New ArrivalsBack in stock

dog gps

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D248371829 second hand :D248371829 |

Manufacturer | dog gps | release date | 2025-05-15 | List price | $33 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | dog gps | ||||||||

| category | |||||||||

Outdoor Gear#Pet Safety Equipment

Pet insurance packages have become increasingly popular among pet owners, providing peace of mind and financial protection for unforeseen veterinary expenses. While these plans primarily focus on medical coverage, there is a growing trend towards integrating additional features that enhance pet safety and well-being. One such feature gaining traction is the inclusion of dog GPS technology within pet insurance packages. This article explores the benefits, functionality, and importance of incorporating dog GPS into pet insurance offerings, highlighting how it can revolutionize pet care.

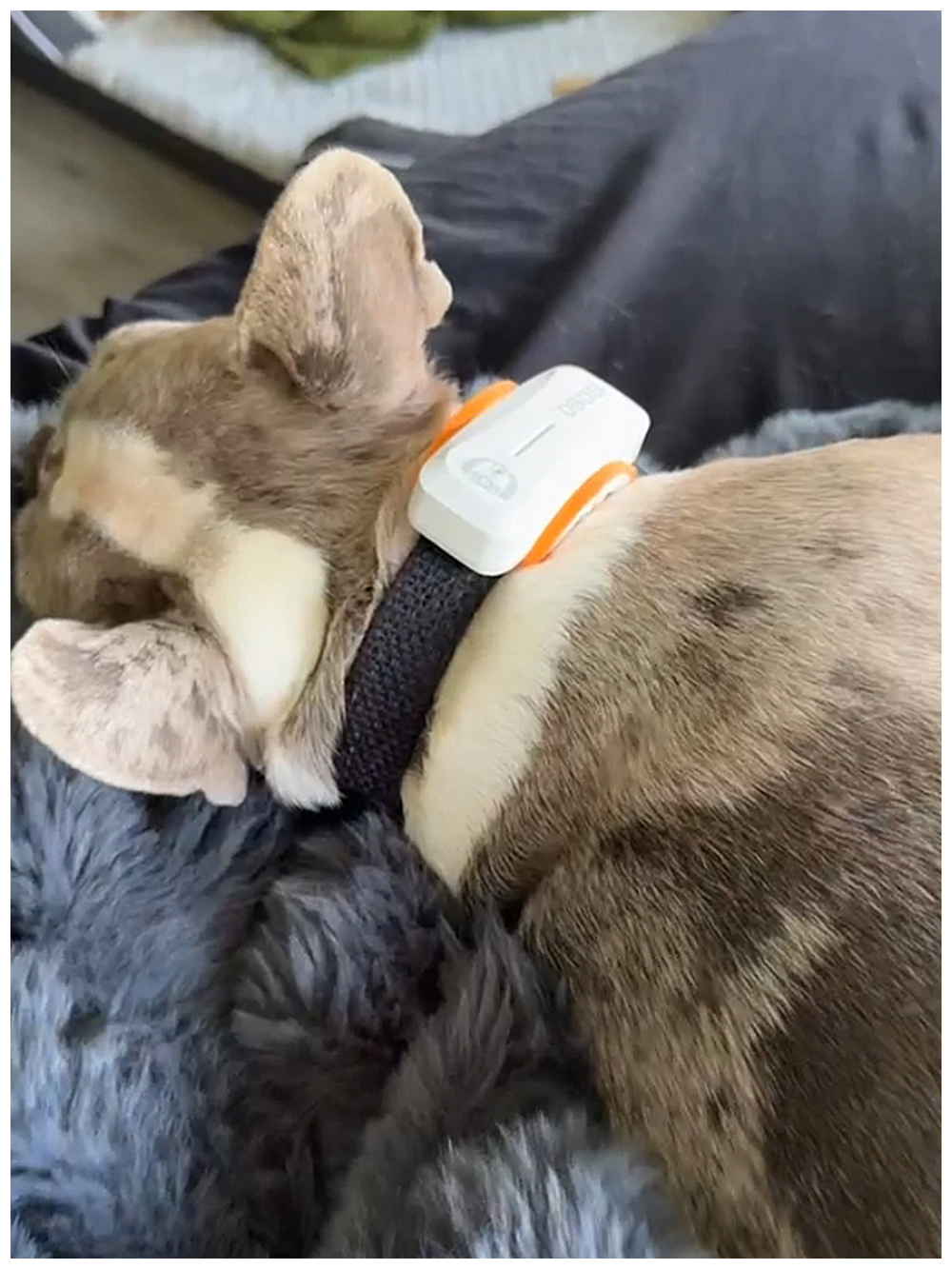

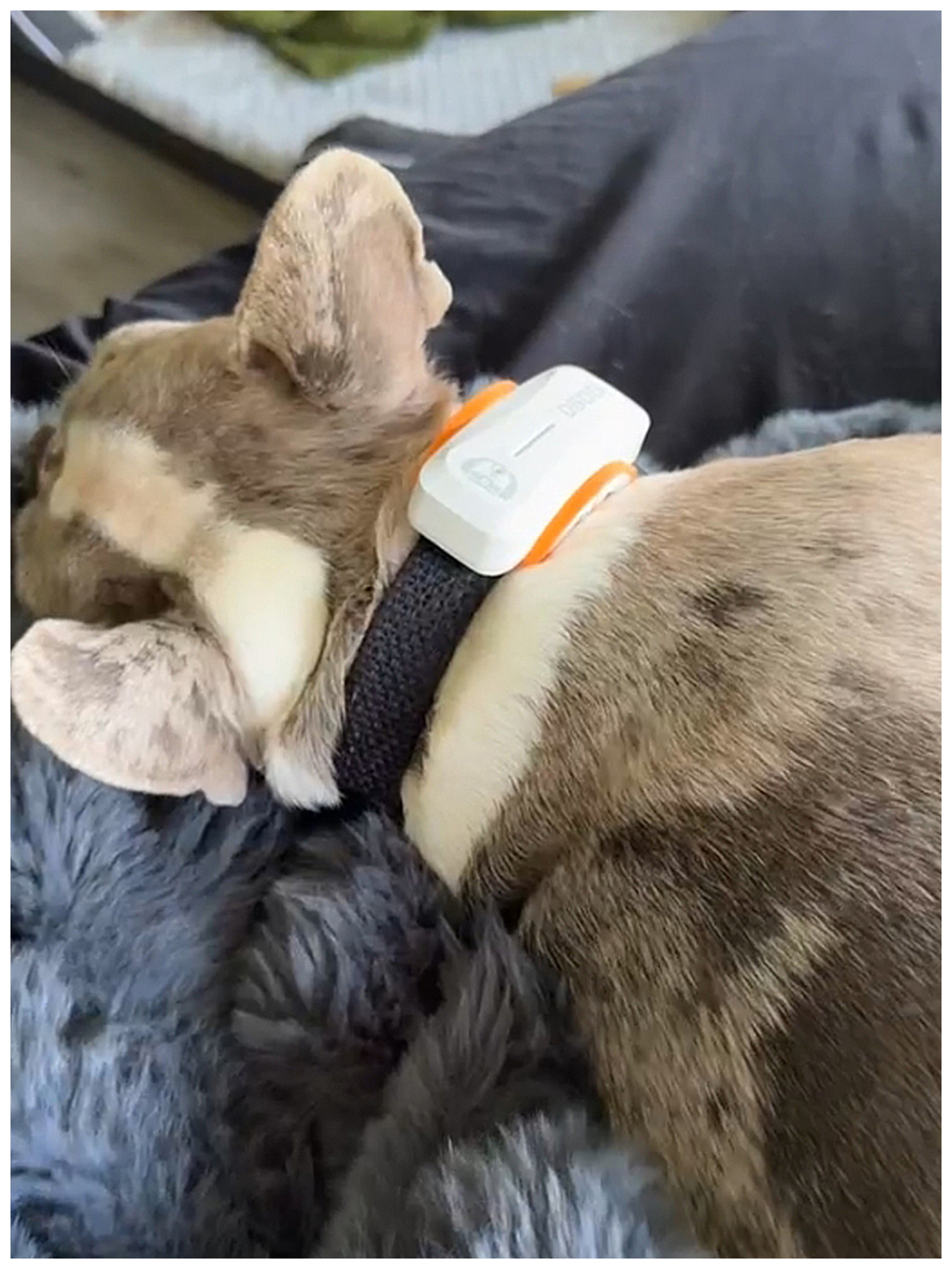

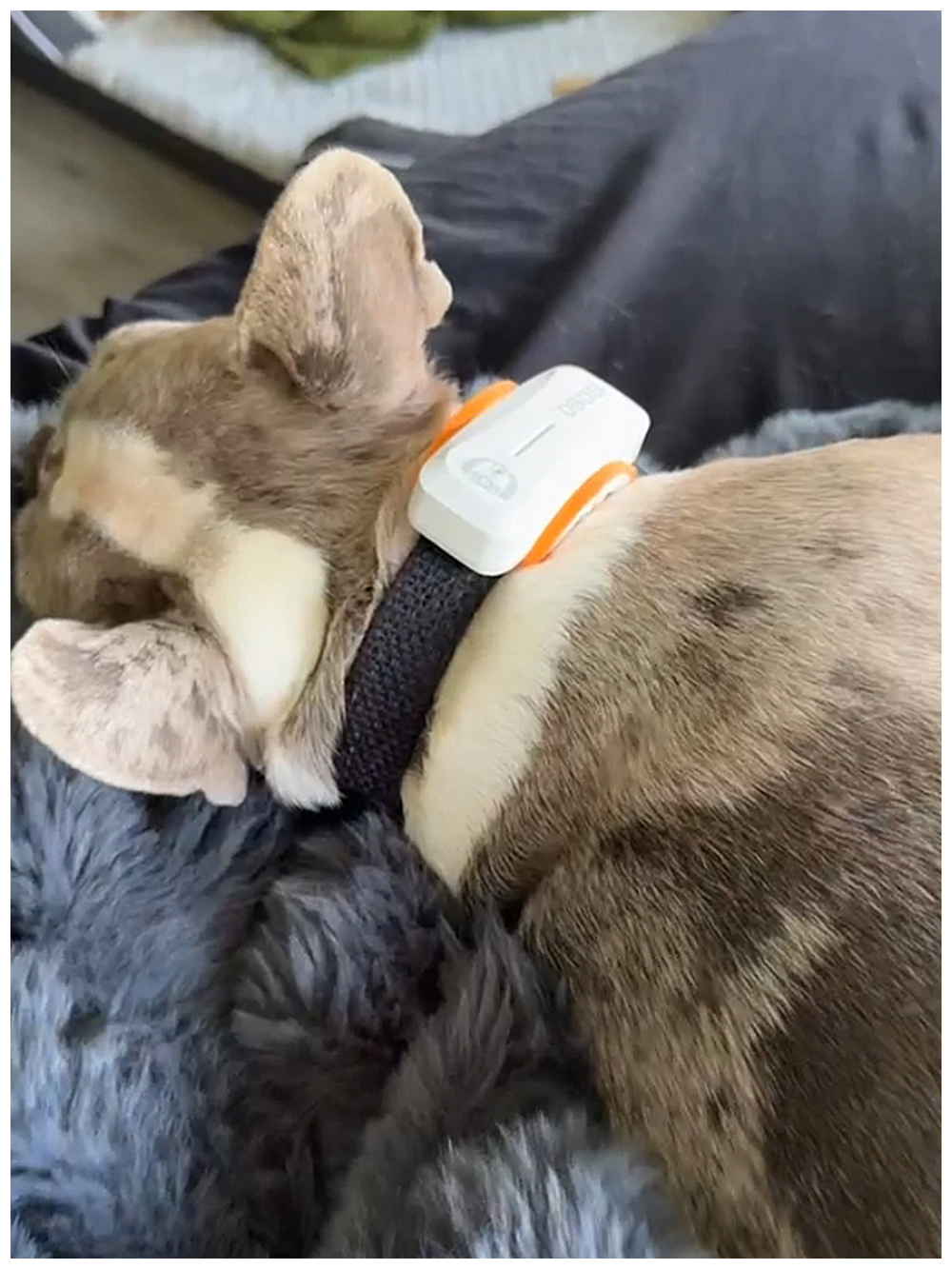

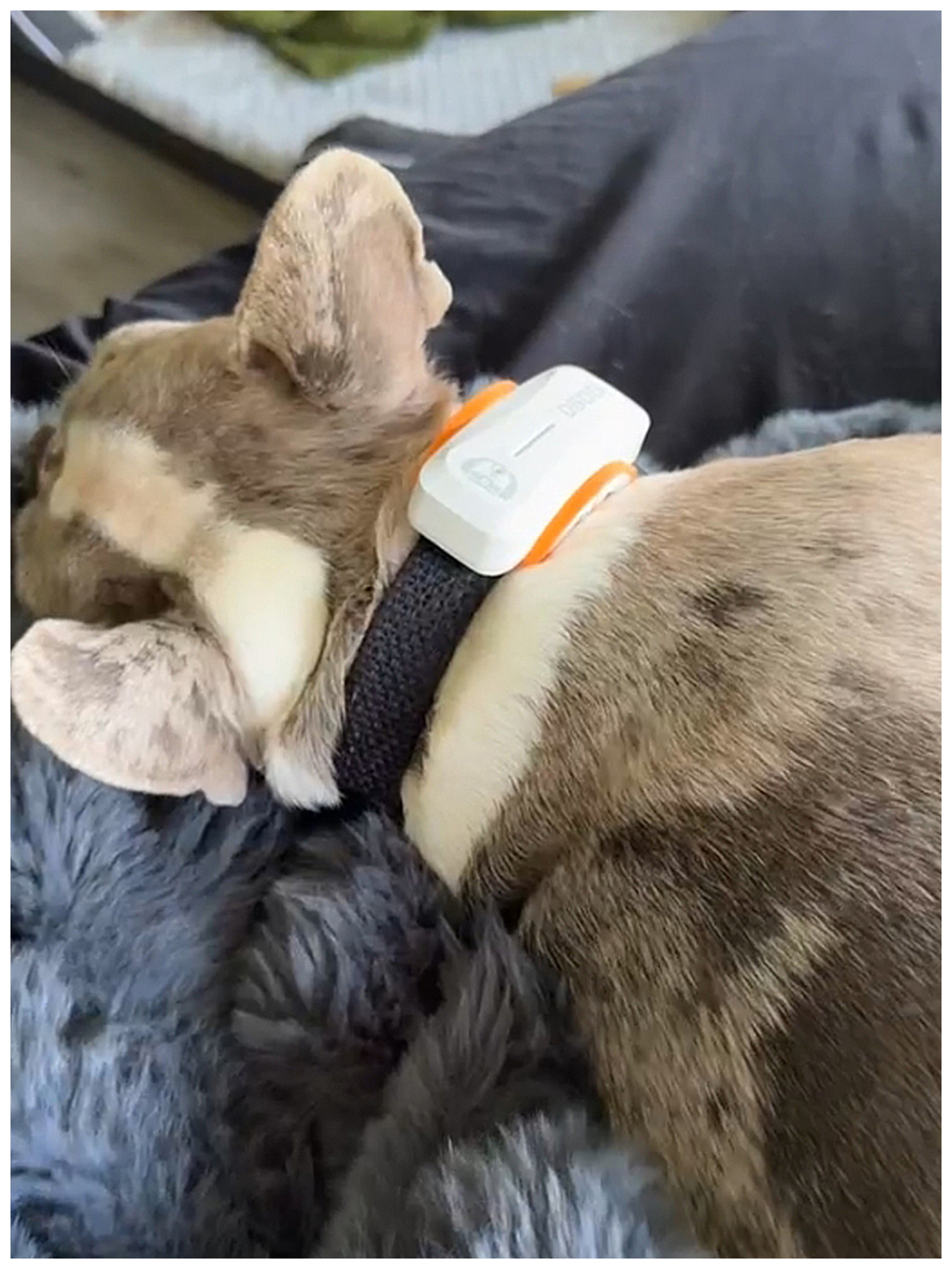

Dog GPS devices are small, lightweight trackers designed to monitor the location of pets in real-time. These devices use satellite technology to pinpoint the exact whereabouts of a dog, allowing owners to locate their pets instantly if they wander off or get lost. The integration of dog GPS with pet insurance packages represents a forward-thinking approach to pet ownership, combining health coverage with advanced safety measures. By bundling these services, pet insurance providers offer comprehensive solutions that address both medical emergencies and potential risks associated with losing a pet.

The primary advantage of including dog GPS in pet insurance packages lies in its ability to prevent costly search-and-rescue operations. When a pet goes missing, the emotional distress and financial burden can be overwhelming. Traditional methods of searching for lost pets often involve posting flyers, contacting shelters, and hiring professional search teams—all of which can be time-consuming and expensive. With a dog GPS device, however, owners can quickly determine their pet's location using a smartphone app, reducing the likelihood of prolonged searches and ensuring a swift reunion.

