New ArrivalsBack in stock

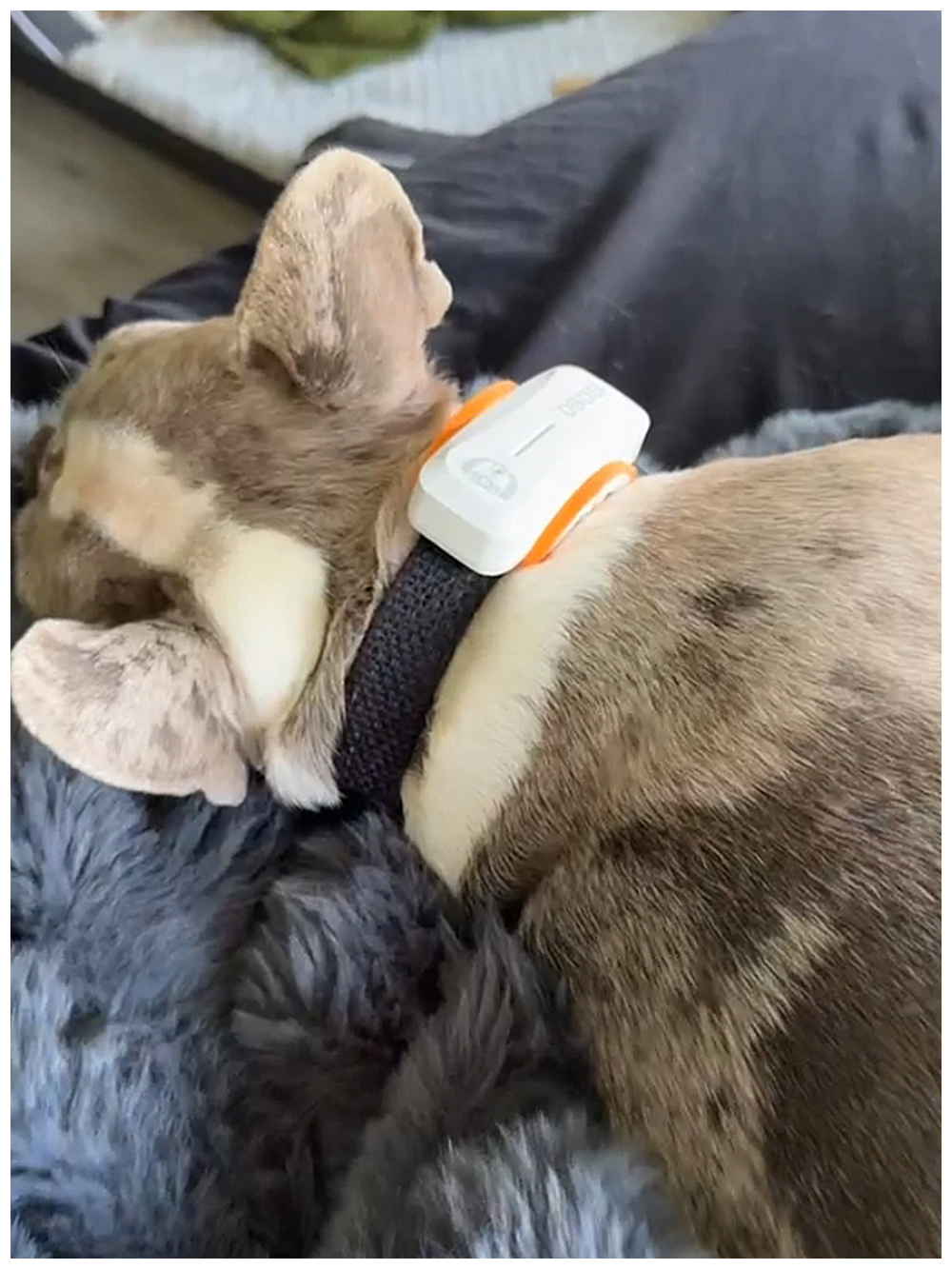

