New ArrivalsBack in stock

dog insurance

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D900074301 second hand :D900074301 |

Manufacturer | dog insurance | release date | 2025-05-15 | List price | $43 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | dog insurance | ||||||||

| category | |||||||||

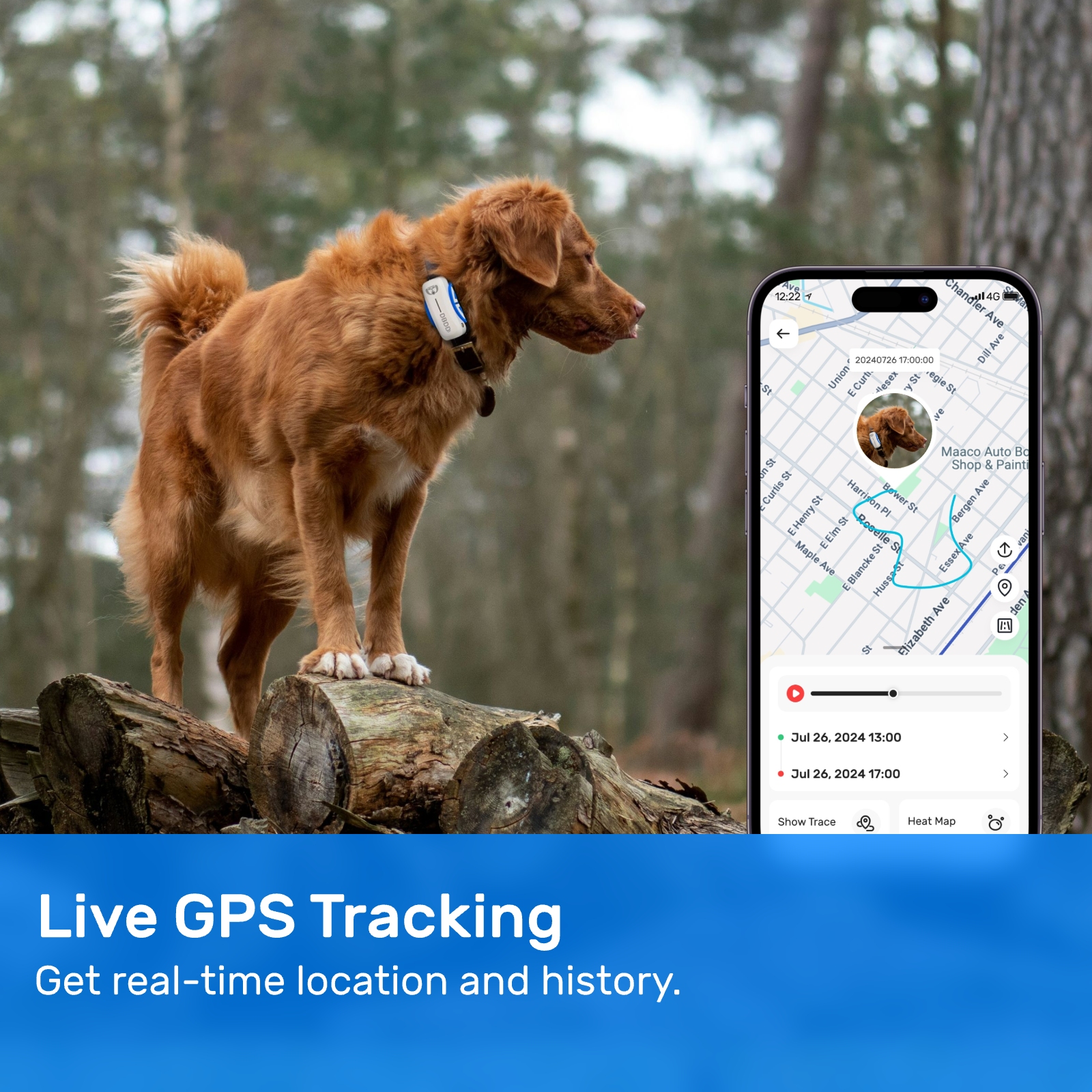

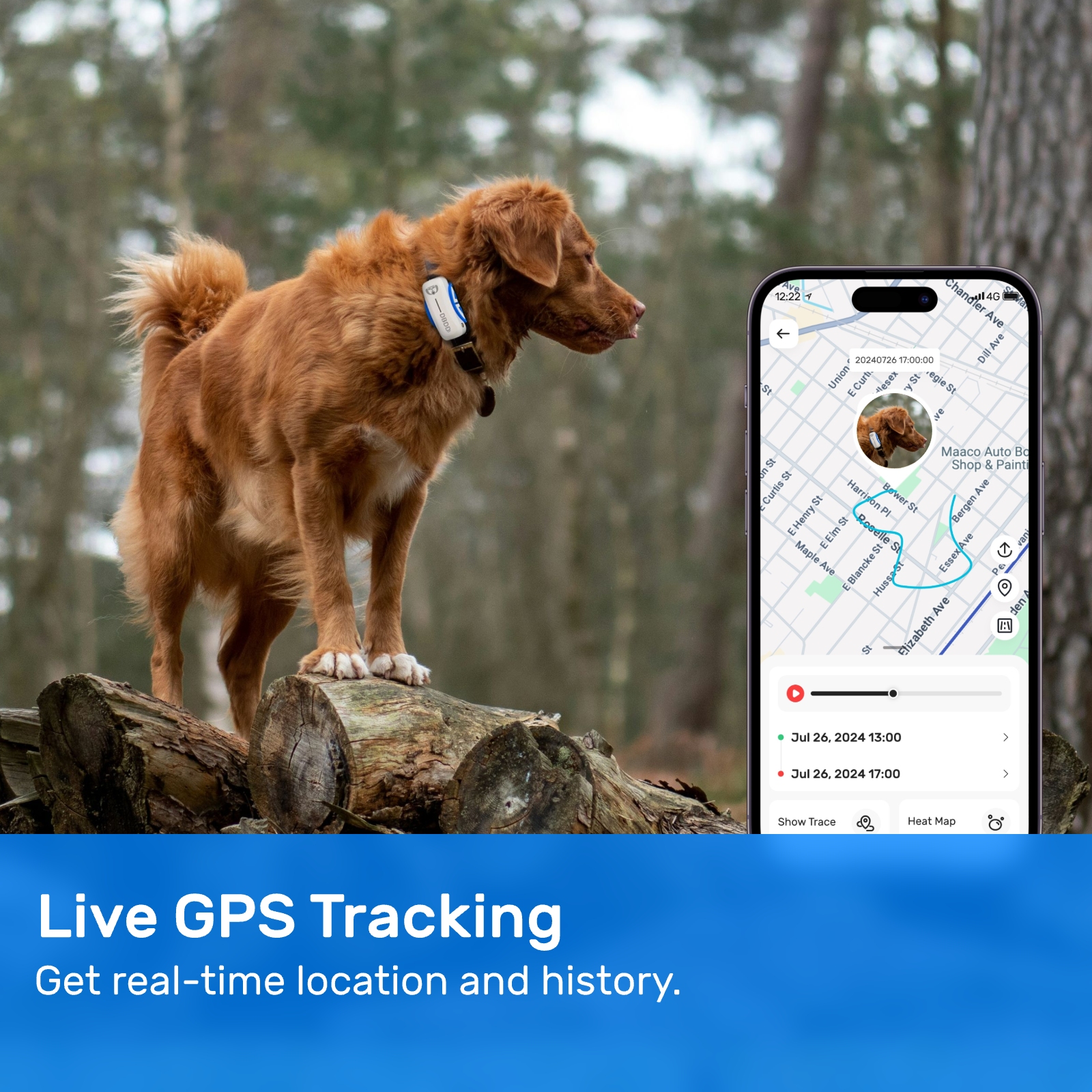

Satellite Tech#Global Positioning Modules

Dog insurance has become an increasingly popular option for pet owners who want to ensure their furry friends receive the best possible care. As veterinary costs continue to rise, many people are turning to dog insurance as a way to manage unexpected expenses and provide peace of mind. This article will explore the benefits, types, and considerations when choosing a dog insurance plan.

Firstly, let's understand what dog insurance entails. Dog insurance is a type of pet insurance that covers medical expenses related to accidents, illnesses, surgeries, and sometimes even routine care. The primary goal of this insurance is to alleviate financial stress in situations where your dog requires extensive or emergency treatment. Unlike human health insurance, dog insurance plans typically reimburse you after you pay the vet bill directly. This means that policyholders submit claims with receipts to the insurance company, which then processes and reimburses according to the terms of the policy.

