New ArrivalsBack in stock

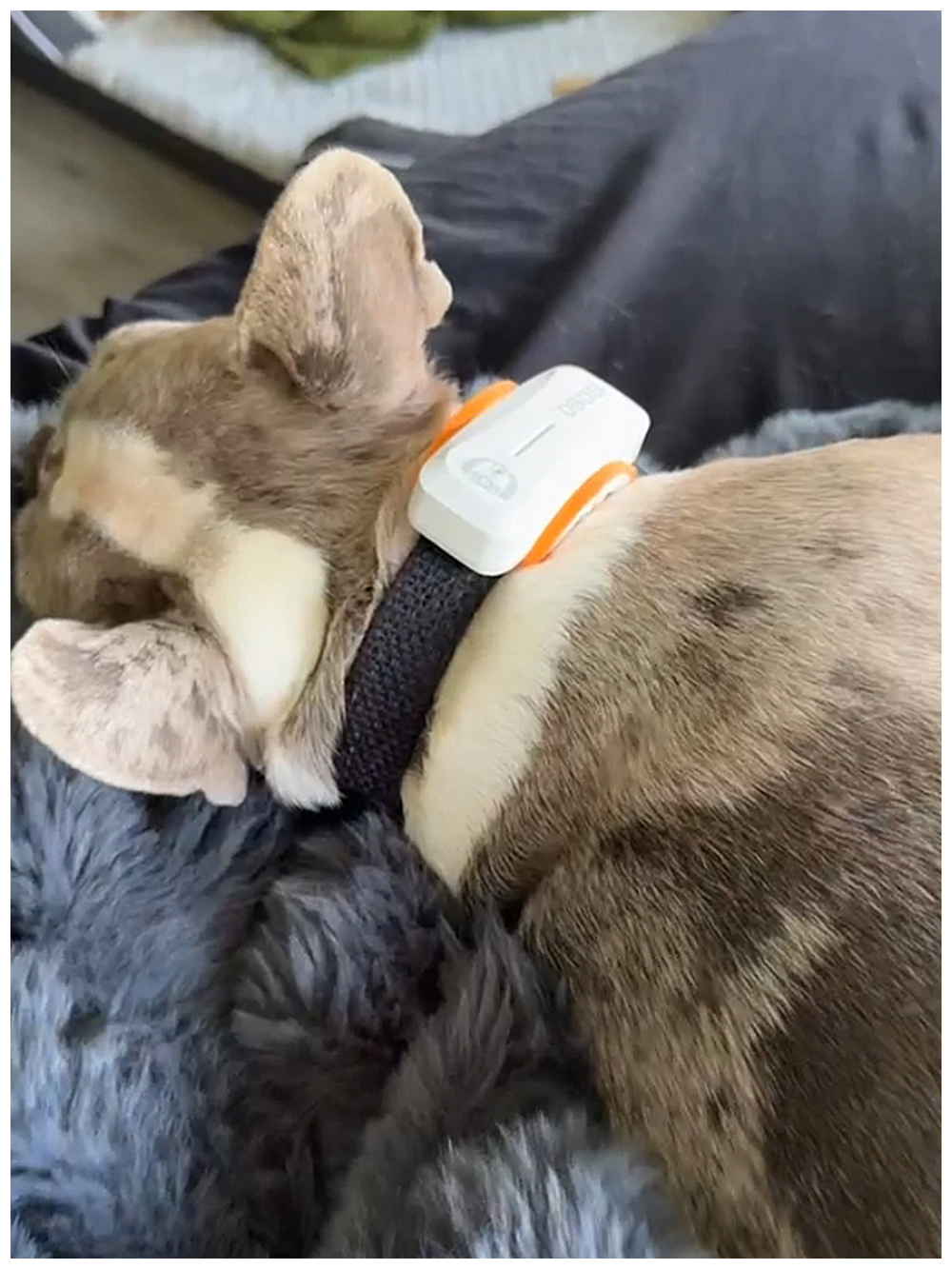

sleeping dogs

Limited Time Sale

Limited Time Sale

Until the end

00

00

00

Free shipping on orders over 999 ※)

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

If you buy it for 999 or more, you can buy it on behalf of the customer. There is no material for the number of hands.