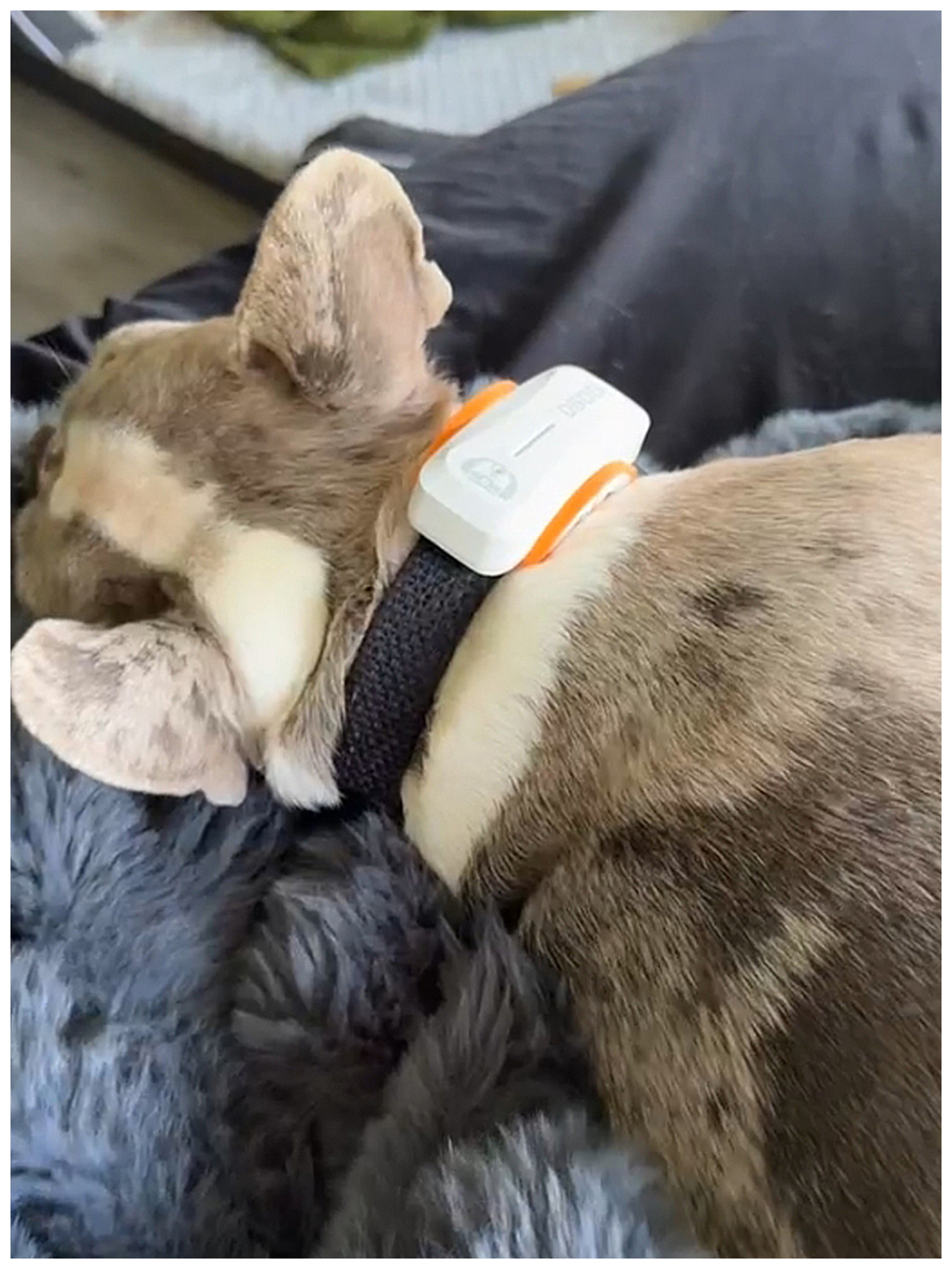

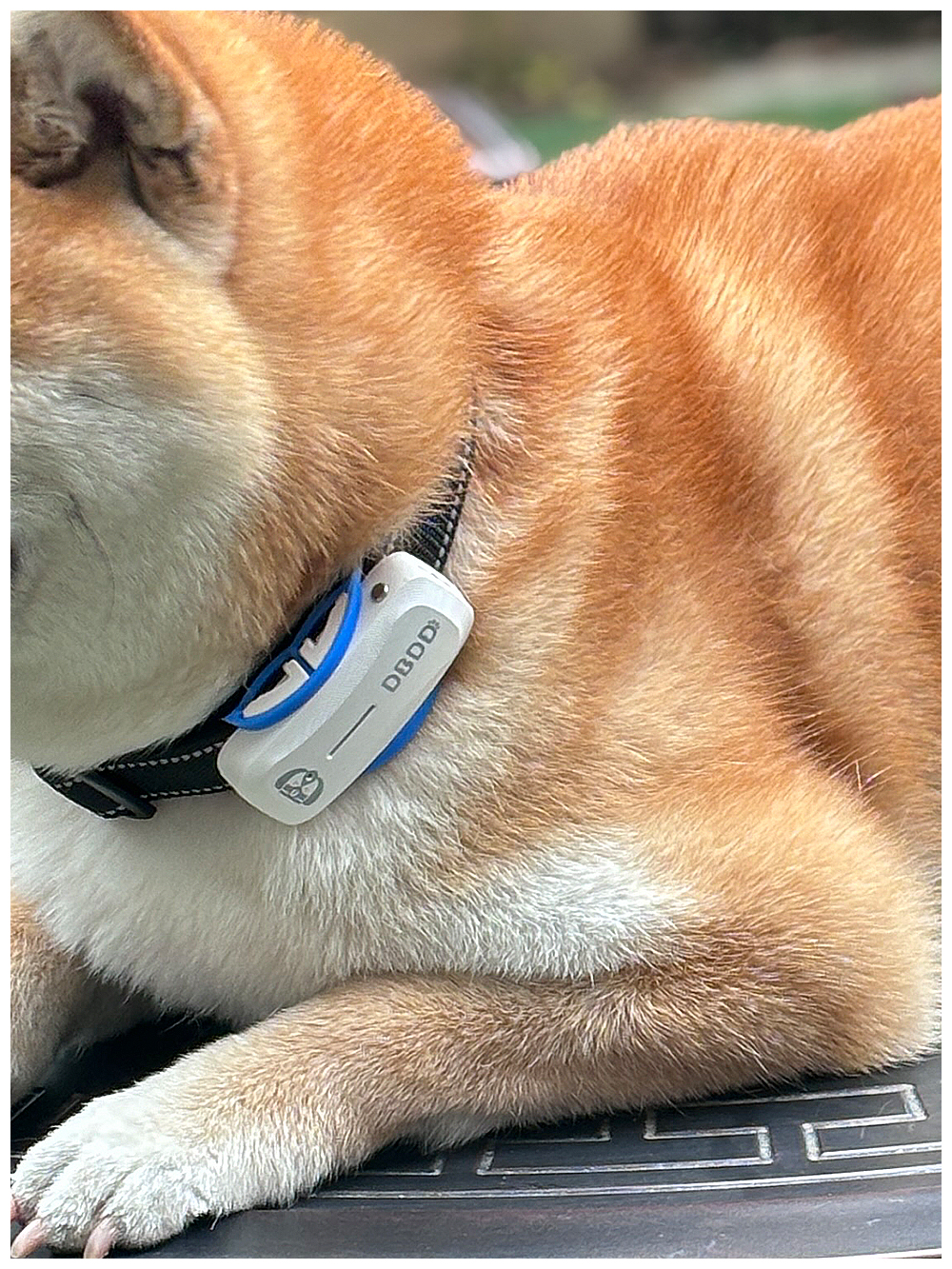