One of the most significant advantages of dog insurance is its ability to cover unexpected veterinary costs. Accidents happen, and dogs can develop health issues without warning. Without insurance, these emergencies could result in hefty out-of-pocket expenses. For example, if your dog ingests something toxic or suffers from a broken bone, the cost of treatment might range from hundreds to thousands of dollars. With dog insurance, you can rest assured knowing that a portion of these costs will be covered, allowing you to focus on your dog's recovery rather than worrying about finances.

There are several types of dog insurance policies available, each catering to different needs and budgets. Basic plans usually cover accidents and illnesses but exclude preventive care such as vaccinations, dental cleanings, and spaying/neutering. On the other hand, comprehensive plans offer broader coverage, including wellness services like annual check-ups, flea and tick prevention, and dietary supplements. Some insurers also offer optional add-ons, such as coverage for hereditary conditions, behavioral therapy, or alternative treatments like acupuncture.

When selecting a dog insurance provider, it's essential to compare various plans and read the fine print carefully. Factors to consider include deductibles, co-pays, reimbursement rates, and exclusions. Deductibles represent the amount you must pay before the insurance kicks in, while co-pays refer to the percentage of costs you're responsible for after the deductible is met. Reimbursement rates determine how much of the remaining bill the insurer will cover—common percentages range from 70% to 90%. It's crucial to evaluate these components alongside premium costs to find a balance that fits your budget and meets your dog's potential healthcare needs.

Another important consideration is whether the policy excludes pre-existing conditions. Most dog insurance plans do not cover ailments that were diagnosed or treated before enrollment. Therefore, enrolling your dog at a younger age is often advantageous because it minimizes the likelihood of excluded conditions. Additionally, some breeds are predisposed to certain genetic disorders, so understanding breed-specific risks can help you choose a plan with appropriate coverage limits.

Cost is undoubtedly a critical factor when deciding on dog insurance. Premiums vary widely depending on factors such as the dog's age, breed, location, and the level of coverage desired. Generally, younger and healthier dogs incur lower premiums, whereas older or high-risk breeds may require higher payments. Location plays a role too; areas with higher veterinary costs tend to have more expensive premiums. Despite the upfront expense, many pet owners find that the long-term savings outweigh the cost, especially if their dog experiences multiple health issues over time.

It's worth noting that not all dog insurance plans are created equal. Some companies impose strict limitations on what they'll cover, while others boast flexible options tailored to individual preferences. To make an informed decision, research reputable providers by reading customer reviews and comparing features side-by-side. Questions to ask might include: Does the policy renew automatically? Are there caps on annual payouts or lifetime benefits? What is the claims process like?

In addition to traditional dog insurance, there are alternative solutions worth exploring. Pet discount programs, for instance, partner with veterinarians to offer reduced prices on services and procedures. While these programs don't function as true insurance, they can still save money on routine care and minor treatments. Another option is setting aside funds in a dedicated savings account specifically for pet-related expenses. This self-insurance method requires discipline but provides complete control over how the money is spent.

Despite its advantages, dog insurance isn't right for everyone. Owners whose dogs remain relatively healthy throughout their lives might view premiums as unnecessary expenditures. However, no one can predict the future, and even seemingly robust dogs can fall victim to unforeseen injuries or diseases. For those willing to invest in peace of mind, dog insurance represents a valuable safeguard against catastrophic veterinary bills.

To maximize the value of your dog insurance, stay proactive about your pet's health. Regular visits to the veterinarian, proper nutrition, exercise, and timely vaccinations contribute to overall well-being and reduce the likelihood of costly complications down the road. Furthermore, familiarize yourself with your policy details so you know exactly what's covered and how to file claims efficiently.

In conclusion, dog insurance serves as a practical tool for managing the financial aspects of pet ownership. By transferring some of the risk associated with veterinary care to an insurance provider, you can ensure your dog receives necessary treatments without compromising your household budget. Whether you opt for basic accident coverage or a comprehensive package encompassing wellness services, selecting the right plan involves careful evaluation of your dog's unique needs and your own financial situation. Ultimately, investing in dog insurance demonstrates a commitment to your pet's long-term health and happiness.

Update Time:2025-05-15 07:21:33

Firstly, let's understand what dog insurance entails. Dog insurance is a type of pet insurance that covers medical expenses related to accidents, illnesses, surgeries, and sometimes even routine care. The primary goal of this insurance is to alleviate financial stress in situations where your dog requires extensive or emergency treatment. Unlike human health insurance, dog insurance plans typically reimburse you after you pay the vet bill directly. This means that policyholders submit claims with receipts to the insurance company, which then processes and reimburses according to the terms of the policy.

