New ArrivalsBack in stock

doge price

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D311619761 second hand :D311619761 |

Manufacturer | doge price | release date | 2025-05-15 | List price | $45 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | doge price | ||||||||

| category | |||||||||

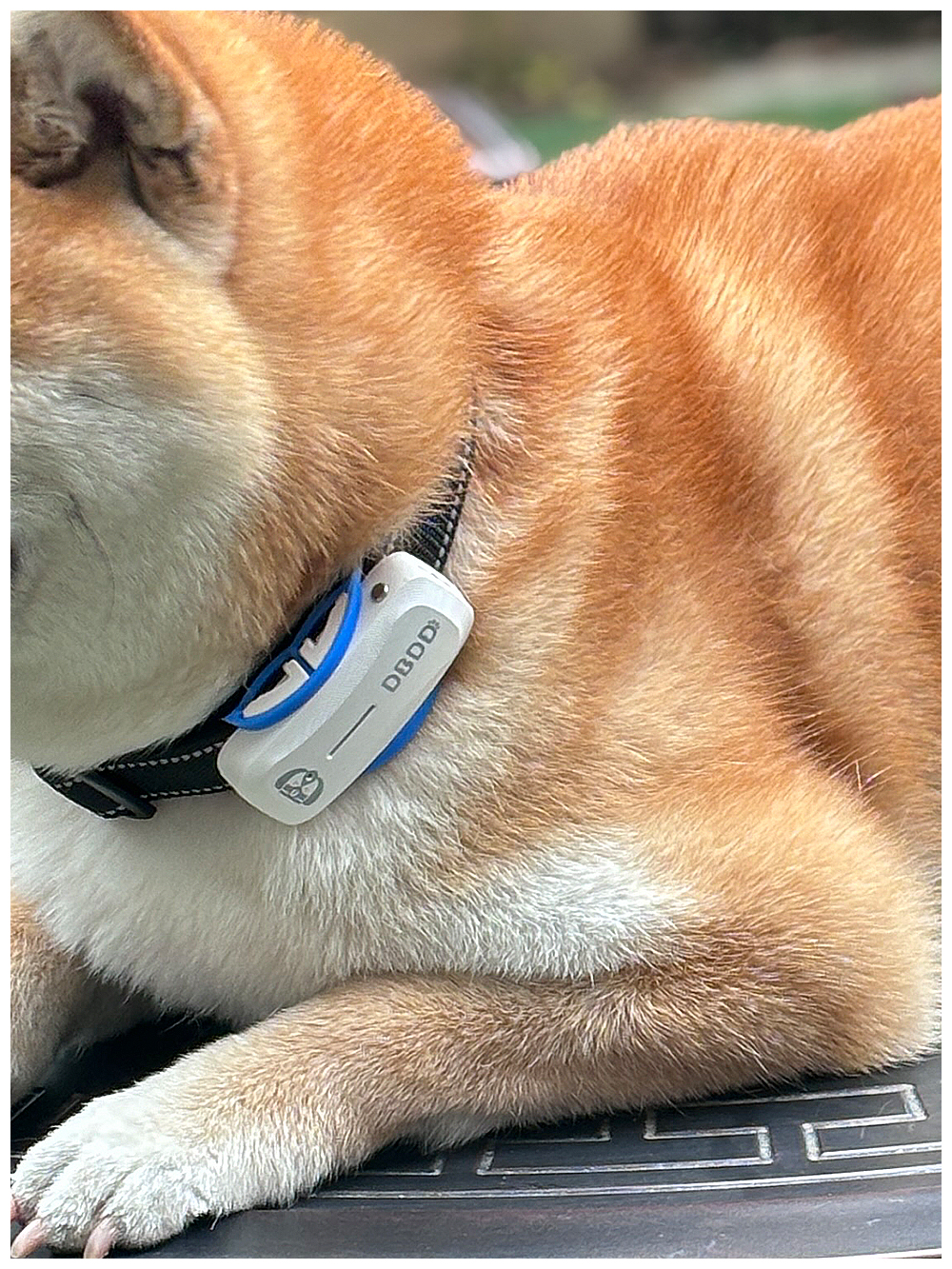

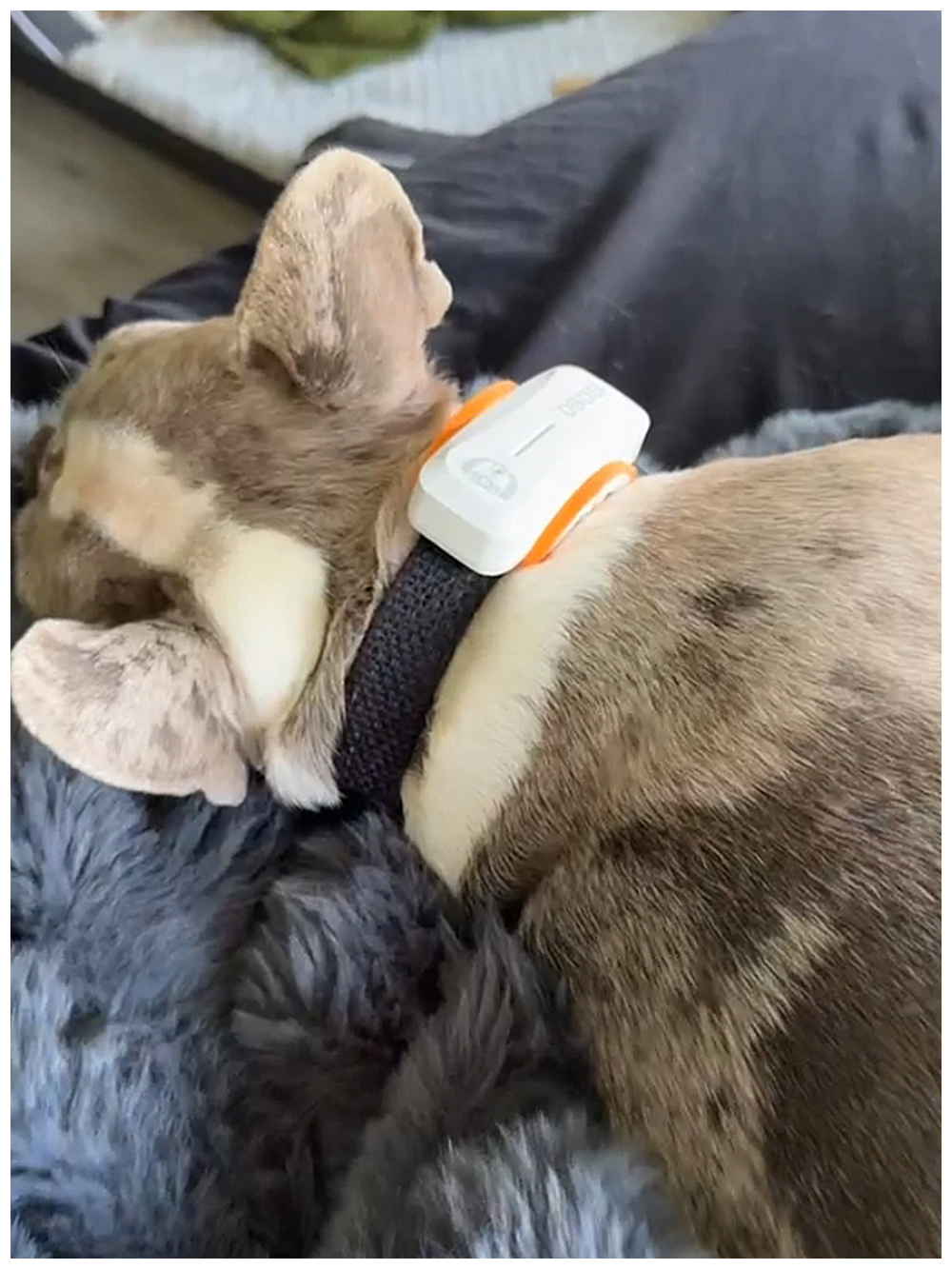

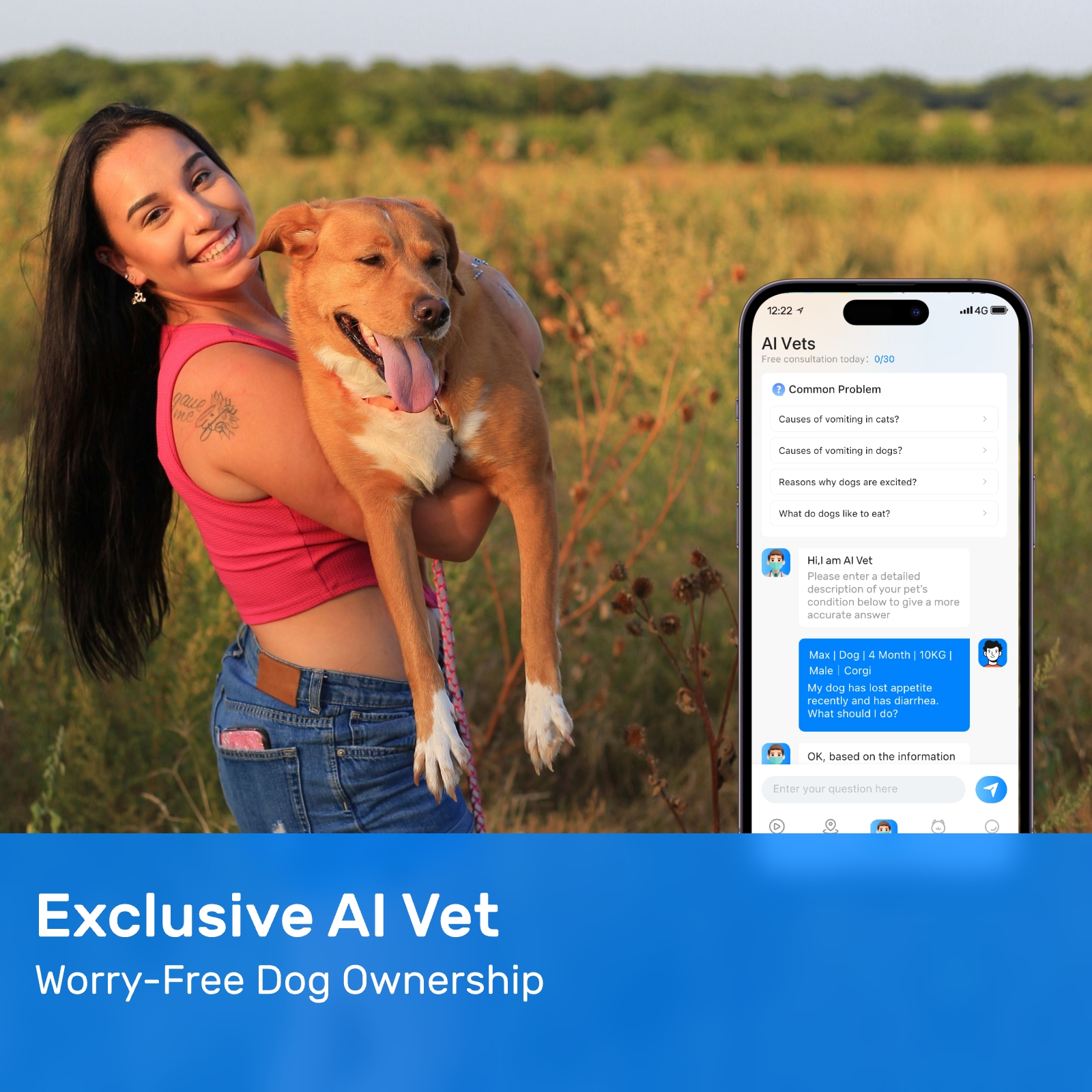

Travel Accessories#Pet Journey Safety

Doge price has become a fascinating topic for many investors and cryptocurrency enthusiasts over the past few years. As one of the most popular meme-based cryptocurrencies, Dogecoin (DOGE) started as a joke but quickly gained traction in the crypto community. Its rise from obscurity to prominence is nothing short of remarkable. This article will explore the factors influencing doge price, its historical journey, and what the future might hold for this beloved digital asset.

Dogecoin was created in December 2013 by software engineers Billy Markus and Jackson Palmer. Initially intended as a parody of Bitcoin and other serious cryptocurrencies, DOGE adopted the image of the Shiba Inu dog from the viral "Doge" meme as its logo. Despite its humorous origins, Dogecoin quickly attracted a loyal following. The community-driven nature of DOGE set it apart from more traditional cryptocurrencies, fostering an inclusive environment that resonated with users worldwide.