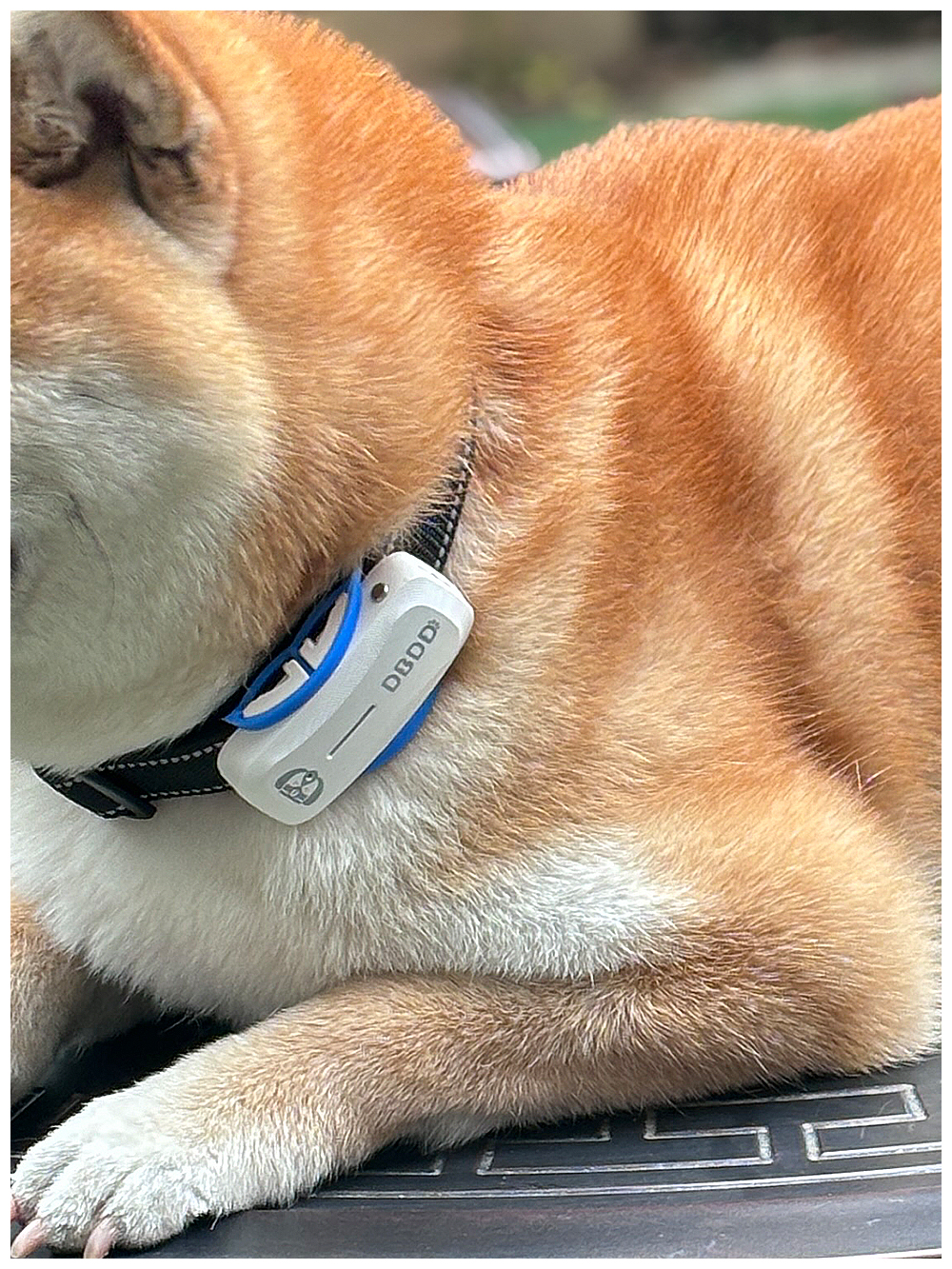

small dog breeds

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D301301758 second hand :D301301758 |

