New ArrivalsBack in stock

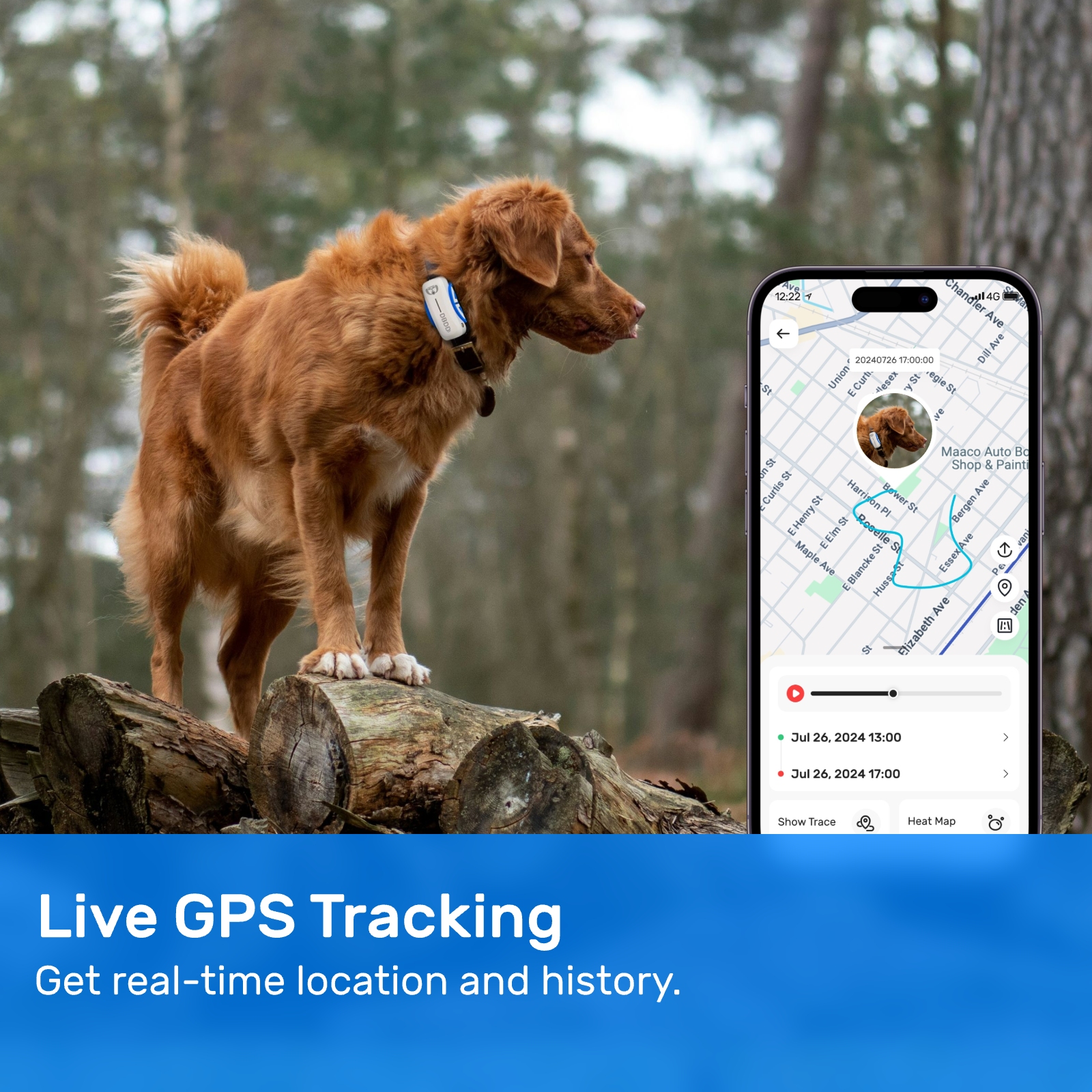

fi tracker

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D235398564 second hand :D235398564 |

Manufacturer | fi tracker | release date | 2025-05-15 | List price | $36 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | fi tracker | ||||||||

| category | |||||||||

5G Applications#Low-Latency Trackers

In the ever-evolving landscape of personal finance and investment tracking, technology has taken a front seat in providing tools that simplify and streamline the process of managing one's finances. Among the various applications and software available, the term "FI Tracker" has emerged as a significant player in this space, catering to individuals who are on the path to financial independence (FI). This article delves into what an FI Tracker is, its features, benefits, and how it can be a game-changer for those seeking to achieve financial goals.

An FI Tracker, short for Financial Independence Tracker, is a specialized software or application designed to help users monitor and manage their journey towards financial independence. Financial independence is a state where one has enough savings and investments to cover their living expenses without the need for a regular job. This concept has gained traction among millennials and Gen Z, who are increasingly seeking alternative paths to traditional employment.

The primary function of an FI Tracker is to provide a comprehensive overview of an individual's net worth, savings rates, and investment growth. By tracking these metrics, users can make informed decisions about their spending, saving, and investing habits, which are crucial for achieving financial independence.

One of the key features of an FI Tracker is its ability to aggregate data from multiple sources. Users can link their bank accounts, investment portfolios, and credit cards to the tracker, allowing it to provide a real-time snapshot of their financial health. This centralized view helps users understand their cash flow, identify areas of overspending, and optimize their savings strategies.