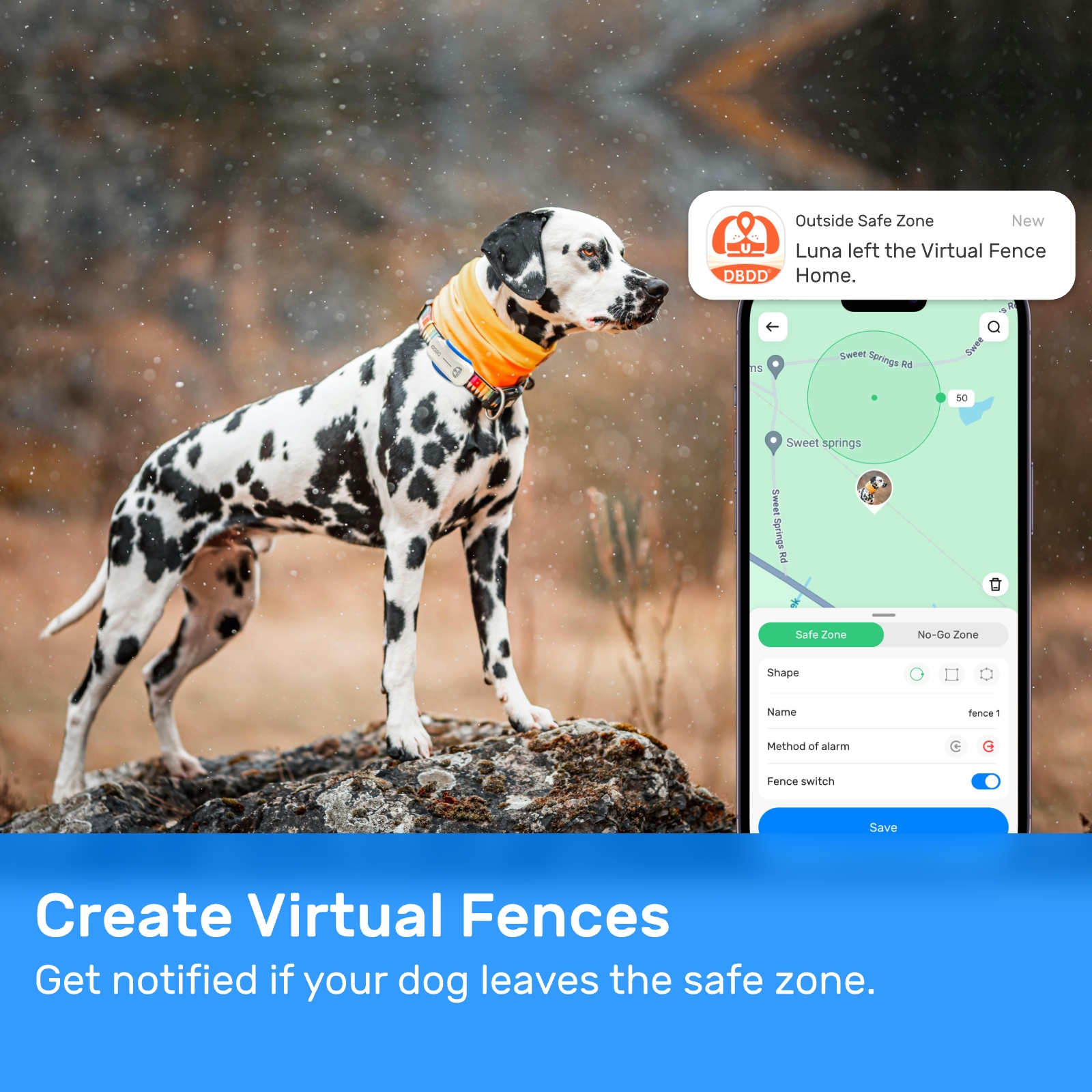

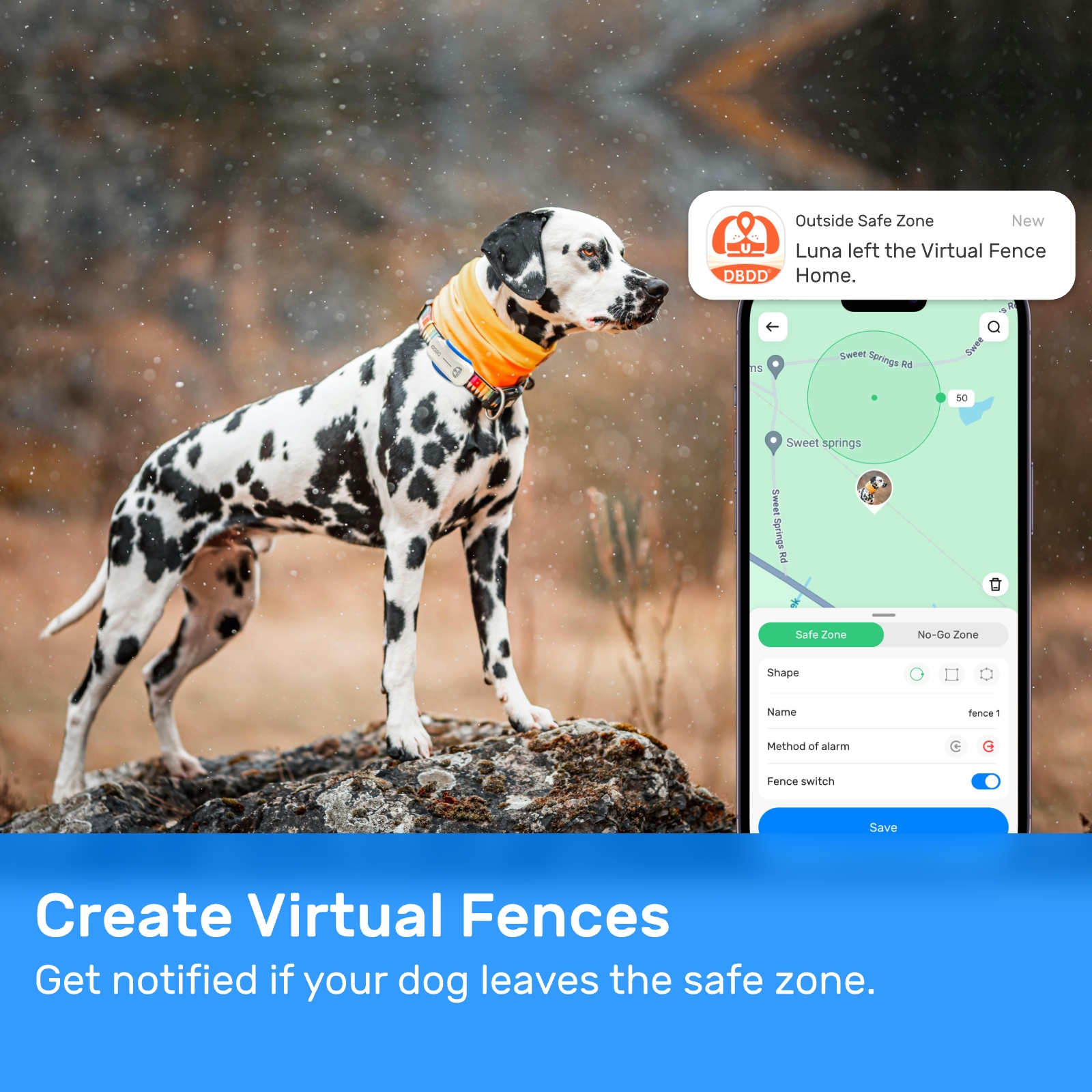

Moreover, dog GPS technology offers more than just location tracking. Many modern devices come equipped with additional features that contribute to overall pet wellness. For instance, some trackers monitor activity levels, helping owners ensure their dogs receive adequate exercise. Others provide geofencing capabilities, allowing users to set virtual boundaries around specific areas. If the dog ventures outside these predefined limits, the owner receives an instant alert via their mobile device. Such functionalities not only enhance safety but also promote responsible pet ownership by encouraging proactive monitoring and management.

From a business perspective, offering dog GPS as part of a pet insurance package can significantly differentiate providers in a competitive market. As consumer awareness grows regarding the benefits of this technology, insurers who incorporate it into their offerings stand to attract tech-savvy pet owners seeking innovative solutions. Furthermore, bundling dog GPS with traditional insurance plans may lead to increased customer satisfaction and retention rates, as clients appreciate the added value provided by these enhanced services.