There is stock in your local store.

Please note that the sales price and tax displayed may differ between online and in-store. Also, the product may be out of stock in-store.

Coupon giveaway!

| Control number |

New :D343479894 second hand :D343479894 |

Manufacturer | sleeping dogs | release date | 2025-05-14 | List price | $33 | ||

|---|---|---|---|---|---|---|---|---|---|

| prototype | sleeping dogs | ||||||||

| category | |||||||||

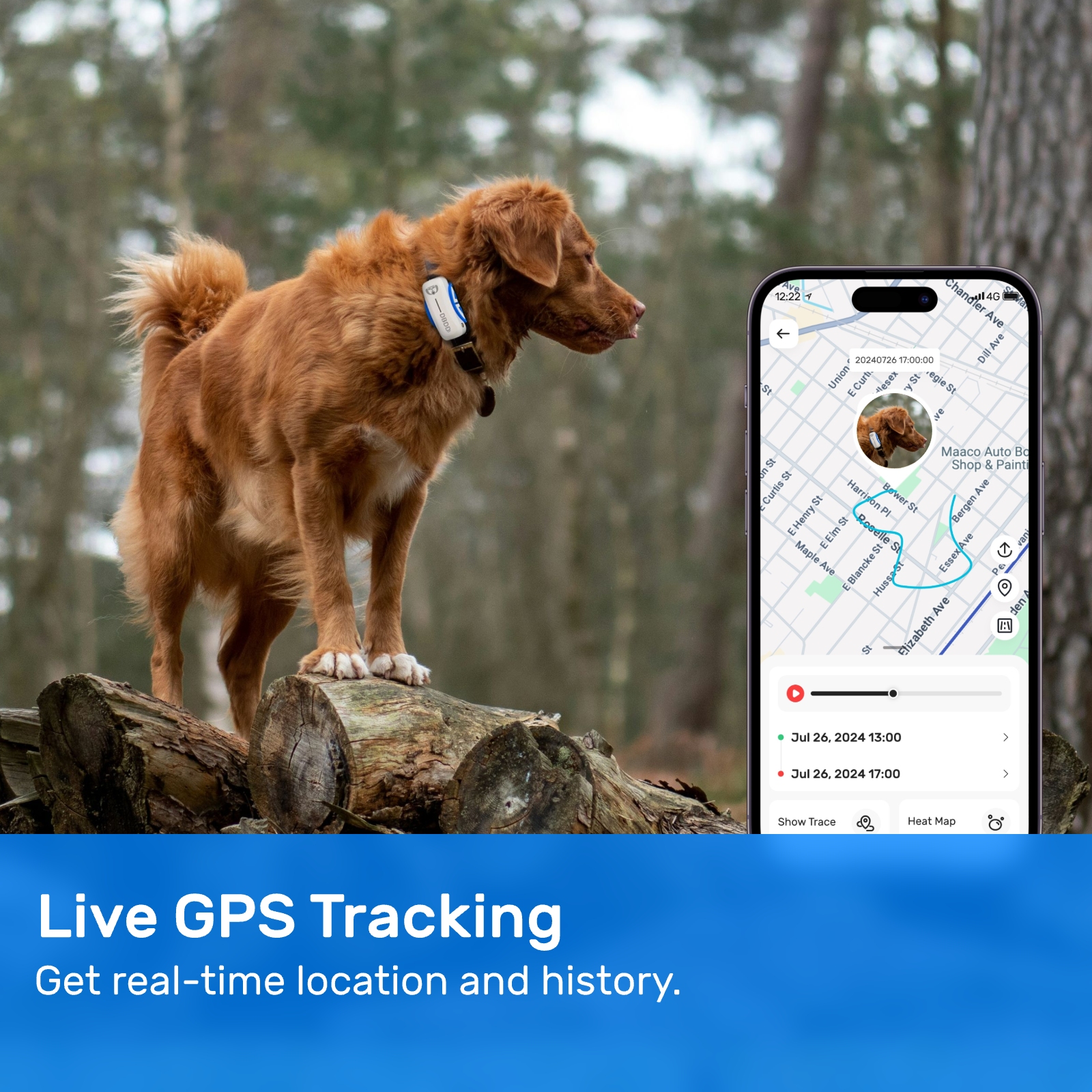

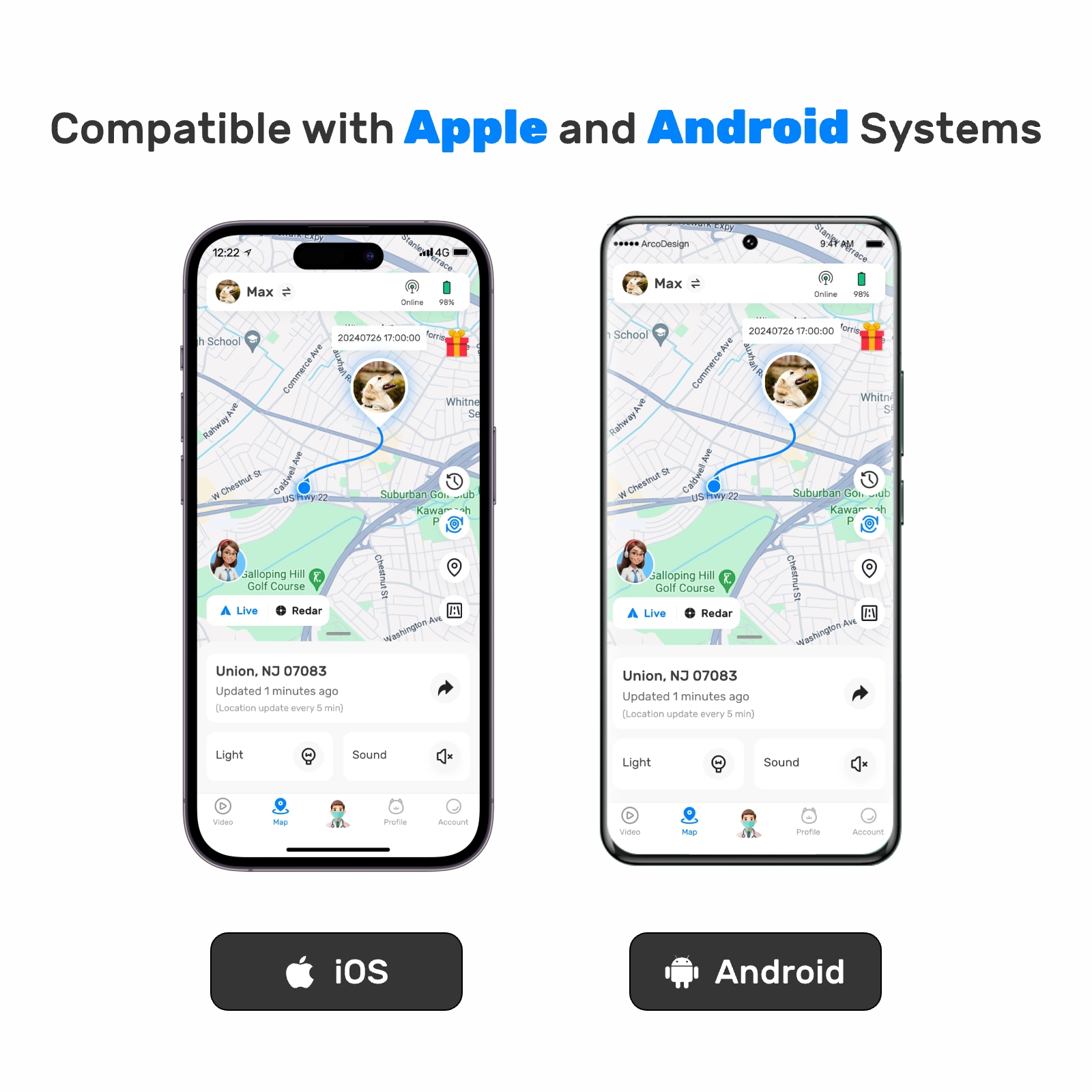

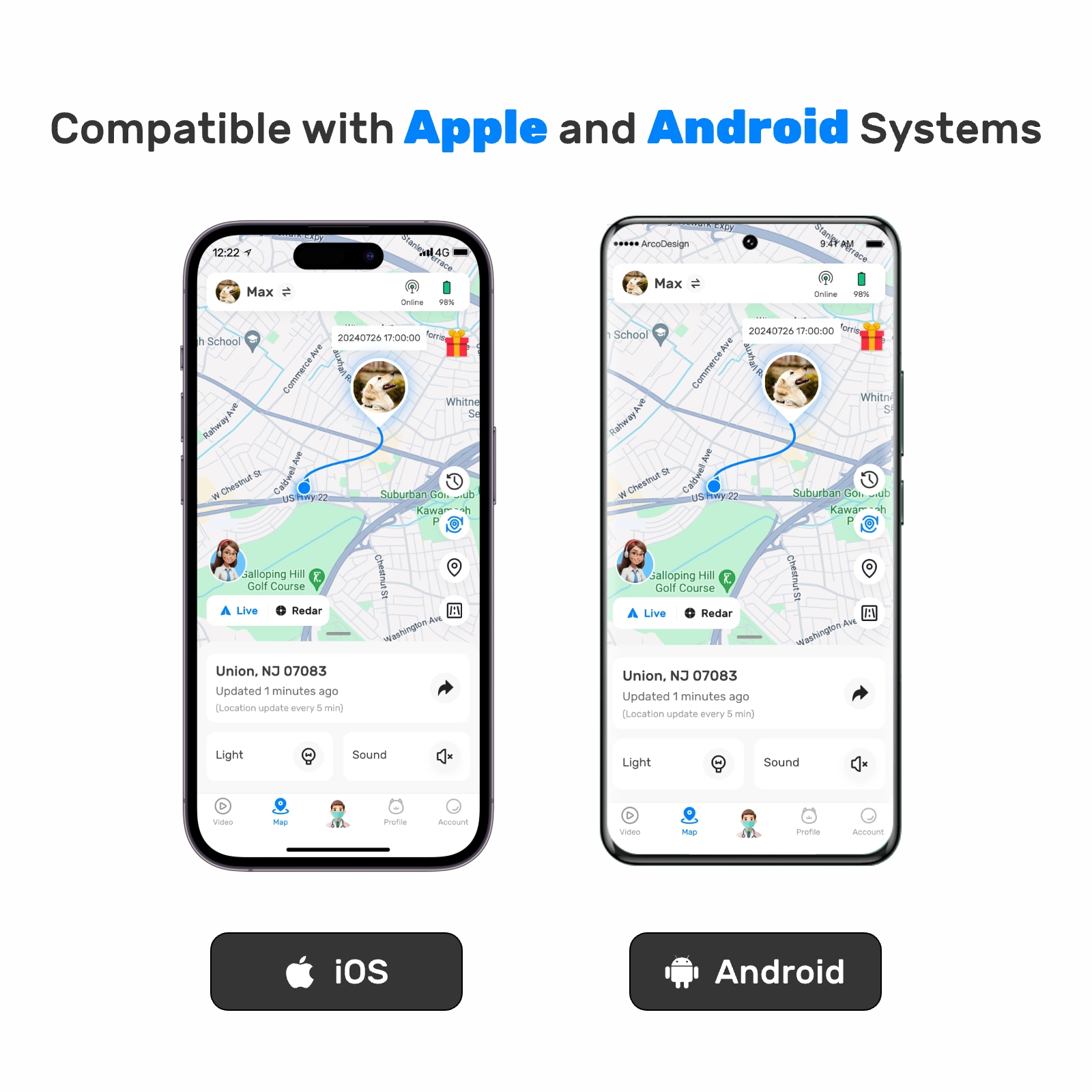

Smart Home#Pet Connected Sensors

Pet insurance has become an increasingly popular option for pet owners who want to ensure their furry friends receive the best possible care. While many people are familiar with the concept of health insurance for humans, pet insurance packages offer similar benefits tailored specifically for animals. These plans can cover a wide range of medical expenses, from routine check-ups to emergency surgeries. For dog lovers, especially those concerned about sleeping dogs, understanding how pet insurance works and what it covers is essential.