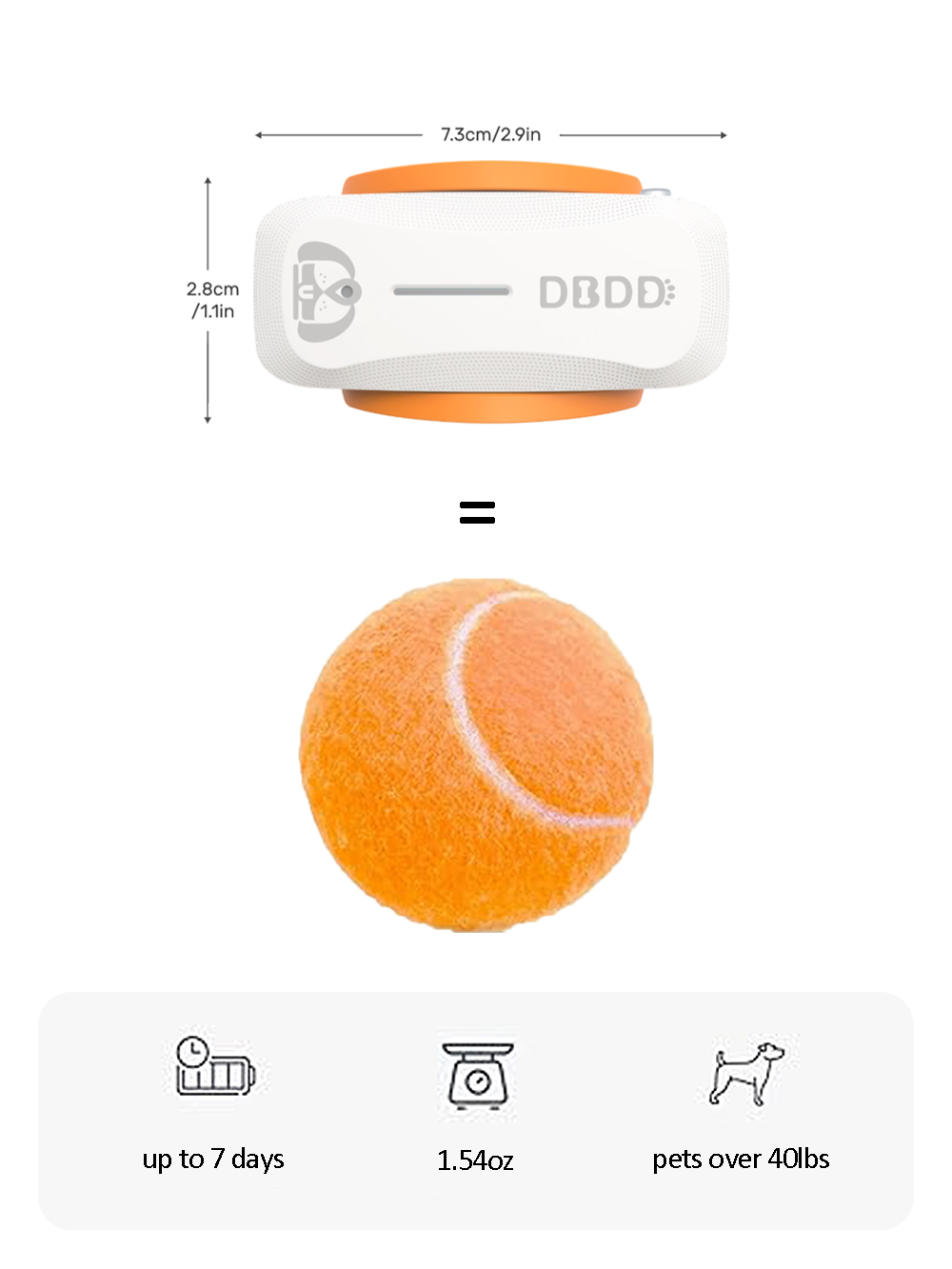

Manufacturer | small dog | release date | 2025-05-15 | List price | $40 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | dog breeds | ||||||||