Despite its advantages, the adoption of dog GPS technology within pet insurance packages does face certain challenges. One major concern is cost. While standalone GPS devices range in price depending on brand and features, integrating them into insurance plans requires careful pricing strategies to remain affordable for consumers. Providers must strike a balance between covering operational costs and maintaining competitive premiums. Additionally, ongoing subscription fees for data usage and software updates need to be factored into the equation, potentially complicating pricing structures.

Another challenge involves educating potential customers about the benefits of dog GPS technology. Many pet owners may not fully understand how these devices work or why they are necessary. Insurers must invest in marketing efforts to raise awareness and demonstrate the practical applications of GPS tracking. Demonstrations, testimonials, and case studies showcasing successful recoveries of lost pets could prove invaluable in convincing skeptical buyers of the technology's worth.

Privacy considerations also play a role in the implementation of dog GPS within pet insurance packages. Owners must trust that their personal information and pet's location data will remain secure. Insurers partnering with GPS manufacturers should prioritize robust cybersecurity measures to protect sensitive information from unauthorized access. Transparent privacy policies and clear communication regarding data collection practices can help alleviate concerns and build trust with clients.

Looking ahead, the future of dog GPS integration within pet insurance packages appears promising. Advancements in technology continue to improve the accuracy and reliability of GPS devices, making them even more appealing to pet owners. Miniaturization efforts allow for smaller, lighter trackers that do not interfere with a dog's comfort or mobility. Battery life has also improved, enabling extended periods of uninterrupted tracking without frequent recharging. These developments make dog GPS devices increasingly practical for everyday use.

In addition to technological improvements, partnerships between pet insurance providers and GPS manufacturers could pave the way for further innovation. Collaborative research and development initiatives might yield new features tailored specifically to meet the needs of pet owners. For example, integrating health monitoring sensors into GPS devices could provide real-time updates on vital signs such as heart rate and body temperature, offering early warnings of potential medical issues. Such advancements would align perfectly with the core mission of pet insurance: safeguarding animal health and happiness.

Consumer demand will ultimately drive the evolution of dog GPS integration within pet insurance packages. As more people recognize the importance of protecting their beloved companions through comprehensive coverage, interest in bundled services is likely to grow. Insurers responding promptly to this trend by offering attractive packages at reasonable prices stand to gain significant market share. Meanwhile, those slow to adapt risk falling behind competitors who embrace cutting-edge technologies.

It is important to note that while dog GPS devices represent a powerful tool for enhancing pet safety, they should not replace other preventive measures. Microchipping remains a crucial component of responsible pet ownership, providing permanent identification in case a GPS device malfunctions or becomes separated from the animal. Similarly, proper fencing, leashing during walks, and training programs focused on recall commands all contribute to minimizing the chances of a pet going missing in the first place. Dog GPS serves as an additional layer of security rather than a substitute for established best practices.

In conclusion, the inclusion of dog GPS technology within pet insurance packages marks a significant step forward in promoting pet safety and well-being. By combining medical coverage with advanced tracking capabilities, insurers offer holistic solutions that address multiple aspects of pet care. Although challenges related to cost, education, and privacy exist, the potential benefits far outweigh these obstacles. As technology continues to evolve and consumer preferences shift toward integrated services, the role of dog GPS in pet insurance is poised to expand, benefiting both animals and their human companions alike. Pet owners seeking peace of mind and comprehensive protection would do well to consider insurance plans featuring this innovative technology, ensuring their furry friends remain safe and sound wherever life takes them.

Update Time:2025-05-15 23:32:16

Dog GPS devices are small, lightweight trackers designed to monitor the location of pets in real-time. These devices use satellite technology to pinpoint the exact whereabouts of a dog, allowing owners to locate their pets instantly if they wander off or get lost. The integration of dog GPS with pet insurance packages represents a forward-thinking approach to pet ownership, combining health coverage with advanced safety measures. By bundling these services, pet insurance providers offer comprehensive solutions that address both medical emergencies and potential risks associated with losing a pet.

The primary advantage of including dog GPS in pet insurance packages lies in its ability to prevent costly search-and-rescue operations. When a pet goes missing, the emotional distress and financial burden can be overwhelming. Traditional methods of searching for lost pets often involve posting flyers, contacting shelters, and hiring professional search teams—all of which can be time-consuming and expensive. With a dog GPS device, however, owners can quickly determine their pet's location using a smartphone app, reducing the likelihood of prolonged searches and ensuring a swift reunion.