When considering pet insurance, it’s important to recognize that each plan varies significantly in terms of coverage, cost, and exclusions. Some policies may focus on accidents and illnesses, while others include preventive care such as vaccinations and dental cleanings. For instance, if you own a breed prone to certain health conditions or have a senior dog that spends more time as sleeping dogs, opting for comprehensive coverage might be beneficial. The key is selecting a package that aligns with your pet's specific needs and lifestyle.

One of the primary advantages of pet insurance is its ability to alleviate financial stress during unexpected veterinary emergencies. Imagine this scenario: your otherwise healthy dog suddenly becomes ill overnight, necessitating urgent treatment. Without insurance, the cost of diagnosis and treatment could easily exceed several hundred dollars—or even thousands, depending on the severity of the condition. However, with a suitable pet insurance plan, these costs can be substantially reduced, allowing you to focus on your dog's recovery rather than worrying about bills.

Sleeping dogs often represent a relaxed state where they appear peaceful and content. Yet, beneath that serene exterior, underlying health issues may go unnoticed until symptoms manifest. This underscores the importance of regular wellness exams covered by some pet insurance plans. During these visits, veterinarians can detect potential problems early, potentially saving both money and heartache down the road. Early detection is particularly crucial for older dogs or breeds predisposed to genetic disorders, ensuring they remain comfortable even when spending much of their day as sleeping dogs.

Another aspect worth exploring is the variety of options available within pet insurance packages. Basic plans typically address accident-related injuries and sudden illnesses but exclude pre-existing conditions. On the other hand, premium plans extend coverage to chronic diseases, hereditary conditions, and sometimes alternative therapies like acupuncture or hydrotherapy. If you have a dog that frequently acts as sleeping dogs due to age or health concerns, investing in a higher-tier plan could prove invaluable over time.

Cost remains one of the most significant factors influencing whether someone chooses to purchase pet insurance. Premiums depend on numerous variables, including the dog's age, breed, location, and chosen level of coverage. Generally speaking, younger animals tend to attract lower rates since they're statistically less likely to require extensive medical intervention compared to older ones. Similarly, smaller breeds usually incur cheaper premiums versus larger counterparts because bigger dogs generally face greater risks of developing certain ailments. Moreover, geographic region plays a role too; urban areas with higher living costs also reflect increased vet fees, thereby affecting overall pricing structures.

Despite initial outlay associated with monthly premiums, many experts argue that long-term savings justify the expense. Consider this example: let's say your Golden Retriever requires knee surgery costing $3,000. With a typical reimbursement rate around 80%, assuming no deductible applies, your portion would only amount to $600 instead of footing the entire bill yourself. Such scenarios illustrate why proactive planning through pet insurance proves prudent for responsible pet parents.

In addition to monetary considerations, emotional peace of mind ranks highly among reasons motivating individuals toward purchasing pet insurance. Knowing that should anything happen to your beloved companion, you possess resources enabling necessary treatments without compromising quality care brings immense relief. Furthermore, having access to advanced diagnostic tools and cutting-edge procedures empowers veterinarians to provide optimal outcomes for their patients, enhancing quality of life for all involved parties—including those cherished sleeping dogs curled up at home.

However, before committing to any particular plan, thorough research proves indispensable. Start by comparing offerings across multiple providers, paying close attention to details regarding deductibles, copayments, annual limits, and exclusions. Some companies impose waiting periods before activating coverage, meaning newly acquired pets must wait weeks or months prior receiving benefits. Additionally, read reviews carefully to gauge customer satisfaction levels and responsiveness from claims processing teams. Transparency regarding terms and conditions helps avoid surprises later on.