| category | |||||||||

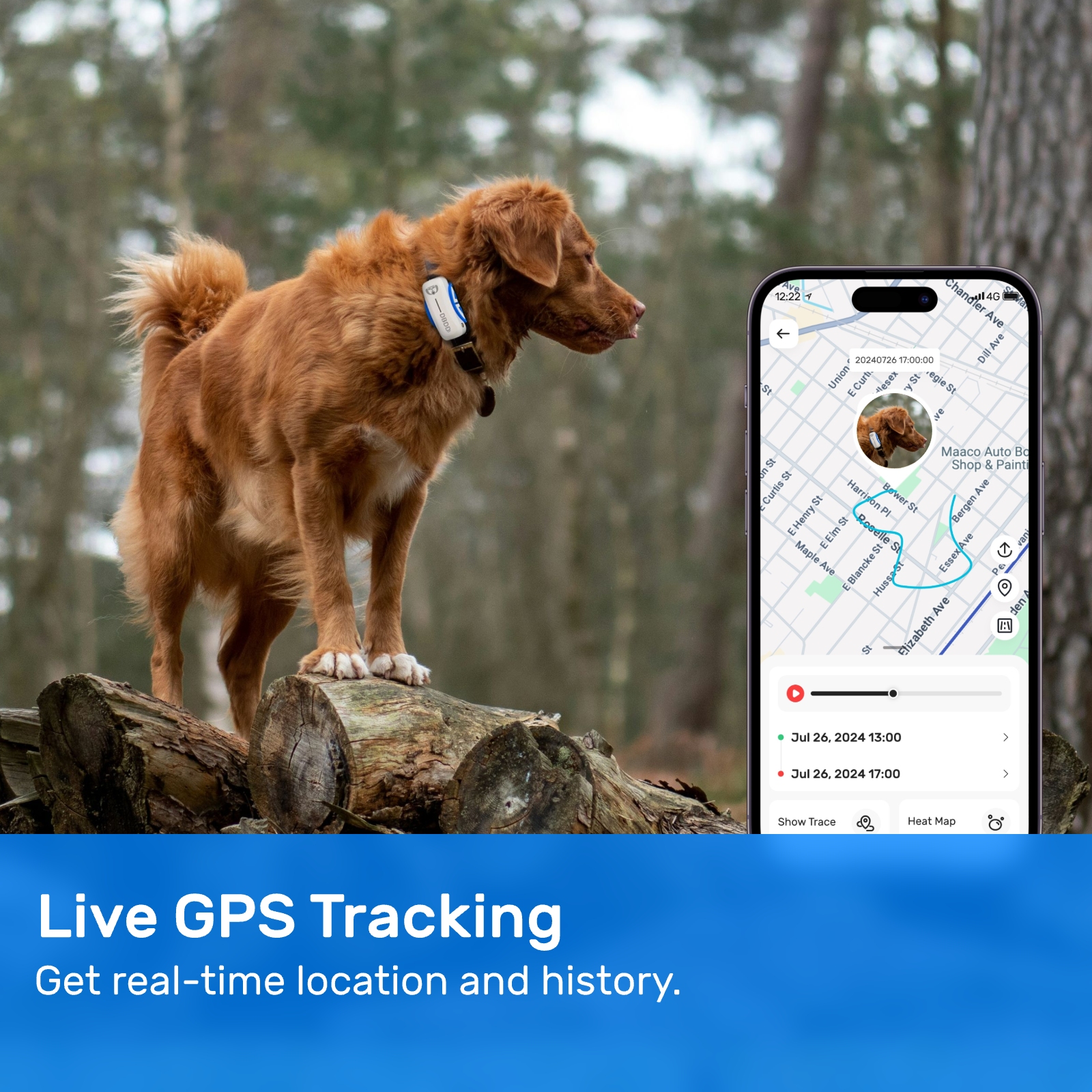

Wildlife Research#Domestic Animal Tracking

Pet insurance is a valuable tool for pet owners to ensure the health and well-being of their beloved companions. It provides financial protection against unexpected veterinary expenses, which can be substantial, especially in cases of serious illness or injury. When it comes to small dog breeds, pet insurance becomes even more relevant due to the unique health concerns that these dogs may face throughout their lives. This article will delve into the importance of pet insurance packages tailored for small dog breeds, highlighting the benefits, considerations, and options available to pet owners.

Small dog breeds, such as Chihuahuas, Pomeranians, Shih Tzus, and Yorkshire Terriers, are popular choices among pet lovers due to their manageable size, affectionate nature, and adaptability to various living environments. However, despite their charm, small dog breeds often come with specific health challenges that can lead to costly vet bills. For instance, smaller breeds are prone to dental issues, luxating patellas (dislocated kneecaps), tracheal collapse, and certain genetic disorders. These conditions necessitate specialized care, making pet insurance an essential consideration for owners who want to avoid unexpected financial burdens.

When selecting a pet insurance package for small dog breeds, it's crucial to understand the different types of coverage available. Most pet insurance plans offer basic coverage for accidents and illnesses, while others provide more comprehensive packages that include preventive care, such as vaccinations, routine check-ups, and dental cleanings. Some insurers even offer optional add-ons like coverage for alternative therapies or behavioral treatments. The key is to choose a plan that aligns with your pet's specific needs and your budget.

One of the primary advantages of pet insurance for small dog breeds is the peace of mind it offers. Knowing that you're prepared for any medical emergency can significantly reduce stress during challenging times. For example, if your small dog breed suddenly develops pancreatitis, a condition common in breeds like Dachshunds and Miniature Schnauzers, the treatment could cost several thousand dollars. With pet insurance, a significant portion of these costs would be covered, allowing you to focus on your pet's recovery rather than worrying about finances.