One of the most significant advantages of dog insurance is its ability to cover unexpected veterinary costs. Accidents happen, and dogs can develop health issues without warning. Without insurance, these emergencies could result in hefty out-of-pocket expenses. For example, if your dog ingests something toxic or suffers from a broken bone, the cost of treatment might range from hundreds to thousands of dollars. With dog insurance, you can rest assured knowing that a portion of these costs will be covered, allowing you to focus on your dog's recovery rather than worrying about finances.

There are several types of dog insurance policies available, each catering to different needs and budgets. Basic plans usually cover accidents and illnesses but exclude preventive care such as vaccinations, dental cleanings, and spaying/neutering. On the other hand, comprehensive plans offer broader coverage, including wellness services like annual check-ups, flea and tick prevention, and dietary supplements. Some insurers also offer optional add-ons, such as coverage for hereditary conditions, behavioral therapy, or alternative treatments like acupuncture.

When selecting a dog insurance provider, it's essential to compare various plans and read the fine print carefully. Factors to consider include deductibles, co-pays, reimbursement rates, and exclusions. Deductibles represent the amount you must pay before the insurance kicks in, while co-pays refer to the percentage of costs you're responsible for after the deductible is met. Reimbursement rates determine how much of the remaining bill the insurer will cover—common percentages range from 70% to 90%. It's crucial to evaluate these components alongside premium costs to find a balance that fits your budget and meets your dog's potential healthcare needs.

Another important consideration is whether the policy excludes pre-existing conditions. Most dog insurance plans do not cover ailments that were diagnosed or treated before enrollment. Therefore, enrolling your dog at a younger age is often advantageous because it minimizes the likelihood of excluded conditions. Additionally, some breeds are predisposed to certain genetic disorders, so understanding breed-specific risks can help you choose a plan with appropriate coverage limits.

Cost is undoubtedly a critical factor when deciding on dog insurance. Premiums vary widely depending on factors such as the dog's age, breed, location, and the level of coverage desired. Generally, younger and healthier dogs incur lower premiums, whereas older or high-risk breeds may require higher payments. Location plays a role too; areas with higher veterinary costs tend to have more expensive premiums. Despite the upfront expense, many pet owners find that the long-term savings outweigh the cost, especially if their dog experiences multiple health issues over time.

It's worth noting that not all dog insurance plans are created equal. Some companies impose strict limitations on what they'll cover, while others boast flexible options tailored to individual preferences. To make an informed decision, research reputable providers by reading customer reviews and comparing features side-by-side. Questions to ask might include: Does the policy renew automatically? Are there caps on annual payouts or lifetime benefits? What is the claims process like?

In addition to traditional dog insurance, there are alternative solutions worth exploring. Pet discount programs, for instance, partner with veterinarians to offer reduced prices on services and procedures. While these programs don't function as true insurance, they can still save money on routine care and minor treatments. Another option is setting aside funds in a dedicated savings account specifically for pet-related expenses. This self-insurance method requires discipline but provides complete control over how the money is spent.

Despite its advantages, dog insurance isn't right for everyone. Owners whose dogs remain relatively healthy throughout their lives might view premiums as unnecessary expenditures. However, no one can predict the future, and even seemingly robust dogs can fall victim to unforeseen injuries or diseases. For those willing to invest in peace of mind, dog insurance represents a valuable safeguard against catastrophic veterinary bills.

To maximize the value of your dog insurance, stay proactive about your pet's health. Regular visits to the veterinarian, proper nutrition, exercise, and timely vaccinations contribute to overall well-being and reduce the likelihood of costly complications down the road. Furthermore, familiarize yourself with your policy details so you know exactly what's covered and how to file claims efficiently.

In conclusion, dog insurance serves as a practical tool for managing the financial aspects of pet ownership. By transferring some of the risk associated with veterinary care to an insurance provider, you can ensure your dog receives necessary treatments without compromising your household budget. Whether you opt for basic accident coverage or a comprehensive package encompassing wellness services, selecting the right plan involves careful evaluation of your dog's unique needs and your own financial situation. Ultimately, investing in dog insurance demonstrates a commitment to your pet's long-term health and happiness.

Update Time:2025-05-15 07:21:33

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form