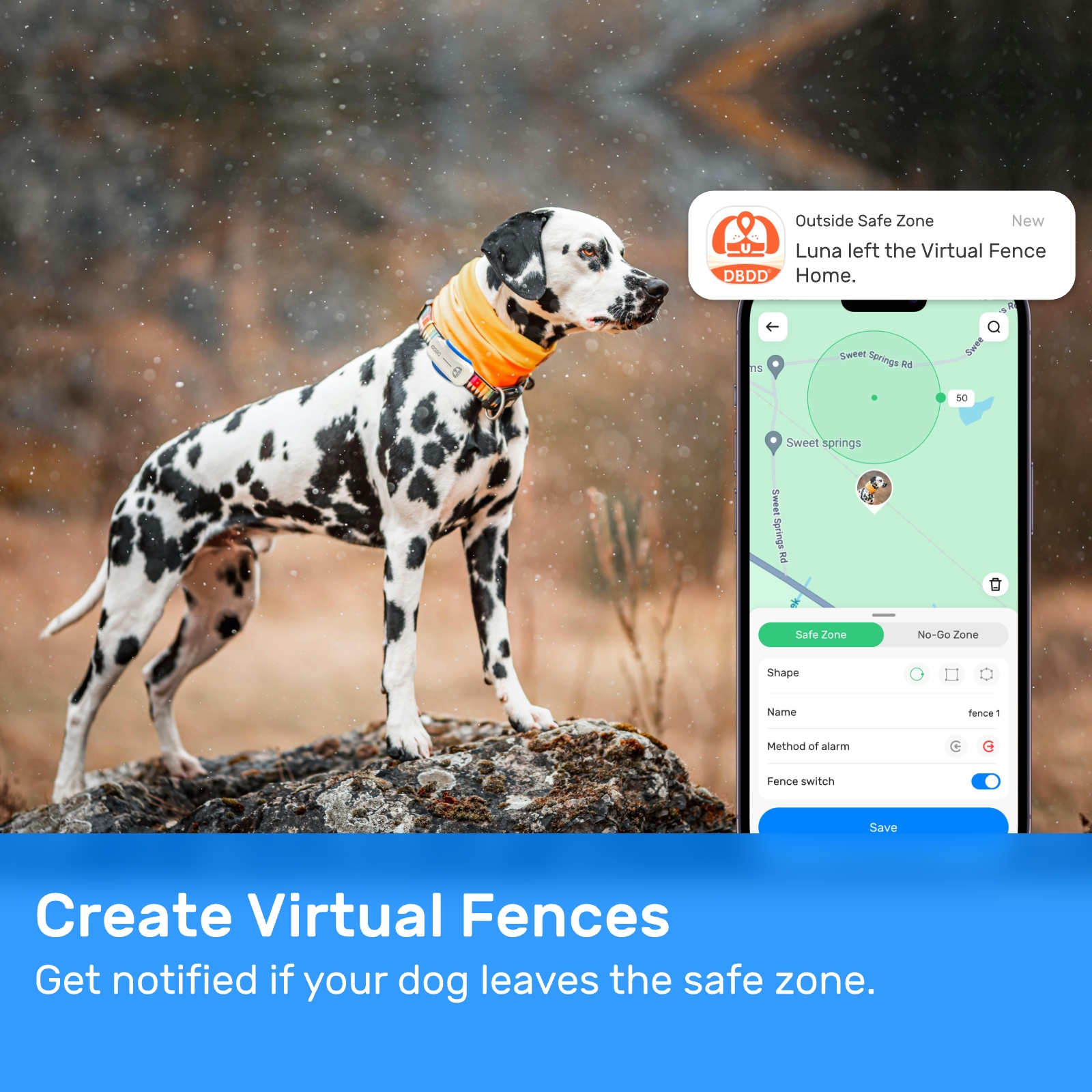

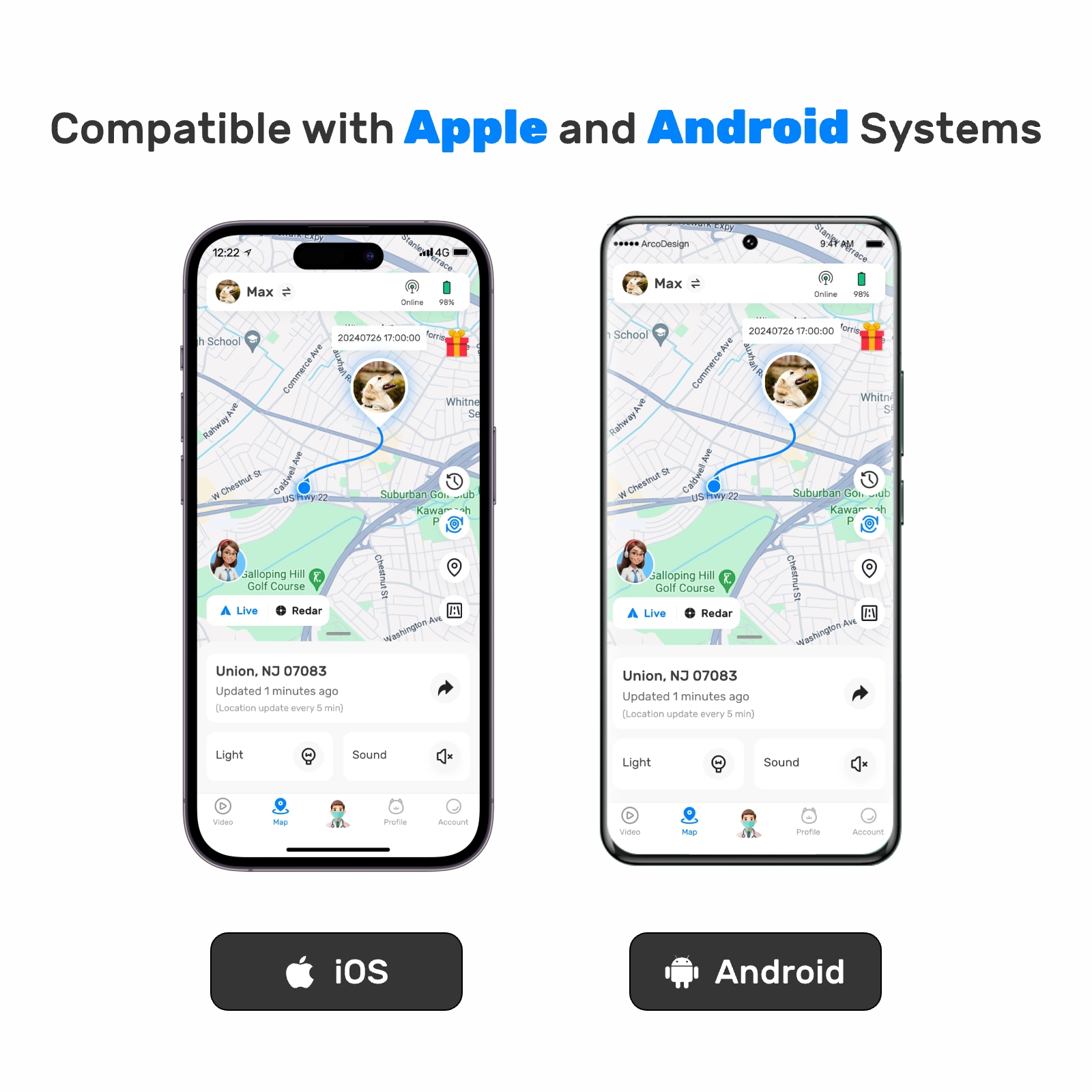

Implementing additional safety measures alongside pet insurance for dogs enhances overall protection during outdoor adventures. Always keep identification tags updated with current contact information attached securely to your dog's collar. Microchipping provides further assurance should your dog get lost since shelters and veterinarians routinely scan found animals for microchip data linking back to owners. Equipping your dog with proper gear like harnesses, leashes, and protective boots minimizes injury risks associated with rough terrains or extreme weather conditions.

Educating yourself about first aid basics equips you to handle minor emergencies effectively until reaching professional help. Carrying a portable pet first aid kit containing essentials like bandages, antiseptic wipes, tweezers, and styptic powder proves invaluable in addressing small cuts, splinters, or bleeding incidents immediately. Familiarizing yourself with local emergency veterinary facilities' locations and operating hours prepares you ahead of time should urgent situations arise requiring immediate attention outside regular office hours.

In conclusion, prioritizing outdoor pet safety through thoughtful planning and appropriate safeguards benefits both you and your canine companion immensely. Investing in reliable pet insurance for dogs offers substantial advantages by mitigating financial burdens tied to unexpected veterinary costs stemming from outdoor-related mishaps. Coupled with practical precautions and education regarding potential hazards, this holistic approach fosters a secure environment conducive to enjoyable, worry-free outdoor experiences shared between humans and their beloved pets. Remember, preparedness equals prevention; taking steps now secures lasting happiness and health for years ahead.

Update Time:2025-05-15 06:04:51

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form