Moreover, dog GPS technology offers more than just location tracking. Many modern devices come equipped with additional features that contribute to overall pet wellness. For instance, some trackers monitor activity levels, helping owners ensure their dogs receive adequate exercise. Others provide geofencing capabilities, allowing users to set virtual boundaries around specific areas. If the dog ventures outside these predefined limits, the owner receives an instant alert via their mobile device. Such functionalities not only enhance safety but also promote responsible pet ownership by encouraging proactive monitoring and management.

From a business perspective, offering dog GPS as part of a pet insurance package can significantly differentiate providers in a competitive market. As consumer awareness grows regarding the benefits of this technology, insurers who incorporate it into their offerings stand to attract tech-savvy pet owners seeking innovative solutions. Furthermore, bundling dog GPS with traditional insurance plans may lead to increased customer satisfaction and retention rates, as clients appreciate the added value provided by these enhanced services.

Despite its advantages, the adoption of dog GPS technology within pet insurance packages does face certain challenges. One major concern is cost. While standalone GPS devices range in price depending on brand and features, integrating them into insurance plans requires careful pricing strategies to remain affordable for consumers. Providers must strike a balance between covering operational costs and maintaining competitive premiums. Additionally, ongoing subscription fees for data usage and software updates need to be factored into the equation, potentially complicating pricing structures.

Another challenge involves educating potential customers about the benefits of dog GPS technology. Many pet owners may not fully understand how these devices work or why they are necessary. Insurers must invest in marketing efforts to raise awareness and demonstrate the practical applications of GPS tracking. Demonstrations, testimonials, and case studies showcasing successful recoveries of lost pets could prove invaluable in convincing skeptical buyers of the technology's worth.

Privacy considerations also play a role in the implementation of dog GPS within pet insurance packages. Owners must trust that their personal information and pet's location data will remain secure. Insurers partnering with GPS manufacturers should prioritize robust cybersecurity measures to protect sensitive information from unauthorized access. Transparent privacy policies and clear communication regarding data collection practices can help alleviate concerns and build trust with clients.

Looking ahead, the future of dog GPS integration within pet insurance packages appears promising. Advancements in technology continue to improve the accuracy and reliability of GPS devices, making them even more appealing to pet owners. Miniaturization efforts allow for smaller, lighter trackers that do not interfere with a dog's comfort or mobility. Battery life has also improved, enabling extended periods of uninterrupted tracking without frequent recharging. These developments make dog GPS devices increasingly practical for everyday use.

In addition to technological improvements, partnerships between pet insurance providers and GPS manufacturers could pave the way for further innovation. Collaborative research and development initiatives might yield new features tailored specifically to meet the needs of pet owners. For example, integrating health monitoring sensors into GPS devices could provide real-time updates on vital signs such as heart rate and body temperature, offering early warnings of potential medical issues. Such advancements would align perfectly with the core mission of pet insurance: safeguarding animal health and happiness.

Consumer demand will ultimately drive the evolution of dog GPS integration within pet insurance packages. As more people recognize the importance of protecting their beloved companions through comprehensive coverage, interest in bundled services is likely to grow. Insurers responding promptly to this trend by offering attractive packages at reasonable prices stand to gain significant market share. Meanwhile, those slow to adapt risk falling behind competitors who embrace cutting-edge technologies.

It is important to note that while dog GPS devices represent a powerful tool for enhancing pet safety, they should not replace other preventive measures. Microchipping remains a crucial component of responsible pet ownership, providing permanent identification in case a GPS device malfunctions or becomes separated from the animal. Similarly, proper fencing, leashing during walks, and training programs focused on recall commands all contribute to minimizing the chances of a pet going missing in the first place. Dog GPS serves as an additional layer of security rather than a substitute for established best practices.

In conclusion, the inclusion of dog GPS technology within pet insurance packages marks a significant step forward in promoting pet safety and well-being. By combining medical coverage with advanced tracking capabilities, insurers offer holistic solutions that address multiple aspects of pet care. Although challenges related to cost, education, and privacy exist, the potential benefits far outweigh these obstacles. As technology continues to evolve and consumer preferences shift toward integrated services, the role of dog GPS in pet insurance is poised to expand, benefiting both animals and their human companions alike. Pet owners seeking peace of mind and comprehensive protection would do well to consider insurance plans featuring this innovative technology, ensuring their furry friends remain safe and sound wherever life takes them.

Update Time:2025-05-15 23:32:16

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form