Another benefit of pet insurance for small dog breeds is the potential savings over time. While premiums vary based on factors such as the dog's age, breed, and location, many pet owners find that the long-term cost of insurance is far less than paying out-of-pocket for major medical procedures. Additionally, some insurers offer discounts for multi-pet households or bundling services, making it even more affordable to insure all your furry family members.

When evaluating pet insurance packages for small dog breeds, there are several important factors to consider. First, review the policy's exclusions and limitations. Some plans exclude pre-existing conditions or certain hereditary diseases common in specific breeds. Since small dog breeds are prone to breed-specific ailments, it's vital to ensure that these conditions are covered under the chosen plan. For example, brachycephalic breeds like Pugs and French Bulldogs may require additional respiratory care, so look for a policy that addresses these needs.

Second, examine the reimbursement structure. Most pet insurance companies require you to pay the veterinarian upfront and then submit a claim for reimbursement. Understanding how quickly claims are processed and what percentage of costs are reimbursed can help you estimate your out-of-pocket expenses. Some policies offer direct payment to veterinarians, which can simplify the process and reduce immediate financial strain.

Third, consider the annual deductible and maximum payout limits. A lower deductible means you'll pay less out of pocket before the insurance kicks in, but it might result in higher monthly premiums. Similarly, a higher maximum payout limit provides greater financial protection in case of severe or chronic conditions, but it could increase the overall cost of the policy. Balancing these elements is essential to finding a plan that suits both your pet's needs and your financial situation.

In addition to traditional pet insurance, there are other options worth exploring for small dog breeds. Wellness plans, offered by some veterinary clinics, bundle routine care services at a fixed monthly rate. While these plans don't cover accidents or illnesses, they can help manage predictable expenses like vaccines and parasite prevention. Combining a wellness plan with a standard pet insurance policy can provide comprehensive coverage for your small dog breed.

For those who prefer a more personalized approach, customizing a pet insurance package is possible. Many insurers allow you to adjust coverage levels, deductibles, and premium amounts to create a plan that fits your specific requirements. If your small dog breed has a known predisposition to a particular condition, such as hypoglycemia in Toy Breeds, you might opt for enhanced coverage in that area. Customization ensures that you're not paying for unnecessary features while still securing adequate protection for your pet.

It's also worth noting that some pet insurance providers specialize in offering plans for small dog breeds. These insurers understand the unique challenges faced by smaller breeds and design policies accordingly. They may offer breed-specific coverage options or additional resources, such as access to breed-focused veterinary specialists. Researching companies with expertise in small dog breeds can lead to a more tailored and effective insurance solution.

Finally, when choosing a pet insurance package for small dog breeds, don't overlook customer reviews and testimonials. Hearing from other pet owners who have similar breeds can provide valuable insights into the reliability and responsiveness of an insurance provider. Look for feedback on claim processing times, customer service quality, and overall satisfaction. A reputable insurer with positive reviews can give you confidence in your decision.

In conclusion, pet insurance is an invaluable resource for owners of small dog breeds, helping to mitigate the financial impact of unexpected veterinary expenses. By understanding the various types of coverage, considering breed-specific health concerns, and carefully evaluating policy details, you can select a package that best meets the needs of your small dog breed. Whether you're insuring a lively Poodle or a playful Cavalier King Charles Spaniel, investing in pet insurance is a responsible step toward ensuring your furry friend receives the care they deserve throughout their lifetime.

Update Time:2025-05-15 00:29:12

Small dog breeds, such as Chihuahuas, Pomeranians, Shih Tzus, and Yorkshire Terriers, are popular choices among pet lovers due to their manageable size, affectionate nature, and adaptability to various living environments. However, despite their charm, small dog breeds often come with specific health challenges that can lead to costly vet bills. For instance, smaller breeds are prone to dental issues, luxating patellas (dislocated kneecaps), tracheal collapse, and certain genetic disorders. These conditions necessitate specialized care, making pet insurance an essential consideration for owners who want to avoid unexpected financial burdens.