For owners dealing with sleeping dogs specifically, special provisions exist addressing geriatric care requirements. As dogs age, their bodies undergo natural changes requiring additional monitoring and maintenance. Arthritis, cognitive dysfunction syndrome (similar to Alzheimer's disease), kidney failure, and cancer represent common challenges faced by seniors. Fortunately, certain pet insurance products cater directly to these populations, incorporating features designed explicitly for managing age-related complications. Features such as unlimited prescription drug refills, extended hospital stay allowances, and specialized dietary consultations contribute positively towards maintaining comfort and dignity throughout golden years.

Beyond traditional health concerns, behavioral issues occasionally arise warranting professional assistance. Anxiety, aggression, separation distress—all present real obstacles impacting daily lives of affected families. Although not universally included under standard pet insurance arrangements, supplementary riders sometimes cover counseling sessions aimed at resolving problematic behaviors. Recognizing signs early enables timely interventions preventing escalation into worse situations. Even seemingly innocuous habits like excessive barking or destructive chewing stem from deeper psychological triggers deserving expert evaluation. Thus, comprehensive packages offering broader scope beyond mere physical ailments hold appeal for holistic-minded caretakers.

Finally, remember that no single "perfect" solution exists universally applicable to every situation. Each household possesses unique circumstances dictating ideal choices regarding pet insurance purchases. By taking inventory of individual priorities alongside realistic budget constraints, informed decisions emerge capable delivering desired protections while respecting financial boundaries. Remember too that flexibility exists within many programs permitting adjustments along way based changing needs or preferences.

In conclusion, pet insurance serves as valuable tool assisting modern pet owners navigate complexities surrounding animal healthcare management. From safeguarding against catastrophic expenses tied to unforeseen accidents or serious diseases to promoting preventative strategies fostering longevity, well-crafted policies deliver tangible advantages worthy consideration. Especially relevant for those nurturing sleeping dogs, thoughtful selection process ensures maximum utility derived investment made. Ultimately, prioritizing wellbeing of four-legged family members reflects commitment compassion and responsibility defining true companionship bonds shared worldwide today.

Update Time:2025-05-14 18:18:03

When considering pet insurance, it’s important to recognize that each plan varies significantly in terms of coverage, cost, and exclusions. Some policies may focus on accidents and illnesses, while others include preventive care such as vaccinations and dental cleanings. For instance, if you own a breed prone to certain health conditions or have a senior dog that spends more time as sleeping dogs, opting for comprehensive coverage might be beneficial. The key is selecting a package that aligns with your pet's specific needs and lifestyle.

One of the primary advantages of pet insurance is its ability to alleviate financial stress during unexpected veterinary emergencies. Imagine this scenario: your otherwise healthy dog suddenly becomes ill overnight, necessitating urgent treatment. Without insurance, the cost of diagnosis and treatment could easily exceed several hundred dollars—or even thousands, depending on the severity of the condition. However, with a suitable pet insurance plan, these costs can be substantially reduced, allowing you to focus on your dog's recovery rather than worrying about bills.

Sleeping dogs often represent a relaxed state where they appear peaceful and content. Yet, beneath that serene exterior, underlying health issues may go unnoticed until symptoms manifest. This underscores the importance of regular wellness exams covered by some pet insurance plans. During these visits, veterinarians can detect potential problems early, potentially saving both money and heartache down the road. Early detection is particularly crucial for older dogs or breeds predisposed to genetic disorders, ensuring they remain comfortable even when spending much of their day as sleeping dogs.

Another aspect worth exploring is the variety of options available within pet insurance packages. Basic plans typically address accident-related injuries and sudden illnesses but exclude pre-existing conditions. On the other hand, premium plans extend coverage to chronic diseases, hereditary conditions, and sometimes alternative therapies like acupuncture or hydrotherapy. If you have a dog that frequently acts as sleeping dogs due to age or health concerns, investing in a higher-tier plan could prove invaluable over time.