Another important aspect of an FI Tracker is its goal-setting capabilities. Users can input their target savings, desired retirement age, and other financial goals, and the tracker will provide a roadmap to achieve these objectives. This includes projections on how much they need to save monthly, the rate of return required from their investments, and the potential impact of lifestyle changes on their financial independence timeline.

The benefits of using an FI Tracker are manifold. For starters, it offers a clear and organized way to monitor progress towards financial independence. By having all financial data in one place, users can quickly identify trends, potential risks, and opportunities for improvement. This transparency is crucial for maintaining motivation and staying on track with financial goals.

Moreover, an FI Tracker can help users visualize their financial future. By inputting various scenarios, such as changes in income, investment returns, or living expenses, users can see how these factors might impact their path to financial independence. This foresight allows for proactive planning and adjustments to financial strategies.

In terms of financial planning, an FI Tracker can be an invaluable tool. It can calculate the time it will take to reach financial independence based on current savings and investment rates. This calculation can be adjusted based on changes in lifestyle, such as cutting expenses or increasing income, providing a flexible and dynamic financial plan.

For those who are new to investing or have a complex financial portfolio, an FI Tracker can serve as a guide. It can provide insights into the performance of different investment vehicles, help diversify portfolios, and suggest asset allocation strategies that align with users' risk tolerance and financial goals.

Privacy and security are also considerations when choosing an FI Tracker. Reputable trackers prioritize user data protection, employing robust encryption and secure data handling practices. Users should research and select a tracker that meets their privacy needs and has a track record of safeguarding sensitive financial information.

As technology continues to advance, so too do the capabilities of FI Trackers. Some advanced features include automated financial planning, machine learning algorithms to predict market trends, and integration with other financial tools for a seamless financial management experience.

In conclusion, an FI Tracker is a powerful tool for individuals serious about achieving financial independence. It offers a centralized platform for managing finances, setting and tracking goals, and making informed decisions about investments and spending. By leveraging the features of an FI Tracker, users can take control of their financial future, navigate the complexities of personal finance, and work towards a future where they are no longer reliant on traditional employment for financial security. As the pursuit of financial independence becomes more prevalent, the role of FI Trackers in supporting this journey will only grow in importance.

Update Time:2025-05-15 06:19:54

An FI Tracker, short for Financial Independence Tracker, is a specialized software or application designed to help users monitor and manage their journey towards financial independence. Financial independence is a state where one has enough savings and investments to cover their living expenses without the need for a regular job. This concept has gained traction among millennials and Gen Z, who are increasingly seeking alternative paths to traditional employment.

The primary function of an FI Tracker is to provide a comprehensive overview of an individual's net worth, savings rates, and investment growth. By tracking these metrics, users can make informed decisions about their spending, saving, and investing habits, which are crucial for achieving financial independence.

One of the key features of an FI Tracker is its ability to aggregate data from multiple sources. Users can link their bank accounts, investment portfolios, and credit cards to the tracker, allowing it to provide a real-time snapshot of their financial health. This centralized view helps users understand their cash flow, identify areas of overspending, and optimize their savings strategies.

Another important aspect of an FI Tracker is its goal-setting capabilities. Users can input their target savings, desired retirement age, and other financial goals, and the tracker will provide a roadmap to achieve these objectives. This includes projections on how much they need to save monthly, the rate of return required from their investments, and the potential impact of lifestyle changes on their financial independence timeline.

The benefits of using an FI Tracker are manifold. For starters, it offers a clear and organized way to monitor progress towards financial independence. By having all financial data in one place, users can quickly identify trends, potential risks, and opportunities for improvement. This transparency is crucial for maintaining motivation and staying on track with financial goals.

Moreover, an FI Tracker can help users visualize their financial future. By inputting various scenarios, such as changes in income, investment returns, or living expenses, users can see how these factors might impact their path to financial independence. This foresight allows for proactive planning and adjustments to financial strategies.

In terms of financial planning, an FI Tracker can be an invaluable tool. It can calculate the time it will take to reach financial independence based on current savings and investment rates. This calculation can be adjusted based on changes in lifestyle, such as cutting expenses or increasing income, providing a flexible and dynamic financial plan.

For those who are new to investing or have a complex financial portfolio, an FI Tracker can serve as a guide. It can provide insights into the performance of different investment vehicles, help diversify portfolios, and suggest asset allocation strategies that align with users' risk tolerance and financial goals.

Privacy and security are also considerations when choosing an FI Tracker. Reputable trackers prioritize user data protection, employing robust encryption and secure data handling practices. Users should research and select a tracker that meets their privacy needs and has a track record of safeguarding sensitive financial information.

As technology continues to advance, so too do the capabilities of FI Trackers. Some advanced features include automated financial planning, machine learning algorithms to predict market trends, and integration with other financial tools for a seamless financial management experience.

In conclusion, an FI Tracker is a powerful tool for individuals serious about achieving financial independence. It offers a centralized platform for managing finances, setting and tracking goals, and making informed decisions about investments and spending. By leveraging the features of an FI Tracker, users can take control of their financial future, navigate the complexities of personal finance, and work towards a future where they are no longer reliant on traditional employment for financial security. As the pursuit of financial independence becomes more prevalent, the role of FI Trackers in supporting this journey will only grow in importance.

Update Time:2025-05-15 06:19:54

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form