When selecting a pet insurance package for small dog breeds, it's crucial to understand the different types of coverage available. Most pet insurance plans offer basic coverage for accidents and illnesses, while others provide more comprehensive packages that include preventive care, such as vaccinations, routine check-ups, and dental cleanings. Some insurers even offer optional add-ons like coverage for alternative therapies or behavioral treatments. The key is to choose a plan that aligns with your pet's specific needs and your budget.

One of the primary advantages of pet insurance for small dog breeds is the peace of mind it offers. Knowing that you're prepared for any medical emergency can significantly reduce stress during challenging times. For example, if your small dog breed suddenly develops pancreatitis, a condition common in breeds like Dachshunds and Miniature Schnauzers, the treatment could cost several thousand dollars. With pet insurance, a significant portion of these costs would be covered, allowing you to focus on your pet's recovery rather than worrying about finances.

Another benefit of pet insurance for small dog breeds is the potential savings over time. While premiums vary based on factors such as the dog's age, breed, and location, many pet owners find that the long-term cost of insurance is far less than paying out-of-pocket for major medical procedures. Additionally, some insurers offer discounts for multi-pet households or bundling services, making it even more affordable to insure all your furry family members.

When evaluating pet insurance packages for small dog breeds, there are several important factors to consider. First, review the policy's exclusions and limitations. Some plans exclude pre-existing conditions or certain hereditary diseases common in specific breeds. Since small dog breeds are prone to breed-specific ailments, it's vital to ensure that these conditions are covered under the chosen plan. For example, brachycephalic breeds like Pugs and French Bulldogs may require additional respiratory care, so look for a policy that addresses these needs.

Second, examine the reimbursement structure. Most pet insurance companies require you to pay the veterinarian upfront and then submit a claim for reimbursement. Understanding how quickly claims are processed and what percentage of costs are reimbursed can help you estimate your out-of-pocket expenses. Some policies offer direct payment to veterinarians, which can simplify the process and reduce immediate financial strain.

Third, consider the annual deductible and maximum payout limits. A lower deductible means you'll pay less out of pocket before the insurance kicks in, but it might result in higher monthly premiums. Similarly, a higher maximum payout limit provides greater financial protection in case of severe or chronic conditions, but it could increase the overall cost of the policy. Balancing these elements is essential to finding a plan that suits both your pet's needs and your financial situation.

In addition to traditional pet insurance, there are other options worth exploring for small dog breeds. Wellness plans, offered by some veterinary clinics, bundle routine care services at a fixed monthly rate. While these plans don't cover accidents or illnesses, they can help manage predictable expenses like vaccines and parasite prevention. Combining a wellness plan with a standard pet insurance policy can provide comprehensive coverage for your small dog breed.

For those who prefer a more personalized approach, customizing a pet insurance package is possible. Many insurers allow you to adjust coverage levels, deductibles, and premium amounts to create a plan that fits your specific requirements. If your small dog breed has a known predisposition to a particular condition, such as hypoglycemia in Toy Breeds, you might opt for enhanced coverage in that area. Customization ensures that you're not paying for unnecessary features while still securing adequate protection for your pet.

It's also worth noting that some pet insurance providers specialize in offering plans for small dog breeds. These insurers understand the unique challenges faced by smaller breeds and design policies accordingly. They may offer breed-specific coverage options or additional resources, such as access to breed-focused veterinary specialists. Researching companies with expertise in small dog breeds can lead to a more tailored and effective insurance solution.

Finally, when choosing a pet insurance package for small dog breeds, don't overlook customer reviews and testimonials. Hearing from other pet owners who have similar breeds can provide valuable insights into the reliability and responsiveness of an insurance provider. Look for feedback on claim processing times, customer service quality, and overall satisfaction. A reputable insurer with positive reviews can give you confidence in your decision.

In conclusion, pet insurance is an invaluable resource for owners of small dog breeds, helping to mitigate the financial impact of unexpected veterinary expenses. By understanding the various types of coverage, considering breed-specific health concerns, and carefully evaluating policy details, you can select a package that best meets the needs of your small dog breed. Whether you're insuring a lively Poodle or a playful Cavalier King Charles Spaniel, investing in pet insurance is a responsible step toward ensuring your furry friend receives the care they deserve throughout their lifetime.

Update Time:2025-05-15 00:29:12

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form