One of the key drivers behind the fluctuations in doge price is social media influence. Platforms like Twitter, Reddit, and TikTok have played significant roles in shaping public perception and demand for DOGE. Notably, high-profile figures such as Elon Musk, CEO of Tesla and SpaceX, have frequently mentioned Dogecoin on their social media accounts. These mentions often lead to spikes in doge price as retail investors flock to buy the coin based on Musk's endorsement. For instance, during one of his appearances on Saturday Night Live in May 2021, Musk joked about Dogecoin being the future of currency, causing a dramatic surge followed by a sharp decline in its value.

Another factor affecting doge price is market sentiment. Cryptocurrency markets are notoriously volatile, and DOGE is no exception. Traders and investors closely monitor news, trends, and technical indicators to predict potential price movements. When positive news emerges—such as partnerships or upgrades to the Dogecoin network—it can drive up the doge price. Conversely, negative developments, such as regulatory crackdowns or unfavorable comments from influential personalities, may cause the price to plummet.

The supply mechanism of Dogecoin also plays a crucial role in determining its price. Unlike Bitcoin, which has a capped supply of 21 million coins, Dogecoin has an uncapped supply. This means that new DOGE tokens are continuously mined, potentially leading to inflationary pressures. However, proponents argue that the unlimited supply helps keep transaction fees low, making it more accessible for microtransactions. The abundance of DOGE in circulation contributes to its affordability compared to other cryptocurrencies, allowing even small investors to participate in the market. Despite this, the sheer volume of available tokens sometimes raises concerns among analysts regarding long-term sustainability and impact on doge price.

Historically, Dogecoin experienced several notable price surges. In early 2021, fueled by growing interest in cryptocurrencies and increased adoption, DOGE saw unprecedented gains. From trading at less than $0.01 per coin at the start of the year, it reached an all-time high of approximately $0.74 in May 2021. During this period, doge price became a hot topic in financial circles, with many speculating whether DOGE could maintain its upward trajectory. Unfortunately, the rally proved unsustainable, and prices subsequently corrected, settling at much lower levels by the end of 2021.

Despite these fluctuations, Dogecoin continues to hold significance within the broader cryptocurrency ecosystem. It serves as a reminder of how grassroots movements and community engagement can shape the success of digital assets. Moreover, DOGE's utility extends beyond mere speculation. Many charitable organizations accept donations in Dogecoin, leveraging its low transaction costs to facilitate global giving. Additionally, some merchants now accept DOGE as payment, further expanding its real-world applications.

Looking ahead, several factors could influence the future of doge price. First, technological advancements within the Dogecoin network may enhance its appeal. Developers are continually working on improving scalability, security, and functionality to make DOGE more competitive against other cryptocurrencies. Second, institutional adoption could play a pivotal role in stabilizing and increasing the doge price. If large corporations or financial institutions begin embracing DOGE, it could attract greater legitimacy and stability to the asset. Lastly, government regulations will undoubtedly affect the trajectory of doge price. Stricter oversight or bans in certain countries could hinder growth, while supportive policies might foster expansion.

Investors should approach doge price with caution due to its inherent volatility. While past performance does not guarantee future results, understanding the underlying dynamics driving DOGE's value can help inform investment decisions. Diversification remains critical when allocating resources to cryptocurrencies, ensuring that exposure to any single asset—including Dogecoin—is balanced against risk tolerance and financial goals.

In conclusion, doge price represents a captivating narrative in the world of cryptocurrencies. What began as a lighthearted experiment evolved into a major player in the digital currency landscape. Driven by social media hype, community support, and occasional celebrity endorsements, DOGE continues to captivate audiences globally. Although challenges remain concerning regulation, scalability, and sustainability, the enduring spirit of Dogecoin ensures that it will remain a relevant conversation piece in the crypto space. Whether you're a seasoned trader or simply curious about blockchain technology, keeping an eye on doge price offers valuable insights into the ever-changing dynamics of the cryptocurrency market.