Cost remains one of the most significant factors influencing whether someone chooses to purchase pet insurance. Premiums depend on numerous variables, including the dog's age, breed, location, and chosen level of coverage. Generally speaking, younger animals tend to attract lower rates since they're statistically less likely to require extensive medical intervention compared to older ones. Similarly, smaller breeds usually incur cheaper premiums versus larger counterparts because bigger dogs generally face greater risks of developing certain ailments. Moreover, geographic region plays a role too; urban areas with higher living costs also reflect increased vet fees, thereby affecting overall pricing structures.

Despite initial outlay associated with monthly premiums, many experts argue that long-term savings justify the expense. Consider this example: let's say your Golden Retriever requires knee surgery costing $3,000. With a typical reimbursement rate around 80%, assuming no deductible applies, your portion would only amount to $600 instead of footing the entire bill yourself. Such scenarios illustrate why proactive planning through pet insurance proves prudent for responsible pet parents.

In addition to monetary considerations, emotional peace of mind ranks highly among reasons motivating individuals toward purchasing pet insurance. Knowing that should anything happen to your beloved companion, you possess resources enabling necessary treatments without compromising quality care brings immense relief. Furthermore, having access to advanced diagnostic tools and cutting-edge procedures empowers veterinarians to provide optimal outcomes for their patients, enhancing quality of life for all involved parties—including those cherished sleeping dogs curled up at home.

However, before committing to any particular plan, thorough research proves indispensable. Start by comparing offerings across multiple providers, paying close attention to details regarding deductibles, copayments, annual limits, and exclusions. Some companies impose waiting periods before activating coverage, meaning newly acquired pets must wait weeks or months prior receiving benefits. Additionally, read reviews carefully to gauge customer satisfaction levels and responsiveness from claims processing teams. Transparency regarding terms and conditions helps avoid surprises later on.

For owners dealing with sleeping dogs specifically, special provisions exist addressing geriatric care requirements. As dogs age, their bodies undergo natural changes requiring additional monitoring and maintenance. Arthritis, cognitive dysfunction syndrome (similar to Alzheimer's disease), kidney failure, and cancer represent common challenges faced by seniors. Fortunately, certain pet insurance products cater directly to these populations, incorporating features designed explicitly for managing age-related complications. Features such as unlimited prescription drug refills, extended hospital stay allowances, and specialized dietary consultations contribute positively towards maintaining comfort and dignity throughout golden years.

Beyond traditional health concerns, behavioral issues occasionally arise warranting professional assistance. Anxiety, aggression, separation distress—all present real obstacles impacting daily lives of affected families. Although not universally included under standard pet insurance arrangements, supplementary riders sometimes cover counseling sessions aimed at resolving problematic behaviors. Recognizing signs early enables timely interventions preventing escalation into worse situations. Even seemingly innocuous habits like excessive barking or destructive chewing stem from deeper psychological triggers deserving expert evaluation. Thus, comprehensive packages offering broader scope beyond mere physical ailments hold appeal for holistic-minded caretakers.

Finally, remember that no single "perfect" solution exists universally applicable to every situation. Each household possesses unique circumstances dictating ideal choices regarding pet insurance purchases. By taking inventory of individual priorities alongside realistic budget constraints, informed decisions emerge capable delivering desired protections while respecting financial boundaries. Remember too that flexibility exists within many programs permitting adjustments along way based changing needs or preferences.

In conclusion, pet insurance serves as valuable tool assisting modern pet owners navigate complexities surrounding animal healthcare management. From safeguarding against catastrophic expenses tied to unforeseen accidents or serious diseases to promoting preventative strategies fostering longevity, well-crafted policies deliver tangible advantages worthy consideration. Especially relevant for those nurturing sleeping dogs, thoughtful selection process ensures maximum utility derived investment made. Ultimately, prioritizing wellbeing of four-legged family members reflects commitment compassion and responsibility defining true companionship bonds shared worldwide today.

Update Time:2025-05-14 18:18:03

Correction of product information

If you notice any omissions or errors in the product information on this page, please use the correction request form below.

Correction Request Form