Update Time:2025-05-15 06:09:33

Dogecoin was created in December 2013 by software engineers Billy Markus and Jackson Palmer. Initially intended as a parody of Bitcoin and other serious cryptocurrencies, DOGE adopted the image of the Shiba Inu dog from the viral "Doge" meme as its logo. Despite its humorous origins, Dogecoin quickly attracted a loyal following. The community-driven nature of DOGE set it apart from more traditional cryptocurrencies, fostering an inclusive environment that resonated with users worldwide.

One of the key drivers behind the fluctuations in doge price is social media influence. Platforms like Twitter, Reddit, and TikTok have played significant roles in shaping public perception and demand for DOGE. Notably, high-profile figures such as Elon Musk, CEO of Tesla and SpaceX, have frequently mentioned Dogecoin on their social media accounts. These mentions often lead to spikes in doge price as retail investors flock to buy the coin based on Musk's endorsement. For instance, during one of his appearances on Saturday Night Live in May 2021, Musk joked about Dogecoin being the future of currency, causing a dramatic surge followed by a sharp decline in its value.

Another factor affecting doge price is market sentiment. Cryptocurrency markets are notoriously volatile, and DOGE is no exception. Traders and investors closely monitor news, trends, and technical indicators to predict potential price movements. When positive news emerges—such as partnerships or upgrades to the Dogecoin network—it can drive up the doge price. Conversely, negative developments, such as regulatory crackdowns or unfavorable comments from influential personalities, may cause the price to plummet.

The supply mechanism of Dogecoin also plays a crucial role in determining its price. Unlike Bitcoin, which has a capped supply of 21 million coins, Dogecoin has an uncapped supply. This means that new DOGE tokens are continuously mined, potentially leading to inflationary pressures. However, proponents argue that the unlimited supply helps keep transaction fees low, making it more accessible for microtransactions. The abundance of DOGE in circulation contributes to its affordability compared to other cryptocurrencies, allowing even small investors to participate in the market. Despite this, the sheer volume of available tokens sometimes raises concerns among analysts regarding long-term sustainability and impact on doge price.

Historically, Dogecoin experienced several notable price surges. In early 2021, fueled by growing interest in cryptocurrencies and increased adoption, DOGE saw unprecedented gains. From trading at less than $0.01 per coin at the start of the year, it reached an all-time high of approximately $0.74 in May 2021. During this period, doge price became a hot topic in financial circles, with many speculating whether DOGE could maintain its upward trajectory. Unfortunately, the rally proved unsustainable, and prices subsequently corrected, settling at much lower levels by the end of 2021.

Despite these fluctuations, Dogecoin continues to hold significance within the broader cryptocurrency ecosystem. It serves as a reminder of how grassroots movements and community engagement can shape the success of digital assets. Moreover, DOGE's utility extends beyond mere speculation. Many charitable organizations accept donations in Dogecoin, leveraging its low transaction costs to facilitate global giving. Additionally, some merchants now accept DOGE as payment, further expanding its real-world applications.

Looking ahead, several factors could influence the future of doge price. First, technological advancements within the Dogecoin network may enhance its appeal. Developers are continually working on improving scalability, security, and functionality to make DOGE more competitive against other cryptocurrencies. Second, institutional adoption could play a pivotal role in stabilizing and increasing the doge price. If large corporations or financial institutions begin embracing DOGE, it could attract greater legitimacy and stability to the asset. Lastly, government regulations will undoubtedly affect the trajectory of doge price. Stricter oversight or bans in certain countries could hinder growth, while supportive policies might foster expansion.

Investors should approach doge price with caution due to its inherent volatility. While past performance does not guarantee future results, understanding the underlying dynamics driving DOGE's value can help inform investment decisions. Diversification remains critical when allocating resources to cryptocurrencies, ensuring that exposure to any single asset—including Dogecoin—is balanced against risk tolerance and financial goals.

In conclusion, doge price represents a captivating narrative in the world of cryptocurrencies. What began as a lighthearted experiment evolved into a major player in the digital currency landscape. Driven by social media hype, community support, and occasional celebrity endorsements, DOGE continues to captivate audiences globally. Although challenges remain concerning regulation, scalability, and sustainability, the enduring spirit of Dogecoin ensures that it will remain a relevant conversation piece in the crypto space. Whether you're a seasoned trader or simply curious about blockchain technology, keeping an eye on doge price offers valuable insights into the ever-changing dynamics of the cryptocurrency market.

Update Time:2025-05-15 06:09:33

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form